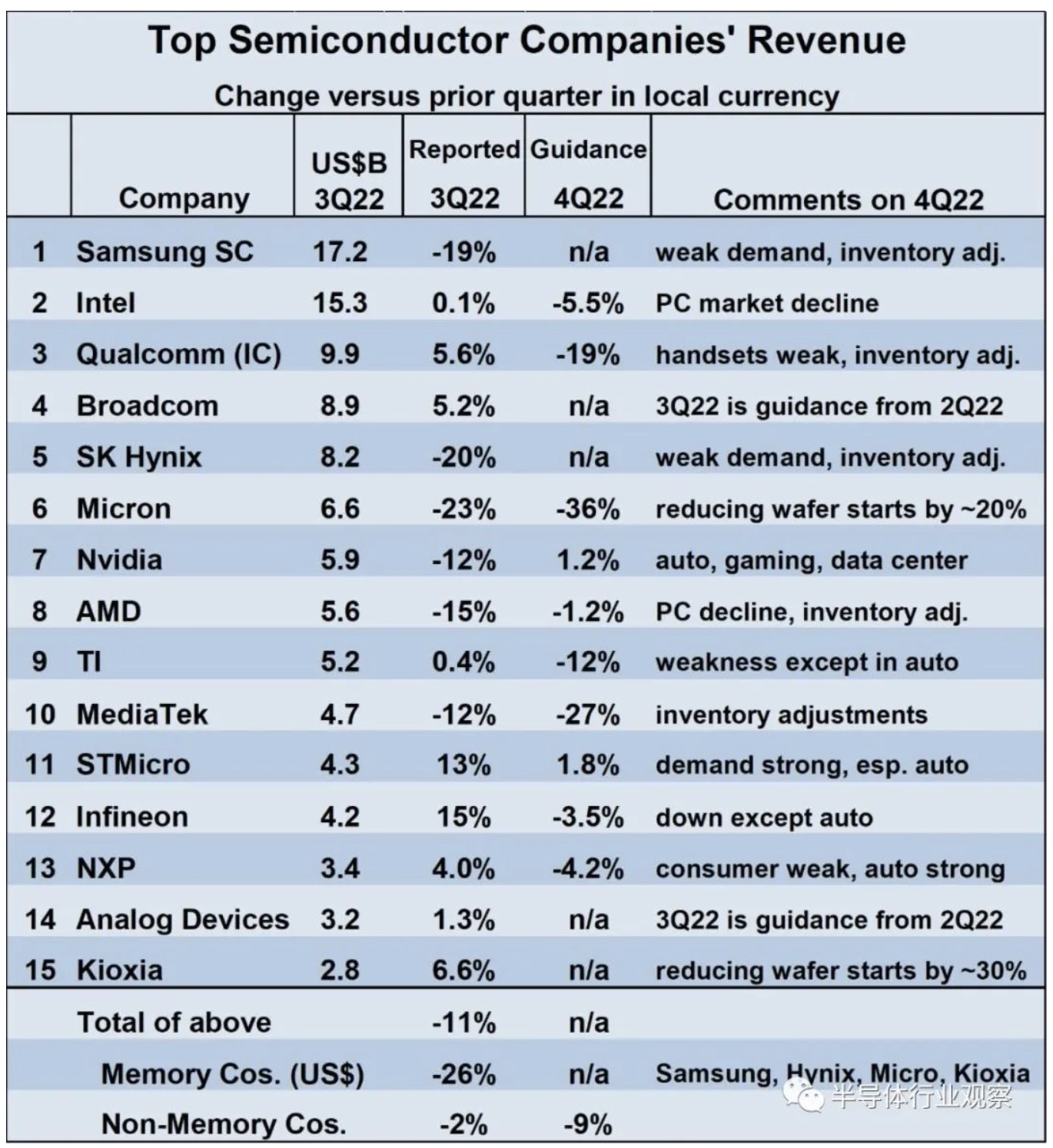

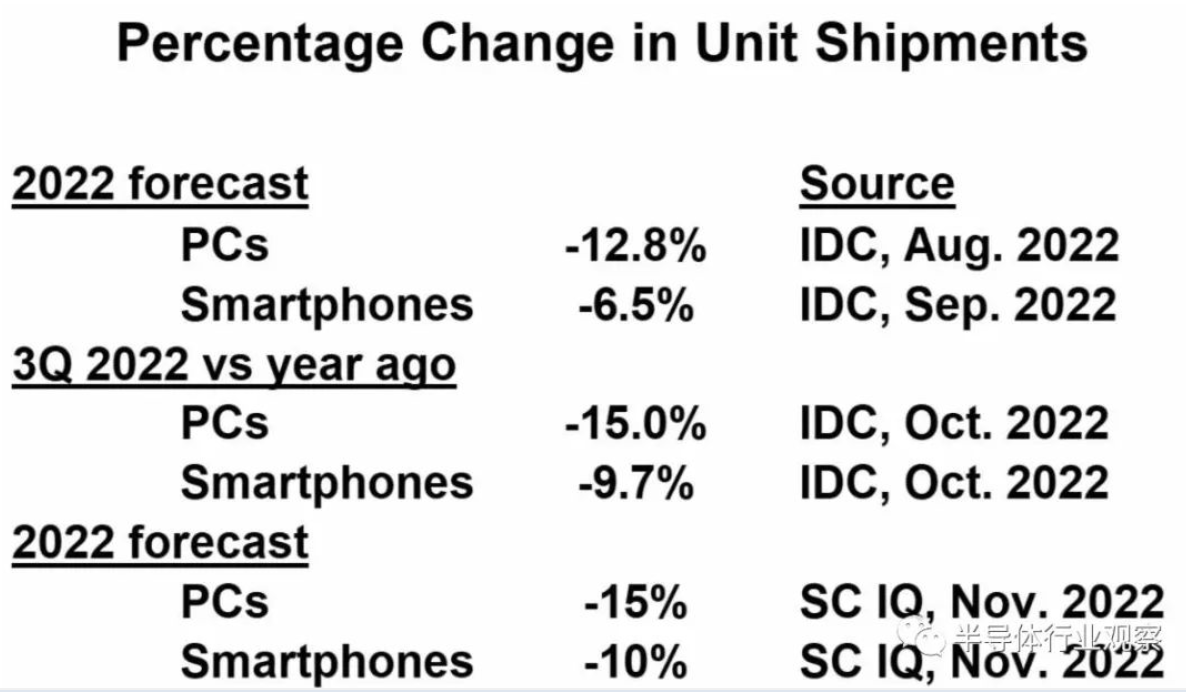

The revenue outlook for Q4 2022 is generally bleak, especially for memory. Micron Technology's guidance is for the fourth quarter of 2022 to be down 36% from the third quarter of 2022. Micron plans to reduce its wafer operations by about 20%. Kioxia plans to reduce its wafer starts by about 30%. Samsung and SK Hynix did not give specific revenue guidance, but both cited weak demand and inventory adjustments as factors affecting revenue in the current quarter. Among non-memory companies, Qualcomm, Texas Instruments and MediaTek all expect double-digit revenue declines in the fourth quarter of 2022. Most companies blame weak overall demand and customer inventory adjustments on the bleak outlook. Cars seem to be the only healthy part. Texas Instruments, STMicroelectronics, Infineon and NXP all said growth in the automotive industry had largely or partially offset declines in other industries. Of the ten companies providing guidance for the fourth quarter of 2022, only Nvidia (+1.2%) and STMicroelectronics (+1.8%) expect revenue to increase. The weighted average revenue change for the nine non-memory companies providing guidance is a 9% decline in Q4 2022 from Q3 2022. Weakness in key end markets such as PCs and smartphones is evident from IDC's forecast for shipments in the third quarter of 2022. PC sales were down 15% from a year ago, and smartphone sales were down 9.7%. Before third-quarter 2022 data becomes available, IDC expects PC shipments to decline 12.8% and smartphone shipments to decline 6.5% in 2022. Based on the latest shipment data, we at Semiconductor Intelligence now predict that PC shipments will decline by 15% and smartphone shipments by 10% in 2022. Given the 6.3% semiconductor market decline in Q3 2022 and the bleak outlook for Q4 2022, only forecasts made after the release of WSTS data for Q3 2022 are relevant. The Cowan LRA model