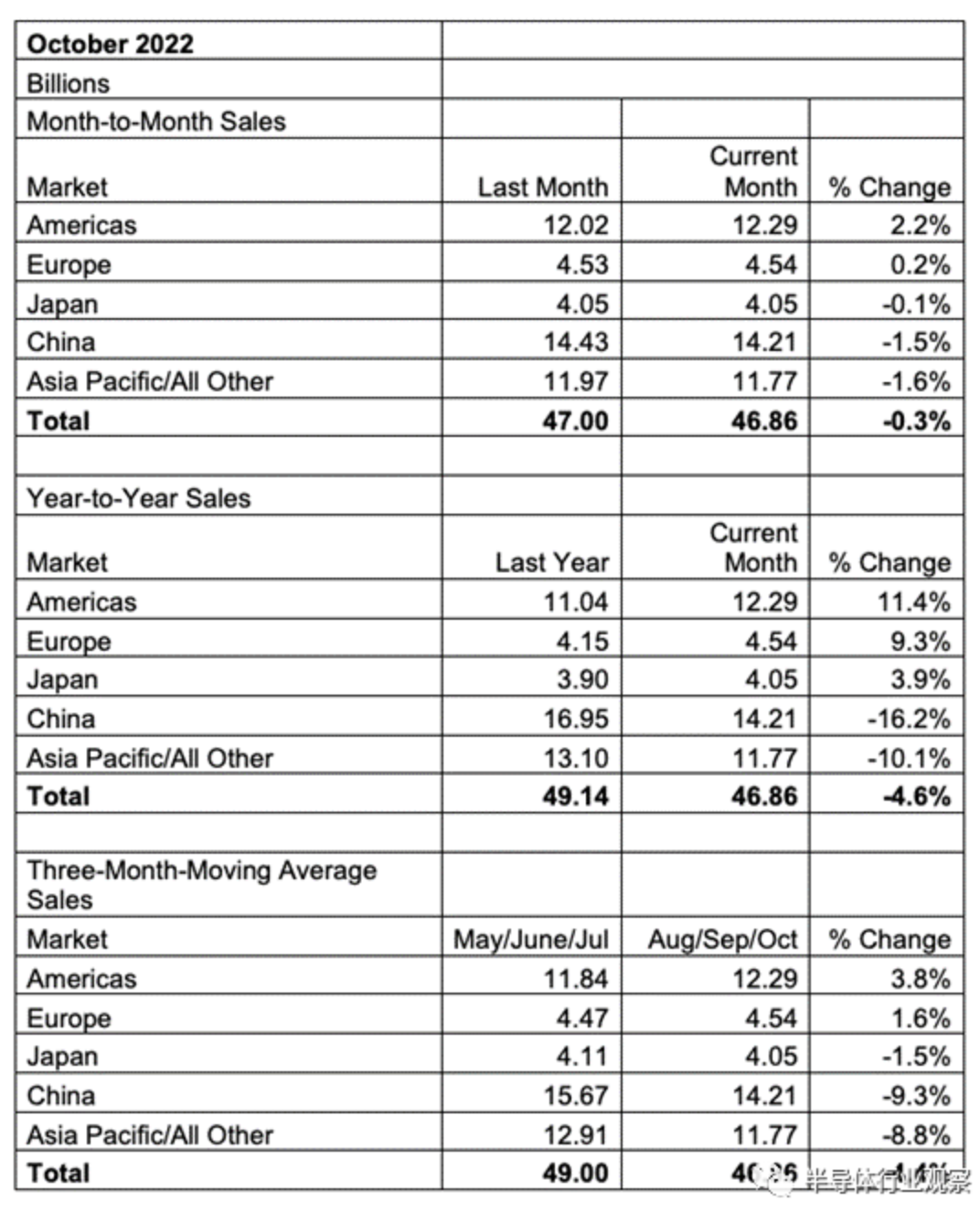

The Semiconductor Industry Association (SIA) announced today that global semiconductor industry sales in October 2022 were US$46.9 billion, a slight decrease of 0.3% from US$47 billion in September 2022, and a total of US$49.1 billion in October 2021. compared to a decrease of 4.6%.

