“Mainland China foundries including SMIC and Hua Hong Semiconductor have cut capacity support for some IC design companies as they prioritize fulfilling orders from local customers.”According to a report by Taiwan media Electronic Times on July 8, there are supply chain sources saying that due to the global mature process capacity being in short supply, in order to give priority to local companies, Hua Hong Semiconductor has canceled orders from many MCU manufacturers, mostly Taiwanese manufacturers. In addition, SMIC has also established a strategy of mainly accepting orders from local customers. Sources pointed out that the above-mentioned wafer fabs have significantly reduced their capacity support, which may affect the annual supply of several IC design plants.The battle for production capacity is getting more intense

The sought-after mature process capacity has become a global strategic material, which has rarely changed the order-taking strategy of wafer foundries. Electronic Times reported that since Huahong was unable to fully meet the orders from Taiwanese factories, Taiwanese factories, which already had a 30% supply gap, were in a state of panic.

It is understood that Hua Hong Semiconductor has built three 8-inch wafer fabs (Hua Hong Fab 1, Fab 2 and Fab 3) in Jinqiao and Zhangjiang, Shanghai, with a monthly production capacity of approximately 180,000 pieces; at the same time, there is a 12-inch wafer fab (Hua Hong Fab 7) with a monthly production capacity of 40,000 pieces in Wuxi High-tech Industrial Development Zone.(Source: China Business News)At the same time, SMIC has also established that orders will mainly come from local customers. Although it will not drastically cut orders from Taiwanese manufacturers, the production order still cannot be advanced for Taiwanese manufacturers that have already significantly increased their prices.IC design companies said that the global production capacity is in short supply and it is very difficult to transfer orders. The price of urgent orders must be raised to obtain production capacity. At present, since many Taiwanese manufacturers have suffered order cuts from mainland manufacturers or the production capacity obtained is not as expected, the supply gap may not be reduced as expected by the end of the year. If a Taiwanese manufacturer is lucky enough to take over the transferred order, the price increase will inevitably increase across the board, which may reduce profits in the second half of the year. It is understood that only World Advanced and Powerchip are likely to take over the transferred order.In addition, due to the shortage of many chips such as MCU, communication chips, and power management chips, bidding for goods has increased recently. IC design companies said that concerns about duplicate orders have reappeared recently, but judging from the fact that wafer foundry and chips are still in short supply, the tight semiconductor production capacity situation will not be alleviated until 2023, as TSMC said. During this period, the competition for wafer foundry capacity, which has been upgraded to a "national battle", will become more intense.The third quarter price increased by another 30%

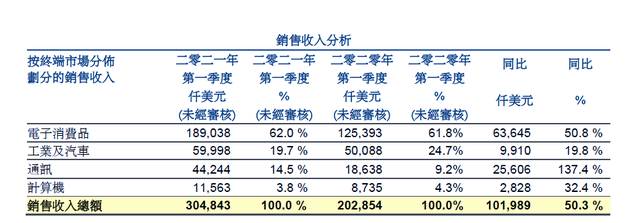

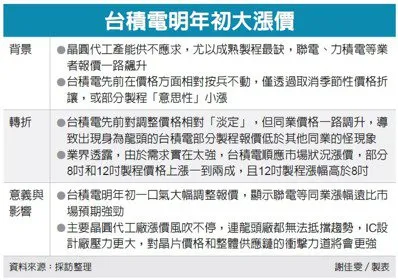

According to data from market research firm TrendForce in June, the total output value of the top ten wafer foundries in the first quarter reached a record high, up 1% month-on-month to US$22.75 billion. Benefiting from strong terminal demand, wafer foundry capacity has been in short supply since 2020, and major manufacturers have raised wafer prices and increased capacity investment.In order to cope with the continued tight production capacity, TSMC began to raise the price of 12-inch wafers in April this year, with an increase of about US$400 per piece, a 25% increase; SMIC has also been adjusting chip prices since March, with the price increase ranging from approximately 15% to 30%.Recently, according to Taiwan media Economic Daily, several wafer foundries decided to increase their quotations by another 30% in the third quarter. Compared with the average price increase of 15% in the first and second quarters of this year, wafer foundries are more willing to increase prices during the traditional third quarter, the peak sales season for the industry. Moreover, this price increase will continue. The market believes that the 30% price increase has exceeded expectations.According to the report, IC design companies revealed that the foundry prices for wafers have been finalized at the beginning of next year. Not only UMC's 8-inch and 12-inch foundry prices continue to rise, but also the leading foundry TSMC has increased prices. The prices of some 8-inch and 12-inch processes have increased by 10% to 20%, and the increase in 12-inch processes is higher than that of 8-inch processes. TSMC said it would not comment on the price issue.(Photo source: Taiwan Economic Daily)At the shareholders' meeting held by Powerchip on July 2, Chairman Huang Chongren stated that next year's production capacity has been fully booked by customers, with not a single piece left. The production capacity of memory chips and logic ICs is extremely scarce. As the price of wafer foundry continues to rise, the company's gross profit margin will also increase rapidly, and it is expected to surpass the world's advanced level in the near future.Not only that, most chip products are facing varying degrees of extended delivery times and prices are on the rise, and the power semiconductor field is no exception.Among them, Infineon's general-purpose transistors, low-voltage MOSFETs and IGBT products have a delivery time of up to 52 weeks, and the delivery time of high-voltage MOSFETs is 26 to 40 weeks, and prices are on an upward trend; in addition, power semiconductor manufacturers including ON Semiconductor, Microsemi, Rohm, and Nexperia, the supply cycles of their IGBTs, diodes, transistors, low-voltage MOSFETs, rectifiers and many other products are 16 to 52 weeks, while the normal supply cycle of these power semiconductors is basically around 8 weeks.Actively expand production across the board

