The automotive semiconductor market has continued to grow over the past decade and shows no signs of slowing down.

The growth of the automotive industry is primarily due to the use of electronics to control almost every aspect of the car, and the growth of the automotive industry is also solidified by the improvement of safety standards and the development of semi-autonomous to fully autonomous electric vehicles. Figure 1 shows that although the production of automobiles is expected to increase by 13% from 2016 to 2022, the amount of electronics in automobiles is expected to increase by 45% from $199 billion to $289 billion during the same period. Figure 1 also shows that the price of electronics per vehicle is increasing in the form of a "hockey stick curve" - from more than $2,000 per vehicle in 2016 to $2,700 per vehicle in 2022.

Figure 1: Automotive electronics market 2016-2022. Source: Prismark, October 2018

Figure 2 shows the projected growth in the number of radar, camera ( CMOS image sensor [ CIS ]), and light detection and ranging system (lidar) sensor modules for each level of automotive driving automation. Most high-end cars today are at level 2, while level 5 is fully autonomous. As shown in the figure, the number of various sensors will increase significantly when reaching levels 4 and 5 of autonomous driving [1].

Figure 2: Number of radar, camera and lidar modules in each level of automotive driving automation. Source: © Infineon Technologies AG.

All of the above-mentioned growth areas of electronic devices use various semiconductor products. Table 1 shows the growth of semiconductor end-application revenue from 2013 to 2018, as well as the growth forecast from 2019 to 2023. In the past five years (2013-2018), the automotive market has a compound annual growth rate (CAGR) of 7.3%, and in the next five years, from 2019 to 2023, it is expected to grow by 6.3%, making it the semiconductor segment with the highest growth rate.

Table 1: Semiconductor product revenue by end-use application, fiscal year 2013-2022. Source: Prismark

Automotive supply chain and key market players

Table 2 summarizes the automotive semiconductor supply chain and the major players in each supply chain industry.

Table 2: Automotive semiconductor supply chain and key players.

Unlike most other markets and industries, semiconductor integrated device manufacturers (IDMs) do not typically supply their products directly to automotive original equipment manufacturers (OEMs).

Instead, they supply their products to another group of companies called “Tier 1” suppliers, such as Bosch and Continental in Europe, Denso and Aisin in Japan or Mobis in South Korea. These Tier 1 suppliers produce various electronic and sensor modules and devices for automotive OEMs. For example, Tier 1 suppliers produce brake and transmission modules, oil pressure or fluid level sensor modules and airbag sensor modules. Semiconductor devices are an indispensable part of these modules manufactured by Tier 1 suppliers. Most of the top semiconductor integrated device manufacturers (IDMs), such as NXP, Renesas or Analog Devices, have their own wafer fabs, packaging and test facilities. However, outsourcing production has become a general trend, with packaging outsourcing being the main one. IDMs usually do not outsource wafer processing, wafer probing and test operations in order to have better control over these manufacturing processes.

This is mainly due to the stringent quality requirements of automotive applications. Perhaps for the same reason, only a few outsourced semiconductor and test suppliers ( OSATs ) participate in the automotive electronics packaging and testing market. The top three OSATs providing automotive electronics packaging and testing services are Amkor, ASE, and UTAC, with a combined market share of 95% [2]. As will be discussed later, the challenges in the automotive electronics packaging field are self-evident, and the barriers to entry are relatively high - professionally trained manufacturing personnel should adhere to the concept of "continuous improvement and zero defects" in their work. In addition, the industry may take up to four years, consuming a lot of valuable resources and going through hardships to reap the rewards and achieve profitability. It must be noted that some fabless design companies (such as Qualcomm) also provide semiconductor components to Tier 1 automotive suppliers.

Of course, they outsource all production tasks to foundry companies and OSATs .

Figure 3: Automotive packaging technology roadmap based on technical requirements for MCU , power supply and analog products [3].

Packaging technologies for automotive applications

In terms of package types, automotive Tier 1 suppliers and OEMs are currently using advanced packaging solutions in addition to traditional lead frame substrate solutions. Technology requirements, package size, and cost reduction are the main factors driving this trend. For example, 8-bit automotive microcontrollers typically use thin narrow pitch small outline packages (TSSOP) and quad flat packages (QFP), and most have shifted to quad flat no-lead packages (QFN) with smaller form factors and lower costs. However, in 16-bit and 32-bit microcontrollers, flip chip ball grid array (FCBGA) packaging solutions are used due to higher input/output (I/O) density. Figure 3 shows a high-level roadmap of automotive microcontroller units (MCUs ) , analog, and power products based on operating temperature and current/power requirements [3].

