The sales rankings of the world's top semiconductor manufacturers have been updated again! There are some market research companies that regularly publish sales rankings of semiconductor companies and also conduct surveys and forecasts on high-tech companies. However, this year (2019) is the first time that these market research companies have so clearly predicted and updated the rankings of semiconductor companies.

As everyone in the semiconductor industry knows, the company with the highest sales last year (2018) was Samsung Electronics of South Korea, and the second place was Intel of the United States. There are three market research companies that are mainly responsible for publishing the annual sales rankings of semiconductor manufacturers, namely Gartner, IC Insights, and I HS Markit. This spring, the three companies announced last year's rankings, with Samsung Electronics (hereinafter referred to as "Samsung") at the top and Intel at the second place.

Among the market research companies that publish rankings of semiconductor companies’ sales, Gartner undoubtedly has the highest influence and the longest history. Gartner published the estimated rankings in January and the final rankings in April.

According to the rankings published by Gartner, Intel has been ranked No. 1 for 25 consecutive years from 1999 to 2016, while Samsung has been ranked No. 2 for 15 years from 2002 to 2016. In other words, Intel has been ranked No. 1 and Samsung has been ranked No. 2 for 15 consecutive years.

Samsung took the top spot two years ago, the first time Samsung won the top spot in history, and Intel dropped to the top two, and it was the same ranking last year. According to the confirmed rankings released by Gartner, Samsung has remained the top one for two consecutive years, and Intel has remained the top two for two consecutive years.

Gartner released last year's sales rankings (confirmed values) on April 11 this year. The data released at this time predicted that due to the decline in memory semiconductor prices, Samsung is almost certain to drop from the top spot in this year's corporate rankings and give up the top spot to Intel.

One month before Gartner released its ranking forecast, market research firm IC Insights released its semiconductor company rankings on March 7, 2019. In the 2019 semiconductor sales ranking forecast, Intel and Samsung swapped positions, which means: Samsung was TOP1 in 2018 and Intel was TOP2; in 2019, Intel will take the first place and Samsung will drop to TOP2.

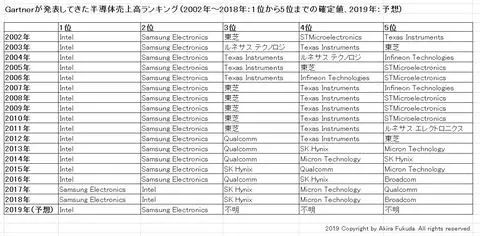

Semiconductor sales rankings released by Gartner

(2002-2018: confirmed values of TOP1-TOP5, 2019 is the predicted value)

Sales ranking of semiconductor manufacturers from 2002 to 2019. The values up to 2018 are compiled by the author based on the confirmed values published by market research company Gartner, and the values for 2019 are the forecast values published by Gartner on April 11, 2019. (Image from: pc.watch)

The sales ranking of semiconductor companies from 2016 to 2019 was announced by market research company IC Insights on March 7, 2019. 2016 to 2018 are actual results, and 2019 is a forecast. (Image from: pc.watch)

The semiconductor sales rankings released by Gartner last year (2018), with the left side showing the forecast value released on January 7, 2019, and the right side showing the confirmed value released on April 11, 2019. (Image source: pc.watch)

The main reason for the change in the ranking of semiconductor companies is the decline in the price of memory semiconductors. In particular, the price of DRAM has been falling since last autumn, which has greatly reduced Samsung's sales.

DRAM and NAND flash memory occupy most of the storage semiconductor market. Among DRAM and NAND flash memory, DRAM has a relatively larger market size. Although the three major storage semiconductor manufacturers - Samsung, SK Hynix, and Micron Technology - all have DRAM and NAND flash memory businesses, DRAM accounts for a large proportion of their sales.

Since the beginning of last year, the price of NAND flash memory has shown a downward trend, and by the end of last year, the price has accelerated! However, the price of DRAM remained stable until the summer of last year, and it can even be said that it showed an upward trend, but it fell sharply from the autumn to the winter of last year.