forecast for November 2022 is 8.1%, IC Insights is 3%, and our Semiconductor Intelligence is 1.5%. The semiconductor market will definitely decline in 2023. IC Insights expects a 6% decline, and we at Semiconductor Intelligence expect a 14% decline. Interestingly, back in August, Future Horizons predicted a 22% decline in 2023. The WSTS committee met last week to discuss its fall forecast, which should be released within the next two weeks. It will be interesting to see how much it changes from WSTS's August update forecasts of 13.9% growth in 2023 and 4.6% growth in 2023. Our Semiconductor Intelligence predicts a 14% decline in 2023, which would be the largest decline in the semiconductor market since a 32% decline in 2001, 21 years ago. Over the past 50 years, the market has experienced double-digit declines in only three years: 1975, 1985 and 2001. Our forecast for 2023 is based on the following assumptions:

No global recession in 2022 or 2023

Inventory corrections will resolve over the next two to three quarters

– PCs and smartphones to return to pre-pandemic trends by mid-2023

If any of the above assumptions fail to materialize, the semiconductor downturn could continue through the entire quarter of 2023 and result in annual declines of more than 20%.

Previous article:TSMC is already planning to build a 1nm process technology factory in Longtan Science Park

Next article:Gartner: Global semiconductor revenue is expected to decline by 3.6% in 2023

- Popular Resources

- Popular amplifiers

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Vietnam's chip packaging and testing business is growing, and supply-side fragmentation is splitting the market

- The US asked TSMC to restrict the export of high-end chips, and the Ministry of Commerce responded

- ASML predicts that its revenue in 2030 will exceed 457 billion yuan! Gross profit margin 56-60%

- ASML provides update on market opportunities at 2024 Investor Day