“Global semiconductor sales fell again in October, with year-over-year sales declining by the largest percentage since December 2019,” said John Neuffer, SIA president and CEO. “Sales into the Americas stood out in October and were on par with last year. A double-digit increase compared to the same month last year.”

By region, sales increased year over year in the Americas (11.4%), Europe (9.3%) and Japan (3.9%), but declined in Asia Pacific/All Other (-10.1%) and China (-16.2%) . Monthly sales increased in the Americas (2.2%) and Europe (0.2%), but declined in Japan (-0.1%), China (-1.5%) and Asia Pacific/All Other (-1.6%).

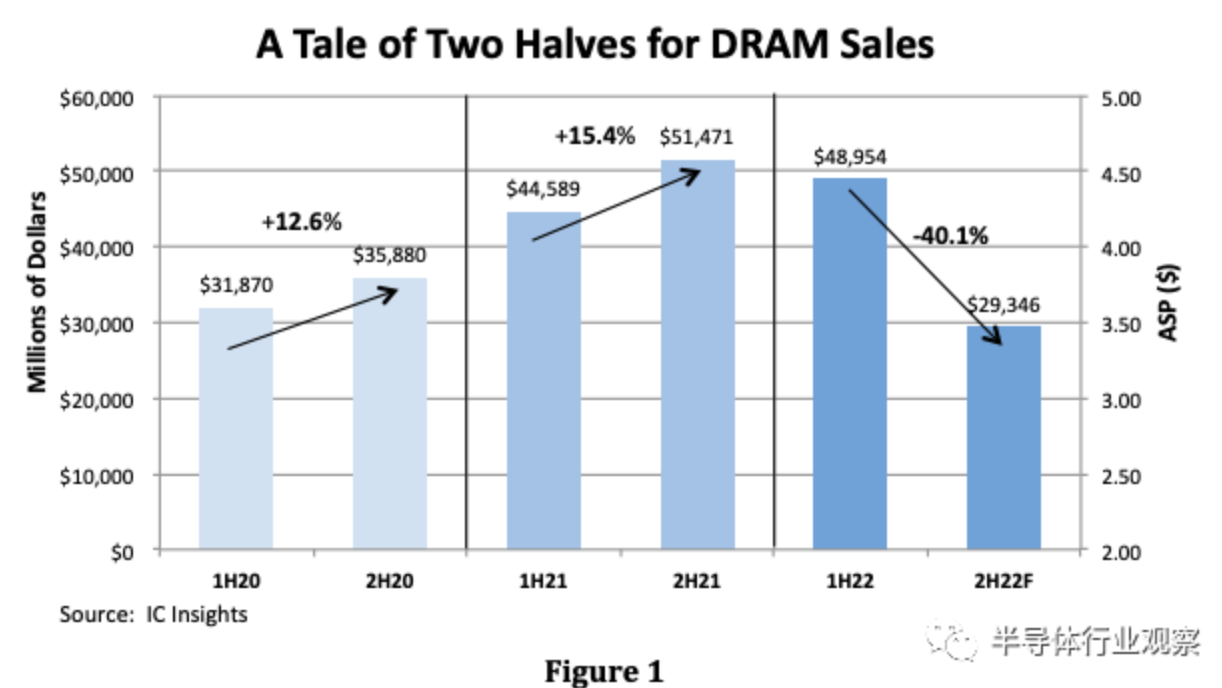

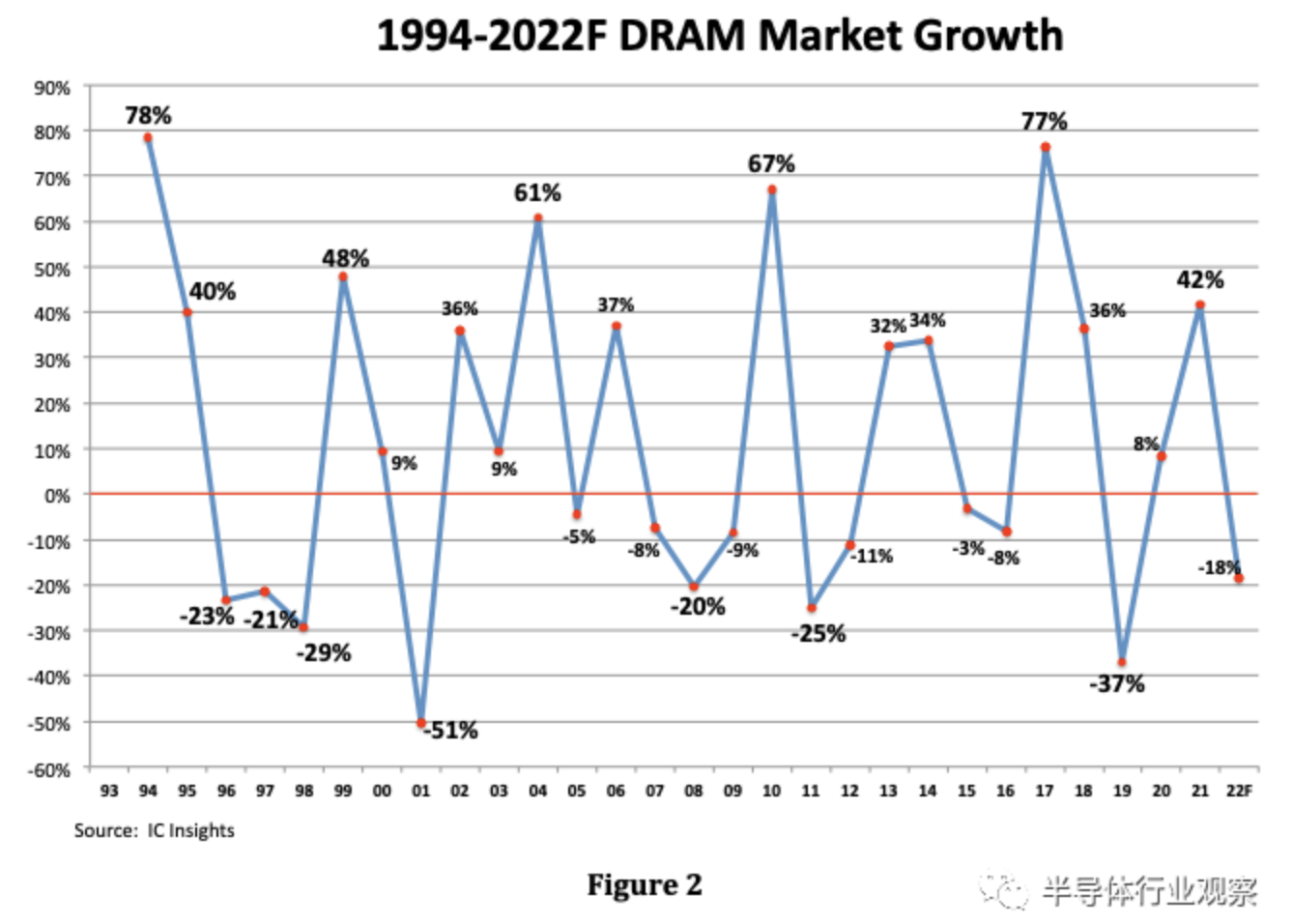

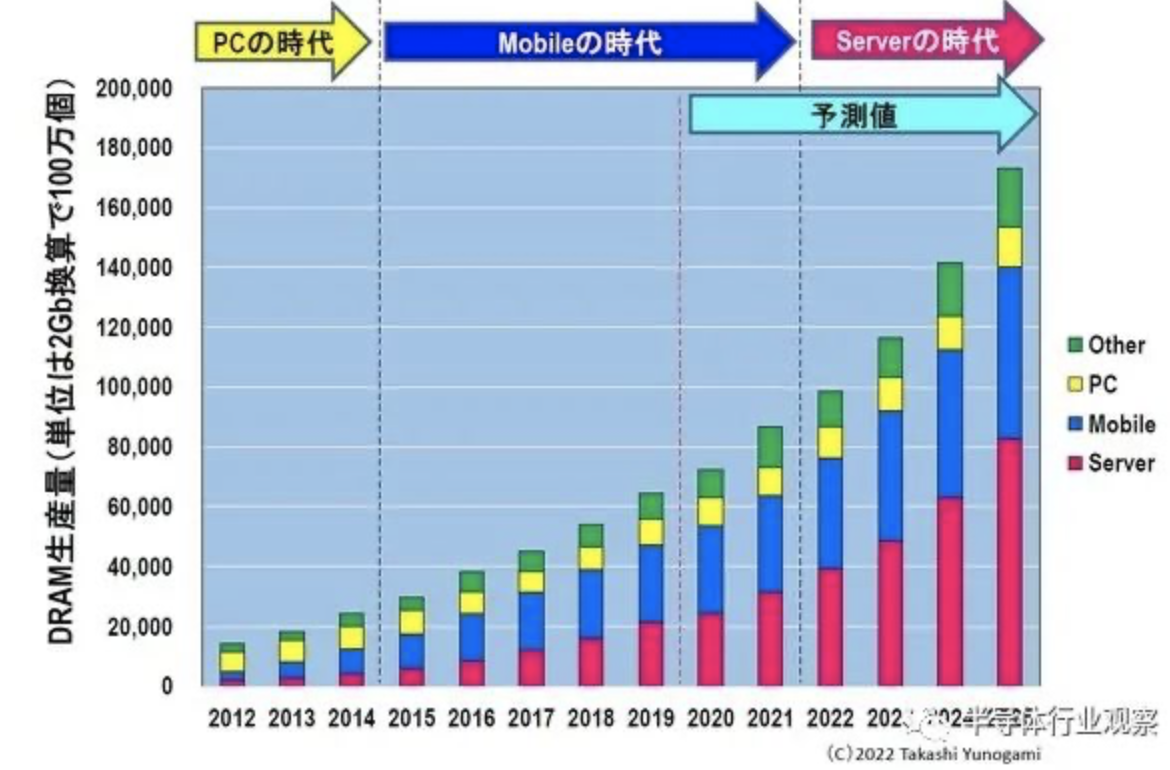

Global chip industry plunges into downturn The head of a global technology giant said that the global chip industry is experiencing a downturn, but it remains important that demand for memory and storage will continue to grow in the long term. On Tuesday (November 22), Micron CEO Sanjay Mehrotra pointed out that the industry has been affected by factors such as China's epidemic prevention, Russia's invasion of Ukraine and high global inflation. "The main driver of the current downturn in the memory industry is that our customers are adjusting inventory to more normal levels, which is reducing demand," he told the media. The resulting imbalance between supply and demand is affecting the industry's pricing environment, he added. It typically takes about six months for customer inventories to return to normal, he said, adding that macroeconomic factors also influence how quickly that happens. It's a U-turn from the past three years of the COVID-19 pandemic, when customers built "high levels of inventory" in response to recent semiconductor supply chain shortages. Mehrotra's comments come as the industry moves to cushion the impact of the global chip slump by cutting capital spending and output amid concerns it is nearing a bottom. Micron was the first major chipmaker to warn of falling demand for PCs and smartphones, cutting chip production by about 20% and suspending hiring. Likewise, Taiwanese chipmaker TSMC has cut its annual investment budget by at least 10% this year, while South Korea's SK Hynix, whose clients include Apple, has cut investment next year in half. The situation is in stark contrast to a year ago, when tight supply led to a surge in demand for chips, leading to a sudden shortage. One of the factors driving the growth at the time was the shift to working from home during the pandemic, as the workforce