Last week, I was talking with a friend about DM-i batteries. When it comes to the DM-i that has been delivered so far, a large number of users choose the 110km version, which is much more than the 50km version. I tried to explore this phenomenon and the logic behind it:

(1) Qin, Song and Tang DM-i are all equipped with 18.3kwh or 21.5kWh extended-range versions, providing 110-120km of pure electric range to cover commuting. They also have a 30-minute 50% SOC fast charging design, and this higher configuration accounts for a large proportion. This proportion verifies the strategy of developing extended-range vehicles, which can indeed enable new energy vehicles to quickly penetrate the market.

(2) In the competition between the 110-120km extended-range electric car and the 55km plug-in electric car, considering the price difference of RMB 24,000, the extended-range version wins.

(3) The extended-range version is designed with DC charging. If combined with the subsequent promotion of small DC (about 20kW) charging piles, users will still have the need to charge when driving out. Such demand will subtly guide consumers to use electricity.

(4) Huawei may have to spend a lot of effort to promote SF5 in 2022. There is a lot of room for imagination as to how much potential there is to be tapped in the extended-range version equipped with fast charging.

In this sense, my previous assumption that the DM-I 50km version would sell better (because of its lower price) was wrong. In fact, the future will focus on the development of the extended-range version, which may be one of the main forces to replace fuel vehicles.

Table 1 DM-i vs. the new version of SF5 supported by Huawei

1. BYD plug-in hybrid sales characteristics

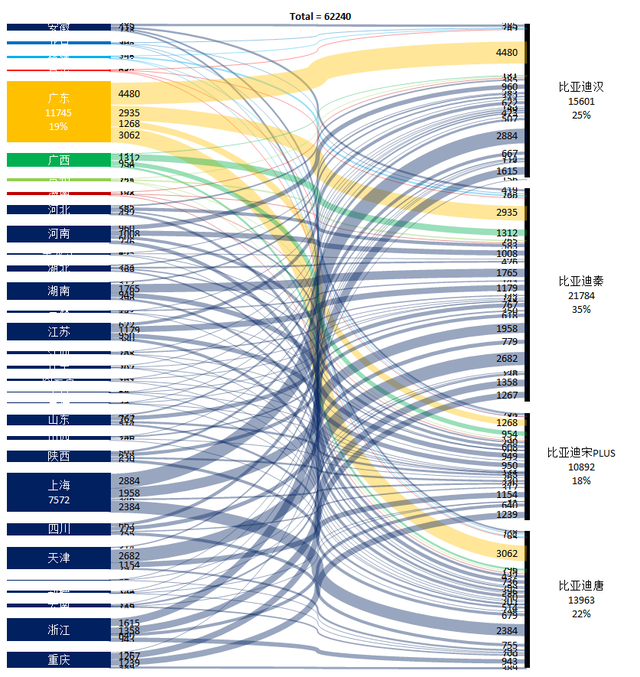

I have broken down BYD's four models, Han DM, Qin DM-i, Song DM-i and Tang (DM+DM-i), by region and found the following characteristics (which are consistent with the conclusions of the sales data analyzed previously):

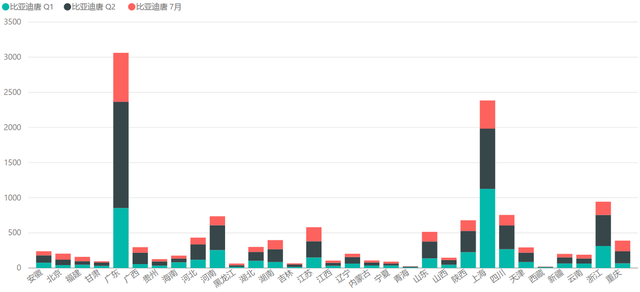

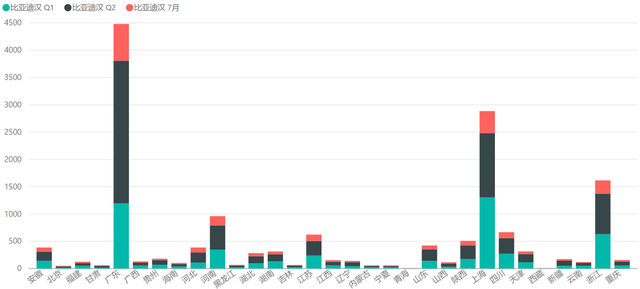

Han DM and Tang DM are essentially based on the PHEV plug-in hybrid concept. The overall sales are very dependent on Guangdong, Shanghai and Zhejiang, and the essence is the purchase restriction policy of the four cities of Shenzhen, Guangzhou, Shanghai and Hangzhou.