- It is reported that memory manufacturers are considering using flux-free bonding for HBM4 to further reduce the gap between layers

- Intel China officially releases 2023-2024 Corporate Social Responsibility Report

- Mouser Electronics and Analog Devices Launch New E-Book

- AMD launches second-generation Versal Premium series: FPGA industry's first to support CXL 3.1 and PCIe Gen 6

- LED chemical incompatibility test to see which chemicals LEDs can be used with

- Application of ARM9 hardware coprocessor on WinCE embedded motherboard

- What are the key points for selecting rotor flowmeter?

- LM317 high power charger circuit

- A brief analysis of Embest's application and development of embedded medical devices

- Single-phase RC protection circuit

- stm32 PVD programmable voltage monitor

- Introduction and measurement of edge trigger and level trigger of 51 single chip microcomputer

- Improved design of Linux system software shell protection technology

- What to do if the ABB robot protection device stops

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- The new forum homepage is online! Do you think it is necessary to keep the old homepage entrance?

- How to quickly write the output logic expression of CMOS logic gate circuit

- Recommendations for components encountered in peak sampling circuit design

- Follow and comment to win gifts! Micron 2022 Taipei International Computer Show Keynote Speech Highlights: Data Center Special

- Prize-winning quiz | How much do you know about Fujitsu's Ferroelectric Random Access Memory FRAM?

- Want to make an embedded machine learning wearable system

- Web front-end/back-end matters, non-technical issues!

- A large bounce occurs on the DC power supply

- "Let's practice together in 2021" + Work hard to become the horns of the ox in the Year of the Ox

- For four-layer boards, high-power routing issues

HA-4741M

HA-4741M

京公网安备 11010802033920号

京公网安备 11010802033920号