In the era of entrepreneurship, there is never a shortage of "Silicon Valley-style" myths.

Over the past twenty years, we have witnessed the overnight rise of BAT, are familiar with the progress and struggles of TMD, and have even personally felt the rhythm of every capital trend.

We talk about mobile communications, new retail, and electronic consumption... but few people pay attention to the chip revolution behind those Internet unicorns and technology giants.

Origin: Thirty years of glory and ups and downs

Chips, or integrated circuits, are ubiquitous in our daily lives, but they have only become an industry that everyone is paying attention to in the past two years. When Huawei and TSMC joined forces, people applauded, but they didn't know that there was a relationship between the two that went back thirty years.

At that time, TSMC founder Morris Chang was at the peak of his career, and was the senior vice president of Texas Instruments' global semiconductor business. Ren Zhengfei had just lost his stable job and was busy raising funds in the small city of Shenzhen to start Huawei. They had nothing to do with each other, but they rarely agreed on the future.

Zhang Zhongmou, who had been working in the semiconductor industry for many years, was very ambitious. He often thought: "Intel is good at designing CPUs, but not at producing them. My cost is half of theirs, but the quality is twice as good as theirs. I can do foundry business." So, one afternoon in 1987, he came to Taiwan with the wealth gained from cashing out his shares, founded TSMC, and became the first person to adopt the foundry model for integrated circuits.

Also in 1987, Ren Zhengfei, who had successfully raised funds, founded Huawei in Shenzhen. Four years later, he planned and built the Huawei Integrated Circuit Design Center, which is the predecessor of the now popular Hain Semiconductor Company.

But if we put aside the God's perspective, the establishment of TSMC and Huawei Haien can only stir up a small splash. In fact, at that time, China's semiconductor industry had just completed its primitive accumulation, and the 908 and 909 projects of the country's development of the semiconductor industry were alone, and scale and industrialization were just empty talk.

Figure: Real view of the Science and Technology Museum in Zhongguancun Integrated Circuit Design Park

TSMC on the other side of the strait and Huawei in Shenzhen failed to make a "groundbreaking" breakthrough from the beginning and light up the glory of China's integrated circuit industry. Instead, the glory fell on a Taiwanese who fled to Shanghai.

In 2000, Zhang Rujing from Taiwan, China, led more than 300 Taiwanese semiconductor practitioners and more than 100 "returnees" to the north to select a factory. He abandoned Taiwan, skipped Shenzhen, and finally built a factory in Shanghai Zhangjiang High-tech Park, becoming the second heavyweight "ally" of Zhangjiang Park after Shanghai Huahong.

"It is not easy to find a piece of land like this to build a factory." Zhang Rujing was attracted by Zhangjiang's favorable land and tax policies, as well as advanced management methods, and founded SMIC, which has gradually developed into China's largest and most advanced chip manufacturing company.

SMIC has successfully set an example for other companies and opened a new door for China's integrated circuit companies to gather in industrial parks.

In 2001, Spreadtrum Communications Ltd. was established and achieved remarkable results in 3G chips; in 2005, Deng Zhonghan's Vimicro was successfully listed on NASDAQ; the Yangtze River Delta with Shanghai as the core and the Pearl River Delta with Shenzhen as the core began to emerge with integrated circuit industrial parks that matched policies and talent dividends, gradually forming a trend of aggregation.

Until now, the decade around 2000 is still regarded as an "ideal era" by entrepreneurs, with countless overseas returnees pouring into the country and joining the chip industry. "Almost everyone is motivated by emotion and believes that they can achieve something."

But the ideal era did not last. A few years later, overseas returnees who came back to China to work in integrated circuits soon discovered that the domestic chip industry had once again fallen into a vicious circle of development.

Since the first batch of chip design companies were almost all supported by returnee designers, they lacked natural genes in marketing and management. The chip production cycle gradually failed to keep up with the product upgrades, and the technology lacked differentiation and innovation. The Chinese chip industry fell into a situation of low-cost competition, low-end technology clustering, and even plagiarism.

In the melee, some people started their own business and reached the top, some failed and left sadly, some rose and some fell.