purchased laptops, webcams and monitors. Automakers, which cut back sharply early in the pandemic, have increased demand as an unexpectedly quick rebound in auto sales has them scrambling to buy chips. That's coupled with Chinese smartphone maker Huawei Technologies rushing to build up inventory in response to a supply crunch caused by U.S. sanctions. The global shortage has halted auto production and delayed consumer electronics launches. Broadband providers also face months-long delays on internet routers. The industry started showing signs of slowing down in the middle of this year and is now facing low demand amid high supply. Mr. Mehrotra said the ongoing imbalance between supply and demand was only short-term. “In the longer term, the key drivers of today’s trends are artificial intelligence, connectivity, smart cities, smart homes and, of course, autonomy – all of which require more and more data insights, so the long-term trends are intact ."He said. He noted that the industry goes through demand cycles. "Importantly, demand for memory and storage continues to grow throughout the cycle," he said, adding that Micron was "well-positioned" to emerge stronger on the other side of the downturn. " "As inventories with our customers and suppliers return to normal levels, then the industry trajectory of increased demand and healthier profitability will resume," he said. DRAM revenue fell 40% in the second half of the year According to ICinsights, the DRAM market typically sees strong sales in the second half of the year, when system manufacturers place orders for the memory to be used in a new generation of products they plan to release during the year-end holiday season. This situation has not occurred this year. Weak economic conditions and high inflation have slowed global demand for personal computers, mainstream smartphones and other consumer electronics. As a result, DRAM demand is on a downward spiral, with sales now expected to decline -40% in 2H22 to $29.3 billion, compared to $49 billion in 1H22 (Figure 1). The DRAM market is expected to decline by -18% throughout 2022. The first signs of a major correction in the DRAM market began to emerge at the end of the second quarter of 2022 after strong sales in the first few months of the year. Micron, for example, reported an 11% sales increase in its third quarter of FY22 (ended in May). The looming market collapse wasn't evident in its quarterly sales results, but then the company dropped the bomb by giving -17% sales guidance for its fiscal fourth quarter, which ended in August. Micron's actual sales