The World Semiconductor Trade Statistics Organization (WSTS) released the latest semiconductor market forecast for August 2022. Due to weak demand for consumer electronic terminals, memory prices have fallen, output value has shrunk, and the growth momentum of the memory market has slowed down. It is estimated that the global semiconductor market growth rate this year will be revised down from the original 16.3% to 13.9%, and the market size will reach US$633.238 billion, a decrease of 2.0% from the original forecast of US$646.456 billion. The market growth rate in 2023 will be revised down from 5.1% to 4.6%, and the market size will reach US$662.36 billion, a decrease of 2.5% from the original forecast of US$679.65 billion. Despite this, the overall market size will continue to set new records this year and next.

As the supply of dynamic random access memory (DRAM) and storage type flash memory (NAND Flash) is oversupplied and prices are falling, prices are likely to continue to fall in the second half of this year. Therefore, WSTS originally estimated that the annual growth rate of the global memory market output value this year would reach 18.7%, and then grow by another 3.4% next year. It has significantly revised down the annual growth rate of the global memory market output value this year to 8.2%, and revised it down to 0.6% next year. This wave of forecast revisions also includes the market growth rate of micro components such as microprocessors (MPUs) and microcontrollers (MCUs), which has been revised down from the original expected 11.4% to 5.9%, and the growth rate next year has been reduced from 5.3% to 3.6%. However, WSTS has reversed and raised the annual growth rate of the analog component market in 2022, from 19.2% to 21.9%, and the growth rate next year has been revised up from 5.7% to 6.4%.

WSTS said that the semiconductor market still has the opportunity to exceed US$600 billion (about NT$17.8 trillion) this year. Most major types of chips have seen double-digit annual growth, among which logic IC output value is expected to grow by about 24.1%, analog IC growth by about 21.9%, sensor growth by about 16.6%, and optoelectronics growth by about 0.2%. In terms of regions, the Asia-Pacific region is expected to grow by 10.5%, the Americas by 23.5%, Europe by 14%, and Japan by 14.2%.

IC Insights estimates that as 5G mobile phone shipments increase and related infrastructure is in place, the communications industry will account for the largest portion of analog IC sales in 2022, of which wireless communications applications will account for 91% of the overall analog communications sales, and wired communications applications will account for 9%. Since the battery-powered systems of mobile phones, laptops, and various mobile devices require such chips to regulate power to prevent overheating during device operation and extend battery life, and these chips also have communication interface, display backlight and other adjustment functions, the overall market demand is still quite large.

Hybrid analog-digital ICs are in vogue, and the “four most important” aspects of the analog chip market

The IC market can be divided into four major product categories: analog, logic, memory and micro-components. In the past two years, the most scarce chips are analog and power management chips. Zhang Shijie, director of the Electronic and Optoelectronic Systems Research Institute of the Industrial Technology Research Institute, pointed out that there are no pure digital ICs or analog ICs nowadays, and most of them are mixed analog and digital ICs. However, there are still pure memory ICs, such as Flash and Dram. Only bit-oriented design ICs can be distinguished, which use process miniaturization to achieve area, speed, power consumption optimization and other benefits, and also include a large number of analog circuits such as clock, transmission, and power supply regulation; non-digital-oriented design ICs (analog ICs) require high precision, low noise and other qualities, and will also rely on a large number of digital circuits to achieve algorithm correction.

Zhang Shijie further explained that currently most industrial applications are "small quantities, diverse quantities, and high specifications", which is a typical analog chip market. "High specifications" refers to characteristics such as accuracy, large voltage range, extremely high speed (radio frequency), extremely low power consumption, and low noise. As smart manufacturing develops at an annual compound growth rate of 10%, industrial applications have become the market that "most needs" analog chips. Since various machines have unique smart manufacturing specifications and characteristics, coupled with small quantities and diverse process requirements, it is bound to drive chip demand and growth.

The semiconductor-based advanced driver assistance system (ADAS) in the automotive industry will have a 20% compound annual growth rate in the next five years; electric vehicles will continue to grow at a penetration rate of 2% per year; the annual output value of automotive chips is about US$60 billion, with a 10% compound annual growth rate, so electric vehicles are the "most growth-oriented" market. Taking the fast-growing electric vehicles as an example, it is conservatively estimated that an electric vehicle requires 500-1,500 chips, and even the new Ford Focus electric vehicle requires up to 3,000 chips. As the demand for electric vehicles increases year by year, it is bound to drive the demand for sensors such as batteries, switches, control circuits, radars, lidars, and the growth of a series of chips.

The communications sector has an annual demand for 1.5 billion mobile phones. The market size is stable and can generate an output value of approximately US$30 billion for analog (RF front-end, power supply) chips. It is also the "most stable" market. The PC/NB market has an annual shipment volume of approximately 300 million units. With the introduction of new IO specifications, the demand for analog chips for peripheral products is expected to reach US$10 billion. This can be described as a market where "the smallest soldier can achieve great results."