Even SMIC, which was a trendsetter at the time, could not escape the loss and fell from the forefront of the industry. Three years after its establishment, it was involved in a patent and trade secret lawsuit with TSMC. In 2009, this six-year lawsuit dispute, which was well known in the semiconductor industry, ended with SMIC losing the case twice and paying a total of US$375 million and 10% of TSMC's shares.

Zhang Rujing, who once vowed to make "China's No. 1 Chip", finally chose to resign and leave, and SMIC was seriously damaged. Jiang Shangzhou, who succeeded SMIC as Chairman, passed away in 2011. Since then, SMIC has entered a long period of decline. The gap that was once "only one generation behind" has gradually widened to 2-3 generations, and has not yet caught up.

The development of history is always a mixture of good and bad. In 2009, when SMIC began to decline, Zhao Weiguo took over Tsinghua Unigroup and took on the mission of re-creating the integrated circuit business.

Tsinghua Unigroup first acquired Spreadtrum Communications, which was listed on NASDAQ, in 2013; a year later, it made another move and acquired RDA Microelectronics, which was also listed on NASDAQ, thus stabilizing its industry position in the global mobile communications and chip design fields and becoming the leader of the fourth wave of China's chip industry.

Migration: The Urban Layout of Integrated Circuits

From the foundry model to the success story, China's chip industry has experienced three decades of ups and downs. By 2018, China has occupied one-third of the world's semiconductor market, and the $158.4 billion is enough to make all parties wary.

In the context of vigorously introducing high-tech industries and developing a new generation of information technology, cities across the country are calling for the "integrated circuit industry" and extending olive branches to upstream and downstream companies, hoping to introduce leading companies and move towards the second echelon of integrated circuit industry development.

Wuhan was approved to build a national optoelectronics industry base as early as 2001, and has successively brought together many well-known domestic and foreign companies such as Wuhan Xinxin, Yangtze Memory Technologies, HiSilicon R&D Center, MediaTek (the world's fourth largest design company), and Synopsys (the leader in semiconductor design software), forming an industrial chain covering design software services, chip design, and testing.

Hefei, which started exploring the field of integrated circuits in 2012, has now gathered three integrated circuit bases: Hefei Economic Development Zone, Hefei High-tech Zone and Xinzhan High-tech Zone. The High-tech Zone has issued 29 support policies in five aspects: enterprise settlement, R&D support, talent support, high growth incentives and financial support. The High-tech Zone alone has gathered 140 chip companies.

Chengdu has Shuangliu District and Tianfu New District as key parks for the development of the integrated circuit industry, covering the entire industry chain including integrated circuit design, manufacturing, packaging and testing, equipment and materials. At present, Huawei Chengdu Research Institute, NXP, Montage Technology, Unigroup Spreadtrum, Goke Microelectronics, GlobalFoundries, Intel and others have settled in. ARM China Western Research Institute, Chengdu Unigroup IC International City, and Yuxin production line transformation projects are under construction.

All regions are vying to seize integrated circuit resources, and the growth areas of chip companies formed over the past few decades are being redefined.

Judging from the output of the integrated circuit industry in various cities in 2018, although the output of the Yangtze River Delta and Pearl River Delta regions accounted for more than 60% of the national total, their proportion showed negative growth.

Even in Shanghai, which has the Zhangjiang High-Tech Park, the output in 2018 still dropped by nearly 4% compared with 2010. The output in Guangdong Province even dropped by more than 7%.

The increase in the proportion of output in Gansu and Beijing was very obvious, with an increase of nearly 10% and 4% respectively. This means that the domestic integrated circuit industry is shifting from traditional advantageous regions to the central and western regions, to more advanced technology - Beijing and cheaper labor, and the urban map of integrated circuits is changing.

Figure: Real view of Zhongguancun Integrated Circuit Design Park

Seeking change: Industrial parks regain their “core” vitality

From 2.5 billion to 13.8 billion, Beijing has completed a five-fold leap in integrated circuit production in the past eight years. Although it is not as productive as Shanghai, Shenzhen and other established chip cities, Beijing has always been a strategic location for chip companies to expand across the country due to its advantages in high-quality talent and the agglomeration effect of high-tech companies.

In 2018, the scale of Beijing's integrated circuit industry reached 96.89 billion yuan, accounting for 14.8% of the national sales revenue (653.14 billion yuan). Among them, the IC design industry's sales revenue was about 55 billion yuan, ranking second in the country. The city's intellectual resources, industrial scale and technological level have always occupied a pivotal position in the country.

