As China's domestic market has just started, Samsung, Micron and other giants have successively predicted the pessimism of the memory chip market

EEWorld

Sharp interpretation of electronic information

Technical content updated daily

Following the "Waterloo" of its mobile phone business in China, on January 8, Samsung Electronics, the world's largest memory manufacturer, released its preliminary financial report for the fourth quarter of 2018, and its performance will be significantly lower than previously expected.

Samsung Electronics said its fourth-quarter profit decline was mainly due to sluggish demand for memory chips, and it expects performance to remain sluggish in the first quarter of 2019.

Previously, US memory giant Micron and South Korea's SK Hynix have stated that DRAM and NAND demand will weaken and prices will fall in 2019, and they will adjust revenue or reduce investment.

Several major companies in China's storage industry are continuously increasing their production capacity. Hefei Changxin started production last year, and Fujian Jinhua and Yangtze Memory are accelerating production. However, sluggish demand and falling memory chip prices may bring challenges to China's nascent memory chip industry.

Report screenshot

On January 8, according to CNBC, Samsung Electronics said on the same day that its fourth-quarter profits may fall sharply due to sluggish demand for its memory chip business and intensified competition in the smartphone market.

Samsung Electronics expects operating profit of 10.8 trillion won ($9.67 billion) in the fourth quarter of last year, lower than analysts' forecast of 13.2 trillion won, and a 38.5% drop from the previous quarter; sales in the fourth quarter of 2018 were 59 trillion won, lower than analysts' forecast of 62.8 trillion won, and down nearly 10% from the third quarter.

Samsung Electronics said that the lower-than-expected demand for the memory business led to a decline in shipments and a significant drop in memory chip prices. In addition, the smartphone market was basically stagnant, and revenue expenses also led to a decline in profitability. Affected by memory chips, the company's performance in the first quarter is expected to remain sluggish.

Samsung Electronics is due to release detailed financial results later this month.

Samsung's quarterly operating profit is expected to fall for the first time in two years as a slowdown in China, a key market, could affect demand for the company's products. One analyst said China accounts for 20% to 30% of global demand for consumer technology. Earlier, Apple also cut its quarterly revenue forecast, blaming China.

Although Samsung is best known for its smartphone and TV businesses, its recent net profit growth has been heavily dependent on its chip business. Since the third quarter of 2017, Samsung has been the world's largest chip shipment company for several consecutive quarters.

As early as November last year, when Samsung released its third-quarter report for 2018, it predicted that the chip market would experience "seasonal weakness" in the fourth quarter of this year, and the company's profits were likely to decline during this period. To this end, Samsung will adjust its spending on factories and equipment while monitoring chip prices.

Samsung Electronics is not the first company to acknowledge sluggish demand for memory chips.

In addition to Samsung, Western Digital, Micron, SK Hynix and others also expect that the demand for DRAM and NAND memory will weaken this year. The above companies have adjusted their output, slowed down their investment plans, and reduced capital expenditures to "make up for the losses."

The first to react was Western Digital, which said it would reduce Fab (wafer factory) output and slow down its next expansion plans to ease operational pressure caused by weak demand and falling prices.

Micron said in its first quarter financial report for fiscal 2019 that demand for DRAM and NAND will weaken this year, and its second quarter revenue is expected to be between $5.7 billion and $6.3 billion, lower than the $7.3 billion expected by Wall Street analysts. Stock earnings are expected to be $1.65 per share to $1.85 per share, also lower than market expectations.

According to the ZACKS investment website, the company's president, Sanjay Mehrotra, said in a subsequent conference call that weak DRAM demand was one of the main reasons for Micron's lowering of its second-quarter expectations. At the same time, in order to solve the problem of oversupply, the company will reduce NAND and DRAM production to maintain prices. Among them, the main reduction is in the production capacity of memory chips in the automotive, smartphone and data center markets.

The industry pointed out that the weakness in demand for downstream semiconductor applications is the biggest concern for 2019, and Micron’s financial report just reflects this.