The roadmap shows that lead frame substrate packages will be used extensively by 2025. However, in high power, high current or high temperature applications, advanced lead frame packaging solutions such as exposed pads, copper clip interconnect technology and silver sintering processes are used. Figure 4 shows modules from several Tier 1 suppliers, all of which use a large amount of lead frame substrate packages. Within the lead frame family, the need for size and cost reduction has led to a significant increase in the use of QFNs in automobiles. However, the automotive industry requires a special QFN version with side-solderable flanks. Automotive component manufacturers require detectable solder joints that cannot be achieved with standard QFNs. Figure 5 shows the details of the side-solderable QFN. Both UTAC and Amkor Technology have patents on side-solderable QFN solutions.

Figure 4: Example of a module showing the extensive use of leadframe substrate packaging for various automotive applications. Source: *TechSearch International; **NVIDIA

Figure 5: The automotive industry requires side-solderable QFNs that allow for board-level solder joint inspection.

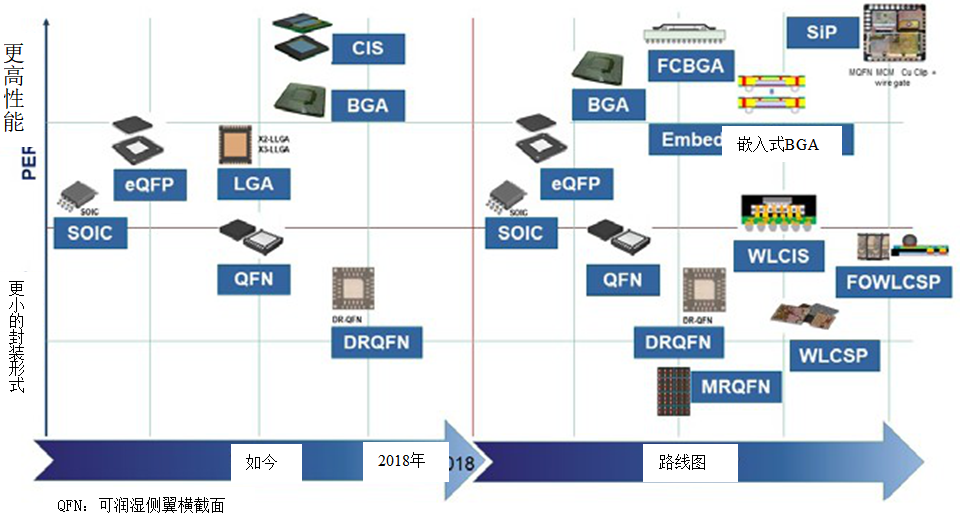

Automakers have traditionally stuck with standard leadframes that have proven their reliability. The use of advanced packaging solutions is increasing due to the widespread use of semiconductors in automobiles. Figure 6 shows the overall roadmap for automotive packaging products. While standard packaging will continue to be used for the next few years, advanced packaging is gaining ground and increasingly appearing in the automotive packaging product roadmap. Products that are using advanced packaging solutions include radar (wafer-level chip scale packaging [WLCSP] and system-in-package [SiP]), high-performance CPUs (high-pin-count FCBGA and SiP), and multi-function modules (SIP and embedded solutions).

Figure 6: High-level automotive packaging roadmap showing increasing use of advanced packaging technologies.

The number of sensors used in automobiles has increased dramatically—it is estimated that there are more than 50 sensors in a typical car today. While microelectromechanical systems ( MEMS ) such as accelerometers and gyroscopes are more likely to be packaged in standard laminate- or ceramic-grade packages, many other sensors, such as oil pressure and fuel level sensors, require unique packaging solutions.

The popularity of cameras in automotive applications has driven the widespread use of ceramic-grade or unique laminate-grade CIS solutions and wafer-level packaging (infotainment systems).

Laser radar (LIDAR) is considered the key to fully autonomous vehicles. Many IDMs and design companies are researching solid-state LiDAR technology.

Automotive companies may require 15 to 20 years of supply assurance and require the same retention period for all production-related data. Since the approval process for product change notifications (PCNs) takes up to 30 months, changes are usually not allowed. Then for the goal of "zero defects", all levels of OSAT organizations need to have certain higher quality standards and a mentality of continuous improvement.