fell -23% in 4Q22, well above its guidance. At the end of the year, Micron also said it expected its annual DRAM bit shipments to decline by -1%, further evidence of the rapid and severe downturn in the DRAM market. SK Hynix (23%) and Samsung (-20%) also announced a sharp decline in their memory sales in 3Q22, and expect the DRAM market weakness to continue until the end of this year, and at least until 1Q23. The three major memory makers noted on earnings calls that inflation has eroded consumer discretionary spending at a time when sales typically heat up each year. Coupled with ongoing supply chain disruptions and inflated inventory levels, a DRAM market correction is all but inevitable. Over the past 30 years, the DRAM market has been characterized by spectacular growth followed by years of devastating collapse (such as 2022), as illustrated by the sawtooth "curve" in Figure 2. Over the past four years, the DRAM market declined by -37% in 2019, grew by 42% in 2021, and is expected to decline by 18% in 2022. With such drastic fluctuations, it’s no wonder that the number of digital DRAM suppliers has dropped from more than 25 30 years ago to 3 today. DRAM quarterly shipments and shipments Figure 3 shows quarterly trends in DRAM shipment value and shipment volume. This picture got me thinking. The sharp decline in shipments in the third quarter of 2022 is understandable. However, I didn’t expect that even shipments would drop so sharply. Figure 3: DRAM shipment value and shipment trends by quarter (as of the third quarter of 2022) Source: Author based on WSTS data DRAM shipments have the following historical background. First, it increased slightly from about 1991 to 2003. However, from 2003 to 2011, shipments grew rapidly. This is because developing countries such as China, known as the BRIC countries, have achieved economic development, and the demand for DRAM has rapidly expanded in PCs, mobile phones (later smartphones) and various electronic products. However, from 2011 to 2018, DRAM shipments per quarter remained stable at around 4 billion units. This is because many existing DRAM manufacturers have been eliminated. Since Elpida Memory went bankrupt in 2012 and was acquired by Micron Technology of the United States, DRAM manufacturers are basically Samsung, SK Hynix and Micron. Believe this is due to the merger into the company. The author speculates that these three companies made production adjustments on the basis of "secret collusion", causing DRAM shipments to stabilize. However, DRAM shipments have increased year by year since 2019, reaching