In addition, low-orbit satellites are deployed in large numbers and continue to increase rapidly, and ground applications are diversified and expanded, from today's fixed ground stations to gradually expand to vehicle-mounted, personal devices to satellite IoT devices. With more and more ground receiving stations, both vehicle-mounted and personal devices require analog chips, which has unlimited potential and deserves attention.

Top 10 analog chip suppliers account for half of the market

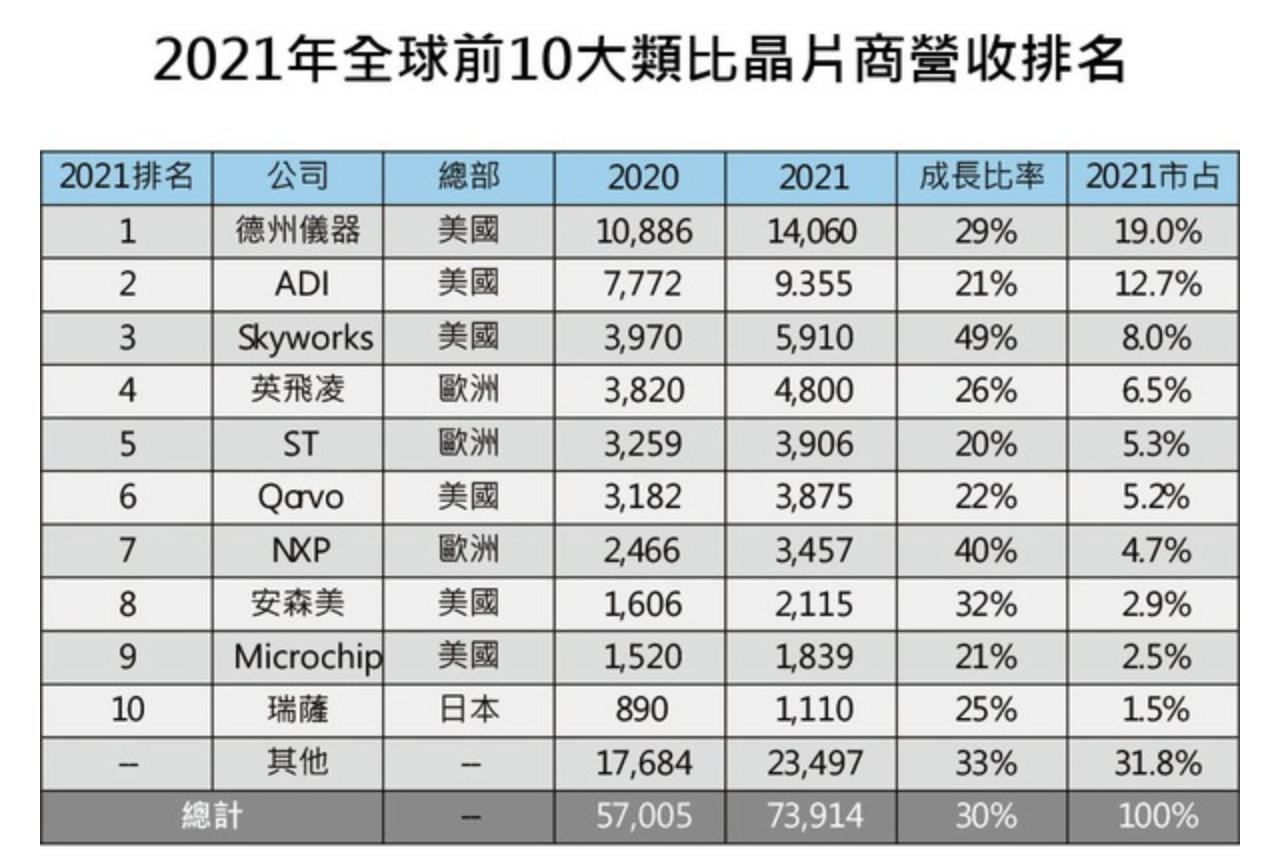

The entry barrier for analog chips is high, and it seems that IDM factories dominate the market. The sales and market share rankings of the top 10 analog chip suppliers released by IC Insights are not much different in 2020 and 2021. The top three are Texas Instruments (TI), Analog Devices (ADI), and Skyworks.

In 2020, analog chips accounted for 75% of Texas Instruments' business, with sales of US$10.886 billion, a year-on-year increase of 9%, and a market share of 19%. About half of the processes are 12-inch wafers. Texas Instruments has built a new 12-inch (300mm) semiconductor wafer fab in Sherman, Texas, USA, which is expected to be put into production in 2025. The new wafer fab will join the existing 12-inch wafer fab camp, including DMOS6 in Dallas, Texas, RFAB1 and RFAB2 in Richardson, Texas; LFAB in Lehi, Utah is expected to be put into production in early 2023.

