4. Competition pattern of wire harness market

4.1. Competition landscape of the wiring harness industry

At present, the global automotive wiring harness market is mainly dominated by companies from Japan, South Korea, Europe and the United States. However, the rapid development of China's automobile market has increased the procurement rate of local parts. Coupled with the cost-cutting needs of international automobile manufacturers, some Chinese automotive wiring harness companies with price advantages have begun to seize market share.

4.2. Development trend of the wiring harness industry - localized procurement cost advantages promote domestic substitution

With the improvement of simultaneous development and independent research and development capabilities, coupled with cost advantages and localized service advantages, local auto parts suppliers have begun to replace imports in some auto parts areas. my country's auto parts industry is in the trend of gradually realizing domestic substitution.

4.2.1.1. The rise of independent brands has driven the transformation of the local parts supply system to a parallel model and a tower model

In recent years, with the rapid development of the domestic automobile market, excellent domestic brands such as Geely, Chery, Great Wall, and BYD are gradually rising. According to statistics from the China Association of Automobile Manufacturers, from January to May 2022, China's self-owned brand passenger cars sold a total of 9.98 million units, accounting for 49.6% of the total passenger car sales. The local parts procurement rate of independent automobile brands is relatively high, and the steady increase in their market share will inevitably bring opportunities for the development of local parts companies. In the development process of the automobile industry, automobile manufacturers and parts suppliers have established a scientific professional division of labor and cooperation system. The main cooperation models include the parallel supporting model represented by European and American automobile companies, the tower development model represented by Japanese and Korean automobile companies, and the vertical integration model represented by some large state-owned vehicle companies in China. Under the parallel supporting model, both automobile parts companies and vehicle companies are oriented to the society and realize the market-oriented operation of global procurement; the tower development model is a pyramid-shaped multi-level supporting supply system with automobile manufacturers as the core and parts suppliers as the support. Under this model, automobile parts companies and vehicle companies have a closer cooperative relationship; the vertical integration model means that vehicle companies produce both complete vehicles and a certain number of automobile parts. my country's independent brands mainly adopt a vertical integration model. As the global automotive industry continues to evolve towards lean production, outsourcing of non-core businesses, globalization of industrial chain configuration, and streamlined management, domestic vehicle manufacturers are gradually shifting to parallel and tower models.

4.2.1.2. Cost control of vehicle manufacturers → strengthening of localized procurement trend

At present, the demand for cost control of vehicle manufacturers is increasing day by day, and the price advantage of domestic auto parts is prominent. The trend of vehicle manufacturers seeking domestic parts has formed. Since 2015, the competition in my country's passenger car market has been fierce, and the price fluctuations have been significant. In order to cope with the pressure of market competition, it is becoming increasingly important for downstream vehicle manufacturers to reduce the cost of vehicle products. With the advantages of relatively low labor costs and cost management, domestic auto parts manufacturers are expected to seize this opportunity to enter the sub-segments previously monopolized by international manufacturers and expand their market share.

With the vigorous development of the automobile industry, the scale and production and R&D capabilities of my country's auto parts industry have continued to improve. The "localization" strategy of international auto parts giants has promoted the optimization of product functions, industrial chain upgrading and advanced production and manufacturing system construction of my country's auto parts. In addition, through independent innovation and technology digestion and absorption, my country's local auto parts companies have greatly improved their ability to tackle key parts and components, and their global comprehensive competitiveness has continued to improve.

4.3. Analysis of major overseas wiring harness manufacturers

4.3.1. Aptiv

Aptiv is one of the earliest high-voltage wire harness and conductor manufacturers to enter the new energy vehicle market. With its unique advantages in product design, testing and verification, and automated manufacturing, Aptiv's high-voltage wire harness products can meet customers' multiple design standards and high-quality requirements. In China, Aptiv innovatively uses aluminum busbars, cooperates with a number of OEMs with different high-voltage design concepts to design and optimize the classification and direction of wire harnesses, and combines automated production processes to provide wire harnesses and conductors for hybrid electric vehicles, plug-in hybrid electric vehicles, and pure electric vehicles.

Aptiv can provide complete architecture support for vehicle customers: from concept, prototype design, to system manufacturing and assembly. Based on the customer's functional and physical requirements, Aptiv's basic research, engineering knowledge and system tools can be used to develop innovative and cost-effective solutions, and the development process of the wiring harness can be optimized with efficient integrated system processes and knowledge tools.

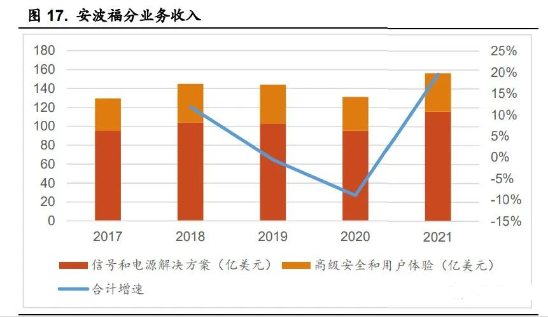

Aptiv currently has two core business units: Advanced Safety and User Experience and Signal and Power Solutions. The main business of the Advanced Safety and User Experience unit includes active safety systems (ADAS), infotainment and user experience, mobile travel and services, network connectivity and security, etc. The core products are smart driving sensors, smart driving systems and platforms, smart car interior perception systems, automotive electronic control units and domain controllers.