This influence can be clearly seen from the ranking of semiconductor sales in each quarter released by market research company IHS Markit. From Q1 (January to March) to Q3 (July to September) last year, Samsung ranked first and Intel ranked second. However, in Q4 (October to December), the situation reversed, with Intel ranking first and Samsung ranking second.

It is worth noting that both Intel and Samsung's Q4 sales were lower than their respective Q3 sales. As mentioned in the article "The Continuous Reversal of the Semiconductor Market" in this column in March 2019, the economic recession in Q4 affected the entire semiconductor market. Although the decline in memory semiconductors was extremely obvious, the markets for processors and ASICs were also in a downturn.

Of course, Intel's decline was relatively small, while Samsung's decline was very large. In the Q4 sales released by IHS Markit, Intel's Q4 sales were 2.3% lower than Q3, while Samsung's sales were 24.9% lower year-on-year.

Samsung's Q4 sales actually decreased by 24.9% compared to Q3, a significant decline, which is almost equivalent to the quarterly performance value announced by Samsung in January 2019 (the performance of three large memory semiconductor manufacturers deteriorated sharply). According to the published data, Q4 sales decreased by 24% compared to Q3, and the sales of memory semiconductors, which account for 83% of the total semiconductor sales, decreased by 26% year-on-year.

According to data released by Samsung, the average selling price of DRAM in Q4 decreased by 7%-8% compared to Q3, and the shipment volume of DRAM converted into storage capacity (bits) decreased by 17%-19% year-on-year. If the sales amount is simply calculated by multiplication, it is about 23%-25% less. Although Samsung did not announce the sales amount of DRAM, it is undeniable that the 24% decline has had a huge impact on the overall semiconductor sales.

On the other hand, Intel's Q4 2018 performance was 2.6% lower than Q3. This decrease includes products other than semiconductors. Although it is not a simple comparison of the increase or decrease of semiconductors, it is almost the same as the 2.3% decline announced by IHS Markit.

IHS Markit released the ranking of semiconductor sales in each quarter of 2018. This table is compiled by the author based on the data released by IHS Markit. (Image from: pc.watch)

Top 10 semiconductor sales rankings for each quarter in 2018

(Source: IHS Markit)

IHS Markit released the top 10 semiconductor sales rankings for each quarter of 2018. This table is compiled by the author based on the data released by IHS Markit. (Image from: pc.watch)

Next, let's look at the sales forecasts for Intel and Samsung in 2019. On April 25, 2019, Intel announced its Q1 (January to March) performance, and according to its forecast, the overall sales in 2019 will be about US$69 billion (about RMB 469.2 billion). In 2018, sales increased by 13% from 2017 to US$70.8 billion (about RMB 481.44 billion). In 2019, it is expected to decrease by 2.5% from 2018, which is definitely not a good sign.

Intel's announced sales include products other than semiconductors. Therefore, let's assume the proportion of semiconductor products to Intel's overall sales. According to Gartner's forecast, Intel's sales in 2018 were approximately US$66.29 billion (approximately RMB 450.77 billion). If we simply calculate, semiconductor products account for approximately 93.6% of Intel's overall sales. If we apply this ratio to the sales forecast for 2019, it is expected that the sales of semiconductor products in 2019 will be approximately US$64.6 billion (approximately RMB 439.28 billion).

Next is Samsung. Samsung did not release its annual semiconductor sales forecast. Regarding Samsung's semiconductor sales, according to data released by IC Insights on March 7, 2019, its sales growth rate was negative 19.7%, or negative 20%. If this ratio is applied to the semiconductor sales in 2018 released by Gartner, Samsung's sales in 2019 will be approximately US$58.919 billion (approximately RMB 400.65 billion).

Intel's semiconductor sales were US$64.6 billion (about RMB 439.28 billion), and Samsung's sales were US$58.919 billion (about RMB 400.65 billion). It can be seen that Intel will exceed Samsung by about 10% in 2019. However, in 2018, Samsung was 11% higher than Intel.

Intel and Samsung's semiconductor sales trends (2002-2019)

Note: 2002-2018 are the figures released by Gartner, and 2019 is the author's prediction.