Analog Devices (ADI) has a market share of about 9%. After acquiring Linear in 2017, it gained new markets such as current sensors and high current for cloud computing. Its revenue is mainly in the industrial sector (about 53%), followed by communications (about 21%), automotive (about 14%), and consumer electronics (about 11%). Skyworks has benefited from the growing demand for wireless communication products and the upgrade of 5G and Wi-Fi 6 technologies, with a market share of 7%.

The three largest European suppliers, Infineon, STMicroelectronics, and NXP, had a combined global market share of 17% in 2020. Infineon, benefiting from the rising demand for sensors in automobiles and power supplies, performed better than STMicroelectronics and NXP. As for Maxim, it has been acquired by Analog Devices.

ONSemi's development in power semiconductors is second only to Infineon and Texas Instruments. Its products include power components, sensors and power management, and its terminal applications cover automotive, medical, consumer electronics, industrial, communications and cloud computing. Automobile (about 37%) is the largest, followed by industry (about 28%). Microchip Technology's products are mainly used in automotive, military, aerospace, communications, computers, manufacturing and consumer electronics. Renesas, a major Japanese IDM manufacturer, will maintain its fab-light strategy from 2021 and expand outsourcing to increase the supply capacity of microcontrollers (MCUs) and power semiconductors. It hopes to increase MCU supply by 50% by 2023.

According to Gartner statistics, the global total output value of automotive semiconductors in 2020 was approximately US$37.4 billion (approximately NT$1.05 trillion). Among them, the five major IDMs including Infineon, NXP, Renesas, Texas Instruments and STMicroelectronics accounted for 43%. In particular, Infineon had a market share of 11.6%, making it the leader in automotive semiconductors.

Zhang Shijie observed that the top 10 analog chip IDM companies in the world are all supported by strong application systems in their home countries, such as the U.S. defense industry and the European and Japanese automotive industries. With the support of the aerospace and military industries, the U.S. companies have developed to the extreme in terms of specifications and operating environment, and have controlled product exports to maintain their own advantages and influence on downstream industries.

Previous article:Samsung uses Ansys simulation tools to create advanced semiconductor designs and optimize high-speed connectivity

Next article:The 2022 Simulation Invitational Tournament was successfully completed, and the TI University Program continues to support dreams!

Recommended ReadingLatest update time:2024-11-16 10:22

- High signal-to-noise ratio MEMS microphone drives artificial intelligence interaction

- Advantages of using a differential-to-single-ended RF amplifier in a transmit signal chain design

- ON Semiconductor CEO Appears at Munich Electronica Show and Launches Treo Platform

- ON Semiconductor Launches Industry-Leading Analog and Mixed-Signal Platform

- Analog Devices ADAQ7767-1 μModule DAQ Solution for Rapid Development of Precision Data Acquisition Systems Now Available at Mouser

- Domestic high-precision, high-speed ADC chips are on the rise

- Microcontrollers that combine Hi-Fi, intelligence and USB multi-channel features – ushering in a new era of digital audio

- Using capacitive PGA, Naxin Micro launches high-precision multi-channel 24/16-bit Δ-Σ ADC

- Fully Differential Amplifier Provides High Voltage, Low Noise Signals for Precision Data Acquisition Signal Chain

- Innolux's intelligent steer-by-wire solution makes cars smarter and safer

- 8051 MCU - Parity Check

- How to efficiently balance the sensitivity of tactile sensing interfaces

- What should I do if the servo motor shakes? What causes the servo motor to shake quickly?

- 【Brushless Motor】Analysis of three-phase BLDC motor and sharing of two popular development boards

- Midea Industrial Technology's subsidiaries Clou Electronics and Hekang New Energy jointly appeared at the Munich Battery Energy Storage Exhibition and Solar Energy Exhibition

- Guoxin Sichen | Application of ferroelectric memory PB85RS2MC in power battery management, with a capacity of 2M

- Analysis of common faults of frequency converter

- In a head-on competition with Qualcomm, what kind of cockpit products has Intel come up with?

- Dalian Rongke's all-vanadium liquid flow battery energy storage equipment industrialization project has entered the sprint stage before production

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- Dynamic Near Field Communication (NFC) Type 4B Tag

- [GD32E231 Work Submission] Environmental Radiation Dose Monitoring Equipment Design

- [RVB2601 Creative Application Development] 7. IoT Control

- DM6446 DSP end program optimization

- MPXV2202DP connected to IN132 output abnormality, I don't know how to deal with it

- A beautiful frame diagram

- CES 2021 Complement Event Activity Recognition on IMU with Machine Learning Core

- Tektronix Prize-giving Event | Popular Applications of Semiconductor Materials and Device Test Technology

- Free shape LED ball

- Internet of Things vs Industrial Internet of Things: 10 Differences That Matter

A Practical Tutorial on ASIC Design (Compiled by Yu Xiqing)

A Practical Tutorial on ASIC Design (Compiled by Yu Xiqing)

京公网安备 11010802033920号

京公网安备 11010802033920号