approximately 5.5 billion units. The reason for this is as follows. Until around 2014, the primary use of DRAM was in PCs. After 2015, mobile phones (i.e. smartphones) have become the protagonist of DRAM. It is expected that after 2022, server DRAM will replace mobile devices and become the main battlefield of DRAM (Figure 4). Figure 4: DRAM output by application In fact, according to "Server DRAM becomes a cash cow for Samsung Electronics and SK Hynix" released by Business Korea on November 2, 2022, server DRAM will reach 68.486 billion gigabits by 2022, while mobile DRAM will reach 66.272 billion gigabits . Reportedly beyond the scope of use. As the main battlefield of DRAM shifts to servers, Samsung, SK Hynix, and Micron gave up their "secret collusion" and began to compete for dominance in server usage. Therefore, we believe DRAM shipments will increase after 2019. As evidence of this, as shown in Figure 5, DRAM shipments did not decrease significantly during the memory recession and the COVID-19 storm. However, after the collapse of the new crown special demand, there will be a decrease of 851 million from Q2 (5.335 billion) to Q3 (4.484 billion) in 2022. This surprised me. Because of this, I'm beginning to think that this semiconductor recession could be as severe as the Lehman Brothers shock, or even worse. Figure 5: DRAM quarterly shipment value and shipment volume Source: Author based on WSTS data The biggest decline since 2008, semiconductors will fall by at least 14% next year According to WSTS, the semiconductor market fell by 6.3% in the third quarter of 2022 compared with the second quarter of 2022. Based on the outlook for the fourth quarter of 2022, the second half of 2022 will be more than 10% lower than the first half of 2022. It can be seen that the decline in the second half of 2022 will be the largest half-year decline since the 21% decline in the first half of 2009. Revenue changes for top semiconductor companies were mixed between Q3 2022 and Q2 2022. Nine of the 15 companies reported (or guided) revenue growth in the third quarter of 2022, with Infineon the highest at 15% and STMicroelectronics at 13%. Six of the companies reported revenue declines, with storage companies Samsung, SK Hynix and Micron Technology seeing the largest declines, down 19% to 23%. The decline in memory revenue in the third quarter of 2022 caused SK Hynix's ranking to drop from 3rd to 5th place, and Micron Technology dropped from 5th to 6th place. Samsung managed to maintain its number one ranking against Intel. Qualcomm rose to 3rd place, and Broadcom became 4th.