Under the development pattern of the integrated circuit industry in Beijing, which is "design in the north and manufacturing in the south", Yizhuang, which has a relatively low population density, has gathered factories of manufacturing and packaging and testing companies such as SMIC, SMIC North, and Verizon. Zhongguancun, known as the "Silicon Valley of China", has gathered design industry leaders such as Unisoc, Beijing Ingenic, and OmniVision Technologies.

After experiencing the 1.0 development model of building Shangdi Information Industry Park in 1992 and the 2.0 development model of building Zhongguancun Software Park in 2000, Zhongguancun has completed the "triple jump" of industrial parks in the field of integrated circuits. Taking the IC PARK, which was officially completed in November 2018, as an example, it has carried out innovation and creation in development model, industrial positioning, carrier space and service means.

Compared with the 1.0 and 2.0 development models of "development first, then industry", IC PARK first has an industrial positioning, clearly defines the need to build an integrated circuit design industrial park, and then carries out six-in-one spatial planning based on the needs of the entire industry chain.

Going north along Beiqing Road to IC PARK, you will find that this is not only an IC highland that gathers the leading and emerging forces in China's chip design industry, but also has the only 2,000-square-meter professional integrated circuit science and technology museum in Beijing, a supporting library with a construction area of 4,200 square meters, a 2,400-square-meter IC International Conference Center, and a 10,000-square-meter commercial district that can meet the quality life needs of IC elites...

Figure: Commercial facilities at Zhongguancun Integrated Circuit Design Park

As the most advanced 3.0 industrial park in Zhongguancun, IC PARK is most different from the previous 1.0 and 2.0 models in that it can develop a new development model of "base + investment + platform + service" based on the precise needs of the industry.

According to the statistics of the "China Integrated Circuit Industry Talent White Paper (2017-2018 Edition)" released by the Ministry of Industry and Information Technology, by around 2020, the scale of talent demand in my country's integrated circuit industry will be about 720,000, while the current talent stock in my country is 400,000, and the talent gap will reach 320,000. Beijing ranks first with a talent demand share of 36.7%.

At the same time, the supply of new professional talents has not kept up. In 2018, only 26,000 college graduates in the field of integrated circuits entered the integrated circuit industry.

In response to the growing gap in talent and the mismatch between training mechanisms, Zhongguancun Integrated Circuit Design Park and industry organizations jointly initiated the establishment of "Zhongguancun Core College" and related industry funds to support integrated circuit companies. By making full use of the resources of Haidian District, a talent-rich district, a bridge between colleges and enterprises for talent training and achievement transformation was built, and by cultivating compound talents in the field of integrated circuits, the construction and implementation of the "Core Fire" dual innovation platform was assisted.

"Our goal is to become a market-oriented resource service platform that supports integrated circuit design and upstream and downstream companies to grow bigger and stronger." IC Park chairman Miao Jun once publicly stated.

From planning and construction to its official opening, IC PARK has gone through five years of arduous preparation. Today, this 3.0 industrial park with a construction area of nearly 220,000 square meters has attracted a number of leading integrated circuit companies such as Bitmain, GigaDevice, Beijing Zhaoxin, and Weian Intelligent, as well as more than 30 upstream and downstream companies. IC PARK's output value in the field of integrated circuit design has accounted for 45% of the total output value of Beijing, and also has a 10% share nationwide.