Image source: Guanyan Tianxia

Another competitor, SK Hynix, also said that in response to the falling price trend of NAND and DRAM in 2019, the company decided to reduce its investment scale starting from the end of 2018 and will monitor and adjust its production capacity in 2019.

In fact, after more than two years of price increases, memory is no longer as popular as it used to be.

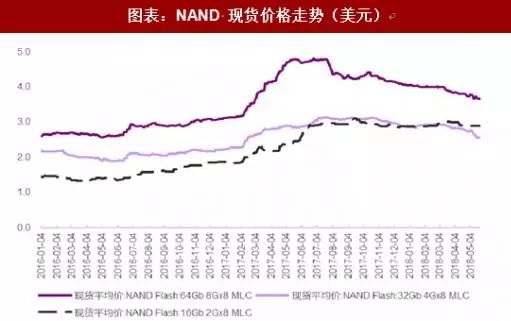

NAND flash memory prices have weakened since the beginning of last year, and the industry expects this trend to continue until 2019. DRAM memory prices also turned from rising to falling in the third quarter of last year, with an average price drop of 10-15%.

Screenshot of Guojin Securities research report

Currently, Samsung Electronics, SK Hynix, Micron Technology and others have a market share of over 90% in the DRAM industry and have made huge profits from the skyrocketing memory prices in the past two years.

As foreign manufacturers are making huge profits, China's memory chip industry is also accelerating its layout and working hard to achieve domestic substitution.

At present, China's storage field has formed three major camps, including Yangtze Memory Technologies Co., Ltd., which develops NAND Flash, Hefei Changxin Memory Technologies Co., Ltd., which focuses on mobile memory, and Fujian Jinhua Technology Co., Ltd., which is committed to niche memory.

At this time, the sluggish demand for memory chips and falling prices may become a "stumbling block" to the development of China's memory chip industry.

In a research report on December 20 last year, Guotai Junan Securities pointed out that this downward trend will make the short-term profit prospects of China's mainstream memory chip manufacturers Yangtze Memory Technologies Co., Ltd. and Hefei Changxin Technology Co., Ltd., which are about to start mass production, even worse.

However, the brokerage firm also pointed out that it estimates that the downward trend in the memory chip industry will last no more than 12 months (starting from January 2019), and related manufacturers will not suffer losses.

Screenshot of Guojin Securities research report

As early as September last year, Guotai Junan Securities analyzed the downward trend of memory chips.

At that time, the brokerage firm believed that the weak demand for mid- and low-end mining machines caused by the decline in Bitcoin prices, the poor sales of mid- and low-end mobile phones caused by the depreciation of emerging market currencies, and the increase in production capacity as 3D NAND moved to 96 layers and DRAM moved to process technology below 19 nanometers, estimated that there would be a 3-5% oversupply of memory DRAM and flash NAND in 2019.

"The downward price trend is established, which will cause the overall memory chip industry to decline by 5-9% year-on-year in 2019 and the global semiconductor industry to decline by 1-4% year-on-year."

Source: Observer.com. If there are any copyright issues, please contact us to delete it.

Recommended Reading

Why is 5G the "hope of the whole village"? A review of the 5G industry in 2018

This is the first time someone has explained 5G so simply and clearly.

Earning a million dollars a year? The secret of overseas permanent income

How to use a servo? Read the development notes of a senior robot maker

Keysight's new DAQ970A data acquisition instrument is now available for free trial!

Focus on industry hot spots and understand the latest frontiers

Please pay attention to EEWorld electronic headlines

https://www.eeworld.com.cn/mp/wap

Copy this link to your browser or long press the QR code below to browse

The following WeChat public accounts belong to

EEWorld (www.eeworld.com.cn)

Welcome to long press the QR code to follow us!

EEWorld Subscription Account: Electronic Engineering World

EEWorld Service Account: Electronic Engineering World Welfare Club

京公网安备 11010802033920号

京公网安备 11010802033920号