Previous article:TSMC is already planning to build a 1nm process technology factory in Longtan Science Park

Next article:Gartner: Global semiconductor revenue is expected to decline by 3.6% in 2023

- Popular Resources

- Popular amplifiers

- Vietnam's chip packaging and testing business is growing, and supply-side fragmentation is splitting the market

- The US asked TSMC to restrict the export of high-end chips, and the Ministry of Commerce responded

- ASML predicts that its revenue in 2030 will exceed 457 billion yuan! Gross profit margin 56-60%

- ASML provides update on market opportunities at 2024 Investor Day

- It is reported that memory manufacturers are considering using flux-free bonding for HBM4 to further reduce the gap between layers

- Intel China officially releases 2023-2024 Corporate Social Responsibility Report

- Mouser Electronics and Analog Devices Launch New E-Book

- AMD launches second-generation Versal Premium series: FPGA industry's first to support CXL 3.1 and PCIe Gen 6

- SEMI: Global silicon wafer shipment area increased by 6.8% year-on-year and 5.9% month-on-month in 2024Q3

- LED chemical incompatibility test to see which chemicals LEDs can be used with

- Application of ARM9 hardware coprocessor on WinCE embedded motherboard

- What are the key points for selecting rotor flowmeter?

- LM317 high power charger circuit

- A brief analysis of Embest's application and development of embedded medical devices

- Single-phase RC protection circuit

- stm32 PVD programmable voltage monitor

- Introduction and measurement of edge trigger and level trigger of 51 single chip microcomputer

- Improved design of Linux system software shell protection technology

- What to do if the ABB robot protection device stops

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- Sandia Labs develops battery failure early warning technology to detect battery failures faster

- [RVB2601 Creative Application Development] 3 Light up the screen to display the letter A

- MSP430 Registers

- Using CircuitPython on PICO to control LED and play music at the same time

- DIY Small Communication System - FM Transmitter Radio Station

- msp430f149 baud rate setting

- Application of STM32F03X serial port idle interrupt + DMA

- Bought a very good ESP32-S2 development board

- What is the IC model of infrared remote control transmitter?

- Please help me explain this circuit schematic, how it works, and where each module is.

- How to use printf for debugging

KF442A

KF442A

京公网安备 11010802033920号

京公网安备 11010802033920号