Figure 1 Tang DM+DM-i (small delivery volume) is concentrated in a few areas

Figure 2: Han DM is also concentrated in a few areas

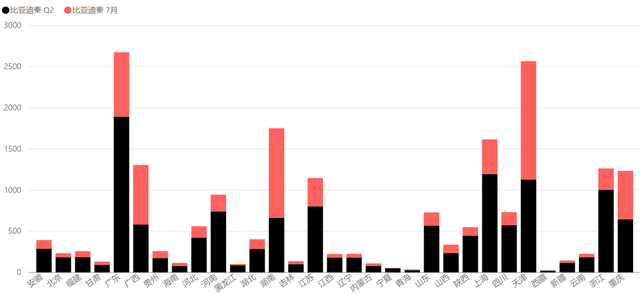

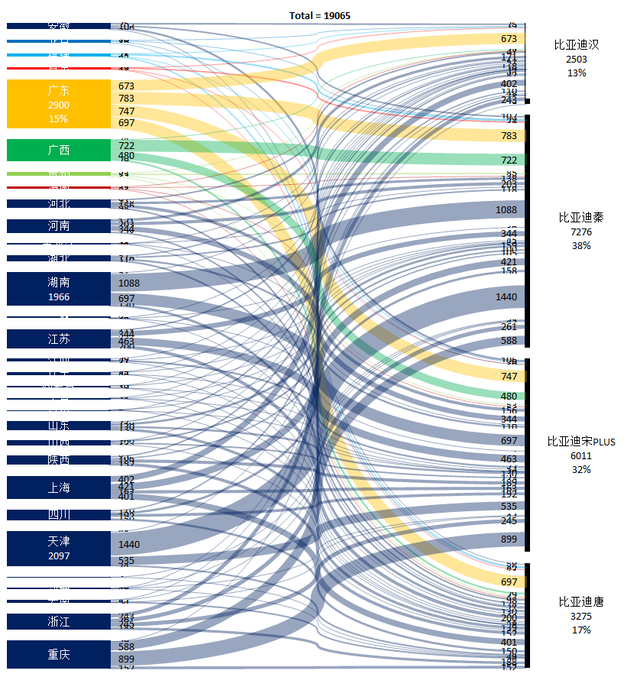

The Qin DM-i and Song DM-i are obviously not only in these areas, but also in Guangxi, Henan, Hunan, Chongqing, and even Hunan and Jiangsu. Moreover, both vehicles started to be delivered in April, and the monthly sales in key areas in July even exceeded those in the second quarter. After the supply is met, the sales will increase significantly.

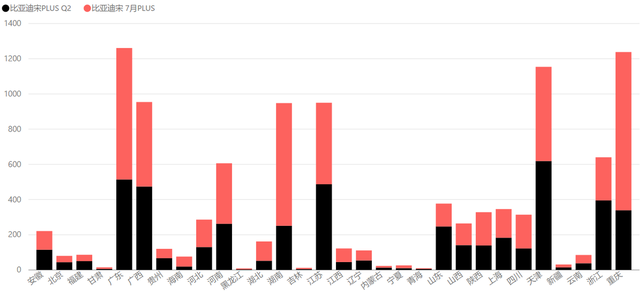

Figure 3: DM-i in Song and Qin show different appearances

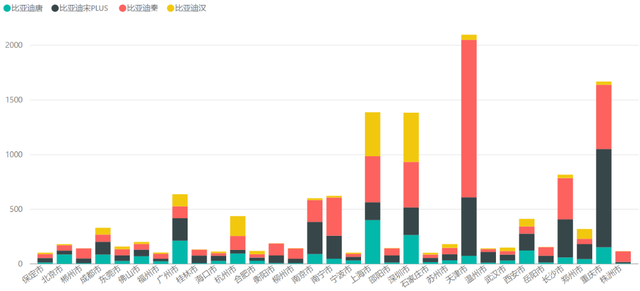

This has resulted in a significant difference in the distribution of PHEVs throughout 2021 and in July, as shown in the figure below: If you look at the BYD PHEV data for the whole year of 2021, the proportion in many regions is very low, while the distribution in July is relatively even (Figure 5). The extended-range approach of the two main forces is different from that of plug-in hybrids.

Figure 4 BYD PHEV in 2021

Especially in areas like Tianjin, sales account for a very small share of the total sales for the whole year, and it was previously a major HEV market. However, with the delivery of DM-i, it can be seen that DM-I is very attractive to Tianjin users.

Figure 5 BYD PHEV in July 2021

Therefore, I pulled apart the data of cities with >100 units in July and I can see the underlying logic: Tianjin, Chongqing, Changsha, Nanjing, Nanning and Guangzhou. These cities, which were originally reluctant to buy plug-in vehicles, were attracted by the DM-i's longer electric mileage and corresponding fuel-saving characteristics.