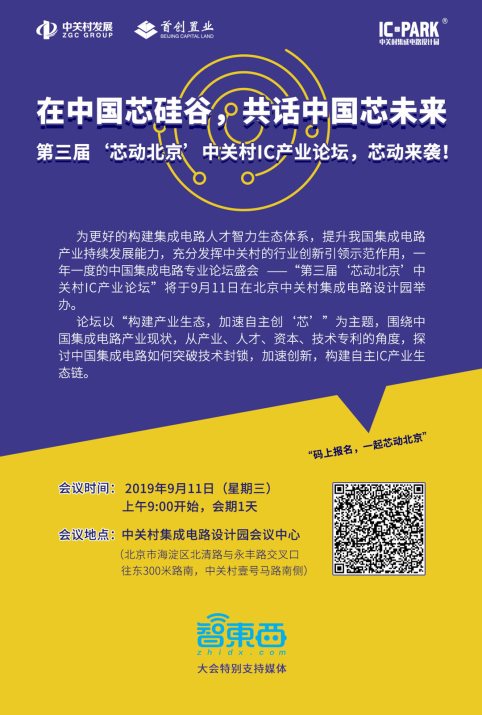

How can China break through the technological blockade and improve my country's independent chip R&D capabilities after experiencing the "bottleneck" of China's chips? How can China break through the technological blockade and improve my country's independent chip R&D capabilities? On September 11, the third "Core Beijing" Zhongguancun IC Industry Forum hosted by IC PARK will be held at the IC International Conference Center, where more than 500 IC elites from home and abroad will gather. They may have the answer to how the "core" story of China's Silicon Valley will develop.

Previous article:Qorvo Announces First Quarter Fiscal Year 2020 Financial Results

Next article:Li Rui from Schneider Electric: How to build a new generation of chip foundries

- Popular Resources

- Popular amplifiers

- ASML provides update on market opportunities at 2024 Investor Day

- It is reported that memory manufacturers are considering using flux-free bonding for HBM4 to further reduce the gap between layers

- Intel China officially releases 2023-2024 Corporate Social Responsibility Report

- Mouser Electronics and Analog Devices Launch New E-Book

- AMD launches second-generation Versal Premium series: FPGA industry's first to support CXL 3.1 and PCIe Gen 6

- SEMI: Global silicon wafer shipment area increased by 6.8% year-on-year and 5.9% month-on-month in 2024Q3

- TSMC's 5nm and 3nm supply reaches "100% utilization" showing its dominance in the market

- LG Display successfully develops world's first stretchable display that can be expanded by 50%

- Infineon's revenue and profit both increased in the fourth quarter of fiscal year 2024; market weakness in fiscal year 2025 lowered expectations

- LED chemical incompatibility test to see which chemicals LEDs can be used with

- Application of ARM9 hardware coprocessor on WinCE embedded motherboard

- What are the key points for selecting rotor flowmeter?

- LM317 high power charger circuit

- A brief analysis of Embest's application and development of embedded medical devices

- Single-phase RC protection circuit

- stm32 PVD programmable voltage monitor

- Introduction and measurement of edge trigger and level trigger of 51 single chip microcomputer

- Improved design of Linux system software shell protection technology

- What to do if the ABB robot protection device stops

- CGD and Qorvo to jointly revolutionize motor control solutions

- CGD and Qorvo to jointly revolutionize motor control solutions

- Keysight Technologies FieldFox handheld analyzer with VDI spread spectrum module to achieve millimeter wave analysis function

- Infineon's PASCO2V15 XENSIV PAS CO2 5V Sensor Now Available at Mouser for Accurate CO2 Level Measurement

- Advanced gameplay, Harting takes your PCB board connection to a new level!

- Advanced gameplay, Harting takes your PCB board connection to a new level!

- A new chapter in Great Wall Motors R&D: solid-state battery technology leads the future

- Naxin Micro provides full-scenario GaN driver IC solutions

- Interpreting Huawei’s new solid-state battery patent, will it challenge CATL in 2030?

- Are pure electric/plug-in hybrid vehicles going crazy? A Chinese company has launched the world's first -40℃ dischargeable hybrid battery that is not afraid of cold

- C2000-GNAG Operation and Use

- What role does artificial intelligence play in chip development?

- HyperLynx High-Speed Circuit Design and Simulation (VI) Non-ideal Transmission Line Differential Pair Eye Diagram (Impedance Mismatch)

- [ESK32-360 Review] 6. Hello! Hello! Hello! Hello!

- [NXP Rapid IoT Review] NXP Rapid IOT Experience

- Is there any teacher who can help me write a program for Mitsubishi FX3U to output pulses?

- RTL8762, an excellent domestic BLE low-power solution

- Bear Pie Huawei IoT operating system LiteOS bare metal driver transplantation 01-Explain driver transplantation using LED as an example

- 【GD32450I-EVAL】Simple oscilloscope demonstration

- [GD32E231 DIY Contest] 05. Automatic Fish Feeding Robot - PWM

MCP632-E/SN

MCP632-E/SN

京公网安备 11010802033920号

京公网安备 11010802033920号