OSATs’ challenges in packaging and testing automotive electronics can be divided into five separate areas: a) qualification and reliability, b) approval to volume production, c) mass production/operation, d) logistics and resources, and e) cost management.

This requires a fully custom packaging solution utilizing current technologies and materials.

Automotive packaging requirements are also driving the development of high-performance materials such as mold compounds and die attach materials for higher operating temperatures and high-power applications under the hood. As shown in Figure 3, copper clips are increasingly used as interconnect technology in power products for high-power and high-current applications. To reduce costs, copper wire has been widely used in standard automotive packaging. Figure 7 shows the growth of copper wire usage in automotive applications at UTAC. We started shipping copper wire in 2015 and have shipped more than 163 billion QFN products with copper wire since then without any quality issues.

Figure 7: UTAC historical shipments by copper interconnect technology package type for automotive applications.

Semiconductor Issues in Automotive Warranty Claims

Currently, approximately 4% of a car’s annual warranty costs are related to semiconductors[3]. This is not surprising given the increasing number of semiconductors in today’s cars. Of this 4% of semiconductor-related failures, more than 50% are related to packaging and final test. Figure 8 shows the breakdown of semiconductor failures. Therefore, the automotive supply chain, including OSATs , is under constant pressure to continuously improve quality to achieve “zero defects”.

Previous article:In-depth | Autonomous driving, how do German car companies challenge Google?

Next article:Mercedes-Benz reiterates electrification strategy, including 48V/plug-in hybrid/pure electric

- Popular Resources

- Popular amplifiers

- A new chapter in Great Wall Motors R&D: solid-state battery technology leads the future

- Naxin Micro provides full-scenario GaN driver IC solutions

- Interpreting Huawei’s new solid-state battery patent, will it challenge CATL in 2030?

- Are pure electric/plug-in hybrid vehicles going crazy? A Chinese company has launched the world's first -40℃ dischargeable hybrid battery that is not afraid of cold

- How much do you know about intelligent driving domain control: low-end and mid-end models are accelerating their introduction, with integrated driving and parking solutions accounting for the majority

- Foresight Launches Six Advanced Stereo Sensor Suite to Revolutionize Industrial and Automotive 3D Perception

- OPTIMA launches new ORANGETOP QH6 lithium battery to adapt to extreme temperature conditions

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions

- TDK launches second generation 6-axis IMU for automotive safety applications

- LED chemical incompatibility test to see which chemicals LEDs can be used with

- Application of ARM9 hardware coprocessor on WinCE embedded motherboard

- What are the key points for selecting rotor flowmeter?

- LM317 high power charger circuit

- A brief analysis of Embest's application and development of embedded medical devices

- Single-phase RC protection circuit

- stm32 PVD programmable voltage monitor

- Introduction and measurement of edge trigger and level trigger of 51 single chip microcomputer

- Improved design of Linux system software shell protection technology

- What to do if the ABB robot protection device stops

- CGD and Qorvo to jointly revolutionize motor control solutions

- CGD and Qorvo to jointly revolutionize motor control solutions

- Keysight Technologies FieldFox handheld analyzer with VDI spread spectrum module to achieve millimeter wave analysis function

- Infineon's PASCO2V15 XENSIV PAS CO2 5V Sensor Now Available at Mouser for Accurate CO2 Level Measurement

- Advanced gameplay, Harting takes your PCB board connection to a new level!

- Advanced gameplay, Harting takes your PCB board connection to a new level!

- A new chapter in Great Wall Motors R&D: solid-state battery technology leads the future

- Naxin Micro provides full-scenario GaN driver IC solutions

- Interpreting Huawei’s new solid-state battery patent, will it challenge CATL in 2030?

- Are pure electric/plug-in hybrid vehicles going crazy? A Chinese company has launched the world's first -40℃ dischargeable hybrid battery that is not afraid of cold

- About MSP430 Miscellaneous Talks --Precise Delay of delay_cycles

- One article to understand the RF chip industry chain and its domestic status!

- Low-cost DIY nano-level lithography machine! This post-95s boy is popular...

- Type-C interface display solution

- Is there any module similar to Yiweilian?

- How to choose the right operational amplifier

- How to use a switching boost chip to solder a circuit to achieve 5-24V output

- Here is a basic CAD shortcut key

- [GD32L233C-START Review] 1. Unboxing + Environment Setup

- Maxim Basic Analog IC APP download helps you innovate analog design!

OPA650P

OPA650P

京公网安备 11010802033920号

京公网安备 11010802033920号