Figure 6 BYD PHEV urban penetration in July 2021 (cities with >100 units)

2. Forecast of extended range

Looking at Toyota and Honda's efforts to promote HEV, and other automakers' experience in promoting 48V, it is actually difficult for China to promote energy-saving models in second- and third-tier cities. The logic of range extension, whether it is simply series connection or BYD's mode switching, is still very sufficient:

The working principle of HEV series mode: the engine is connected to the generator through the engine shaft, driving the generator to generate electricity, and then through the excellent control performance of the dual electronic control, the electric energy is directly output to the drive motor to drive the wheels. When the vehicle is driving at low speed or accelerating, if the vehicle SOC value is high, the excellent vehicle control strategy will intelligently switch the drive to pure electric mode, the engine will stop, and the fuel consumption will be zero; if the vehicle SOC value is low, the surplus energy will be converted into electric energy through the generator and temporarily stored in the battery. The working principle of HEV parallel mode: let the battery intervene at the right time to provide electric energy to the drive motor, forming a parallel mode with the engine direct drive path. When the vehicle's driving power demand is too high and it is out of the engine's economic power, the vehicle is generally in high-speed overtaking or ultra-high-speed driving. The working principle of the engine direct drive mode: when cruising at high speed, the engine is directly driven, no gear shifting is required, which simplifies the transmission path and reduces fuel consumption. In order to reduce fuel consumption under high-speed conditions, when the vehicle speed is higher than a certain threshold, the vehicle control strategy will intelligently switch to high-speed cruise mode, directly apply the engine power to the wheels, and control the engine to operate in the most efficient area to reduce engine fuel consumption. In order to avoid wasting engine energy, when the engine direct drive power has surplus, it intervenes in time to convert energy into electrical energy and store it in the battery.

summary

In this sense, I understand that in the evolution over the next two years, with the advancement of Ideal, BYD and Huawei, the plug-in hybrid market may switch directly from 50km plug-in to 120km or even higher extended-range. Continuing to make 50-60km PHEVs will really be limited to Shenzhen, Shanghai and Hangzhou, which provide green license plates. After there are no license plates in 2022, sales may drop off a cliff. However, the vitality of extended-range vehicles will be effectively supported in second- and third-tier cities without license plate restrictions on the one hand, and in terms of power and economy of use on the other. Users who buy extended-range vehicles are unwilling to make charging plans, nor do they want to experience charging anxiety. So I think the extended-range can be put into an observation mode, which is easier to develop than the 50km plug-in.

Previous article:Commercial vehicle intelligent driving terminal based on Feiling FETMX8MP-C core board

Next article:AI DAY Interpretation - Tesla Autopilot's Visual Architecture

- Popular Resources

- Popular amplifiers

- Red Hat announces definitive agreement to acquire Neural Magic

- 5G network speed is faster than 4G, but the perception is poor! Wu Hequan: 6G standard formulation should focus on user needs

- SEMI report: Global silicon wafer shipments increased by 6% in the third quarter of 2024

- OpenAI calls for a "North American Artificial Intelligence Alliance" to compete with China

- OpenAI is rumored to be launching a new intelligent body that can automatically perform tasks for users

- Arm: Focusing on efficient computing platforms, we work together to build a sustainable future

- AMD to cut 4% of its workforce to gain a stronger position in artificial intelligence chips

- NEC receives new supercomputer orders: Intel CPU + AMD accelerator + Nvidia switch

- RW61X: Wi-Fi 6 tri-band device in a secure i.MX RT MCU

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

- LED chemical incompatibility test to see which chemicals LEDs can be used with

- Application of ARM9 hardware coprocessor on WinCE embedded motherboard

- What are the key points for selecting rotor flowmeter?

- LM317 high power charger circuit

- A brief analysis of Embest's application and development of embedded medical devices

- Single-phase RC protection circuit

- stm32 PVD programmable voltage monitor

- Introduction and measurement of edge trigger and level trigger of 51 single chip microcomputer

- Improved design of Linux system software shell protection technology

- What to do if the ABB robot protection device stops

- CGD and Qorvo to jointly revolutionize motor control solutions

- CGD and Qorvo to jointly revolutionize motor control solutions

- Keysight Technologies FieldFox handheld analyzer with VDI spread spectrum module to achieve millimeter wave analysis function

- Infineon's PASCO2V15 XENSIV PAS CO2 5V Sensor Now Available at Mouser for Accurate CO2 Level Measurement

- Advanced gameplay, Harting takes your PCB board connection to a new level!

- Advanced gameplay, Harting takes your PCB board connection to a new level!

- A new chapter in Great Wall Motors R&D: solid-state battery technology leads the future

- Naxin Micro provides full-scenario GaN driver IC solutions

- Interpreting Huawei’s new solid-state battery patent, will it challenge CATL in 2030?

- Are pure electric/plug-in hybrid vehicles going crazy? A Chinese company has launched the world's first -40℃ dischargeable hybrid battery that is not afraid of cold

- RSL10 family unboxing photos

- Disassembly of Delixi infrared thermometer -38~520℃

- Is there any room for optimization of simpliciti's power consumption?

- Design of an extremely low power digital thermometer using MSP430

- Eight practical ways to solve Spark data skew

- Will it damage the phone or battery if I play games while charging my phone after it is fully charged?

- [NXP Rapid IoT Review] + Experience of using Rapid IOT Studio

- My goodness, what kind of electronic component is this?

- Record errors encountered in CCS

- How to choose TVS tube for MSP430FR2633 touch chip

LM101AJG/883B

LM101AJG/883B

京公网安备 11010802033920号

京公网安备 11010802033920号