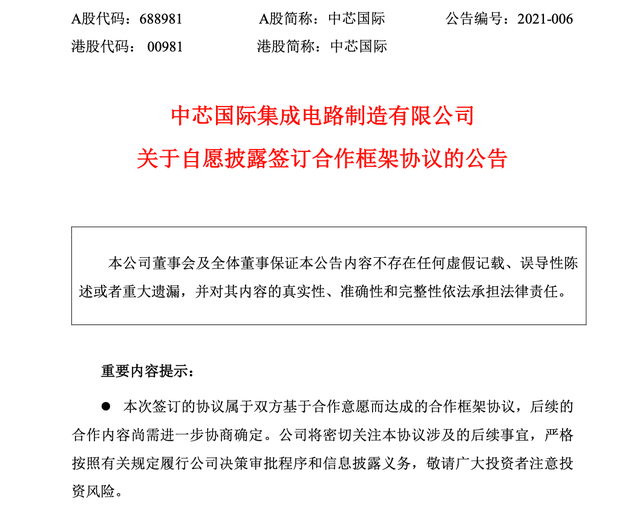

As of December 2020, the global wafer production capacity is still led by the five major wafer fabs. Among them, Samsung ranks first with a monthly production capacity of 3.1 million wafers, accounting for 14.7% of the global wafer production capacity; TSMC ranks second with a monthly production capacity of approximately 2.7 million wafers; followed by Micron, SK Hynix, and Kioxia.At present, global semiconductor manufacturers are actively expanding production capacity to alleviate supply chain shortages. SEMI released the latest wafer fab forecast, and the industry will build 19 and 10 high-volume semiconductor wafer fabs in 2021 and 2022 respectively. Equipment spending for these wafer fabs should exceed US$140 billion. China and Taiwan will each have 8 new wafer fabs, including 6 in the Americas, 3 in Europe and the Middle East, and 2 each in Japan and South Korea.As the United States strives to achieve its semiconductor manufacturing goals, Intel not only announced outsourcing and returned to the foundry battlefield, but also has a large-scale production and manufacturing expansion plan and plans to set up a new plant in Europe. Last week, analog chip giant Texas Instruments announced that it had signed an agreement with Micron Technology to acquire Micron Technology's Lehi 12-inch wafer fab in Utah for US$900 million. After the transaction is completed, the Lehi wafer fab will become Texas Instruments' fourth 12-inch wafer fab after DMOS6, RFAB1 and the soon-to-be-completed RFAB2.Texas Instruments announced that it would acquire Micron's 12-inch wafer fab in Lehi, Utah, for USD 900 million, and plans to produce its own analog and embedded chips using 65nm and 45nm processes. Under the U.S.'s targeting, China's SMIC, Huahong, CSMC, and Hefei Jinghe have continued to expand production, while Huawei, BYD, and Wingtech have also joined the manufacturing battle. Taiwan's four major wafer foundries have also successively revealed plans to expand production using mature processes.Previously, TSMC formulated a three-year capital expenditure plan of up to US$100 billion, promising to build a 5nm wafer factory in the United States and an advanced packaging factory or a further 3nm plan that may be launched in the future. At the same time, TSMC plans to use NT$80 billion to expand 28nm production in Nanjing. However, Taiwanese media reported on July 8 that TSMC is under pressure from the Biden administration of the United States because the Biden administration is worried that TSMC's Nanjing plant expansion project will help mainland China's semiconductor self-sufficiency.In March, SMIC announced that it would launch a 12-inch wafer production project with a process of 28nm and above through SMIC Shenzhen, and planned to start production in 2022. The planned monthly production capacity of the new project is 40,000 pieces, which is 5,000 pieces more than the planned monthly production capacity of the 12-inch production project launched by SMIC South in Shanghai.(Source: SMIC announcement)Since last year, Hua Hong Semiconductor has accelerated the expansion plan of its Wuxi 12th plant, and expects its monthly production capacity to reach 65,000 pieces by the end of this year, and is expected to exceed 80,000 pieces by mid-2022.Recently, there have been news reports that companies such as Huawei, BYD, and Wingtech have also joined the battle of wafer manufacturing.When will the chip gap be filled?

The global chip shortage began in the second half of last year and has not shown any signs of easing. It has even intensified. This domino effect is spreading across the global industrial chain. A recent study by Goldman Sachs shows that as many as 169 industries around the world are affected to some extent by the chip shortage, ranging from automobiles, steel products, concrete production to air conditioning manufacturing, and even soap production.Currently, major chip manufacturers around the world have launched expansion plans one after another. So, can they make up for the chip demand? When can they make up for the gap? At present, the answers to these questions are still uncertain.

Research and design of single-cell lithium battery charge and discharge protection circuit

Research and design of single-cell lithium battery charge and discharge protection circuit SMIC RD and semiconductor technology development trends

SMIC RD and semiconductor technology development trends

京公网安备 11010802033920号

京公网安备 11010802033920号