Amount: 1 million USD

Intel and Samsung's semiconductor sales trends (2002-2019). The data from 2002 to 2018 is compiled by the author based on the data released by Gartner, a crane company. The data for 2019 is the author's prediction (Intel's year-on-year decrease was 2.5% last year, and Samsung's year-on-year decrease was 20%). (Image from: pc.watch)

Intel and Samsung's semiconductor sales ratio (2002-2019)

Ratio = Intel/Samsung's value

Note: 2002-2018 are the figures released by Gartner, and 2019 is the author's prediction.

The ratio of semiconductor sales of Intel and Samsung (2002-2019). The ratio is the value of Intel/Samsung. The values from 2002 to 2018 are the author's summary based on the data published by Gartner, and the value in 2019 is the author's prediction. (Image from: pc.watch)

What will the ranking be like after the top 3 in 2019? In the semiconductor sales in 2018 announced by Gartner, there is a gap of about US$30 billion (about RMB 204 billion) between the top 2 Intel and the top 3 SK Hynix, and the sales of SK Hynix and the top 4 Micron Technology (hereinafter referred to as "Micron") are relatively close. In addition, there is a gap of about US$13.5 billion (about RMB 91.8 billion) between the top 4 Micron and the top 5 Broadcom. Broadcom, top 6 Qualcomm, and top 7 Texas Instruments form a group with sales of about US$15 billion (about RMB 102 billion). In addition, there is a gap of about US$5 billion (about RMB 34 billion) between the top 7 and the top 8.

Previous article:The ranking of the top ten analog IC suppliers in 2018 is released

Next article:STMicroelectronics CEO: Market downturn continues to increase R&D, with focus on China

- Popular Resources

- Popular amplifiers

- Vietnam's chip packaging and testing business is growing, and supply-side fragmentation is splitting the market

- The US asked TSMC to restrict the export of high-end chips, and the Ministry of Commerce responded

- ASML predicts that its revenue in 2030 will exceed 457 billion yuan! Gross profit margin 56-60%

- ASML provides update on market opportunities at 2024 Investor Day

- It is reported that memory manufacturers are considering using flux-free bonding for HBM4 to further reduce the gap between layers

- Intel China officially releases 2023-2024 Corporate Social Responsibility Report

- Mouser Electronics and Analog Devices Launch New E-Book

- AMD launches second-generation Versal Premium series: FPGA industry's first to support CXL 3.1 and PCIe Gen 6

- SEMI: Global silicon wafer shipment area increased by 6.8% year-on-year and 5.9% month-on-month in 2024Q3

- LED chemical incompatibility test to see which chemicals LEDs can be used with

- Application of ARM9 hardware coprocessor on WinCE embedded motherboard

- What are the key points for selecting rotor flowmeter?

- LM317 high power charger circuit

- A brief analysis of Embest's application and development of embedded medical devices

- Single-phase RC protection circuit

- stm32 PVD programmable voltage monitor

- Introduction and measurement of edge trigger and level trigger of 51 single chip microcomputer

- Improved design of Linux system software shell protection technology

- What to do if the ABB robot protection device stops

- Huawei's Strategic Department Director Gai Gang: The cumulative installed base of open source Euler operating system exceeds 10 million sets

- Download from the Internet--ARM Getting Started Notes

- Learn ARM development(22)

- Learn ARM development(21)

- Learn ARM development(20)

- Learn ARM development(19)

- Learn ARM development(14)

- Learn ARM development(15)

- Analysis of the application of several common contact parts in high-voltage connectors of new energy vehicles

- Wiring harness durability test and contact voltage drop test method

- MSP432 100-pin Target Board

- TI eSMO library Fsmopos and Gsmopos parameter analysis

- Data Structures in Embedded System Software Design

- Has anyone in the forum used a domestic DSP? Do you have any recommendations?

- EEWORLD University Hall ---- A Global View of Analog IC Design

- It's still a boost problem. The unit price of lithium battery 4.2V is boosted to 50V

- Altium designer safety spacing setting problem

- If the lift table you buy has a hidden camera, but the manufacturer does not inform you in advance, do you make a profit or a loss?

- How to solve the abnormal application of RS-485 automatic transceiver circuit?

- DSP_28335_SCI_FIFO transceiver experiment

5962-89640012A

5962-89640012A

京公网安备 11010802033920号

京公网安备 11010802033920号