The main business of the Signal and Power Solutions Division includes: providing complete design, manufacturing and assembly of vehicle electrical architecture, including engineering component products, connectors, wiring components, wire harness cable management, electrical centers, hybrid high-voltage safety distribution systems, and signal distribution and computing networks in vehicles.

Aptiv is a century-old company dedicated to parts manufacturing, with production and business operations all over the world. It is one of the world's largest auto parts manufacturers, and its customers include 23 of the world's top 25 auto OEM manufacturers. As a long-established first-tier supplier of auto parts, Aptiv has a mature customer system with high stickiness. The top ten high-quality customers rarely change (including GM, Volkswagen, Fiat, Ford, SAIC GM, Geely, etc.). Since 2018, the company's top ten customers have accounted for 55%-60% of its revenue, and the top five customers have accounted for about 40% of its revenue.

Aptiv has completed a wide layout in the Chinese market. The company has established 13 wiring harness system production bases and 1 technical center in China. It has comprehensive engineering capabilities including new technology development, product engineering design, testing and verification, and provides customers with comprehensive localized services. At the same time, Aptiv is developing the next generation of intelligent and reliable automotive wiring and wires, and responding to the development trend of intelligent, electrified, automated and lightweight vehicles through miniaturization and automation innovation.

4.3.2. Lenny

As a veteran wiring harness manufacturer, LEONI is committed to developing and providing automotive wiring harness system solutions as a global partner for the automotive industry. It has more than 60,000 employees in 30 countries around the world, with total sales of 5.119 billion euros in 2021. In addition to the production of wiring harnesses, LEONI Wiring Systems has always attached great importance to the development and research of overall solutions for wiring harness systems and related electronic components. LEONI Wiring Systems has established a good reputation in the automotive industry through continuous innovation.

LEONI currently has two core business units: automotive standard cables (Wiring Systems) and automotive special cables (Wire & Cable Solutions). The core competencies of the standard cable business unit include: the automotive standard cable business unit is one of the global market leaders; it offers a comprehensive product range; it has obtained various certifications from OEMs and Tier 1 customers; cables that meet international standards such as ISO (Europe), JASO (Japan) and SAE (USA), and are based on the specifications of all major international automakers, are part of its product portfolio, and are also the highest quality of global standardized products. The core competencies of the automotive special cable business unit include: identifying the latest technologies at an early stage and providing customized solutions; LEONI maintains close contact with automakers, Tier 1 suppliers, and connector manufacturers, and cooperates with experts from international organizations, has the most advanced production processes, and develops customized solutions, including insulation materials for high-temperature applications.

4.4. Major domestic wiring harness manufacturers

Previous article:Dongfeng Motor builds Hubei's first power battery safety storage base

Next article:Hirain's full-link testing platform helps intelligent driving technology to be quickly implemented and applied

- Popular Resources

- Popular amplifiers

- Huawei's Strategic Department Director Gai Gang: The cumulative installed base of open source Euler operating system exceeds 10 million sets

- Analysis of the application of several common contact parts in high-voltage connectors of new energy vehicles

- Wiring harness durability test and contact voltage drop test method

- Sn-doped CuO nanostructure-based ethanol gas sensor for real-time drunk driving detection in vehicles

- Design considerations for automotive battery wiring harness

- Do you know all the various motors commonly used in automotive electronics?

- What are the functions of the Internet of Vehicles? What are the uses and benefits of the Internet of Vehicles?

- Power Inverter - A critical safety system for electric vehicles

- Analysis of the information security mechanism of AUTOSAR, the automotive embedded software framework

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

- LED chemical incompatibility test to see which chemicals LEDs can be used with

- Application of ARM9 hardware coprocessor on WinCE embedded motherboard

- What are the key points for selecting rotor flowmeter?

- LM317 high power charger circuit

- A brief analysis of Embest's application and development of embedded medical devices

- Single-phase RC protection circuit

- stm32 PVD programmable voltage monitor

- Introduction and measurement of edge trigger and level trigger of 51 single chip microcomputer

- Improved design of Linux system software shell protection technology

- What to do if the ABB robot protection device stops

- Keysight Technologies Helps Samsung Electronics Successfully Validate FiRa® 2.0 Safe Distance Measurement Test Case

- Innovation is not limited to Meizhi, Welling will appear at the 2024 China Home Appliance Technology Conference

- Innovation is not limited to Meizhi, Welling will appear at the 2024 China Home Appliance Technology Conference

- Huawei's Strategic Department Director Gai Gang: The cumulative installed base of open source Euler operating system exceeds 10 million sets

- Download from the Internet--ARM Getting Started Notes

- Learn ARM development(22)

- Learn ARM development(21)

- Learn ARM development(20)

- Learn ARM development(19)

- Learn ARM development(14)

- What is the principle of keyless entry for cars?

- What does OVRD_ALERT in BQ76940 OVRD_ALERT mean?

- Can SDRAM chips be used on 2-layer boards?

- Let Arduino play with your useless STM32 board Part 2

- Even Huawei can’t hold on?

- Recommend a low thermal potential relay

- Modern rectifier technology - active power factor correction technology

- About FlashBurn can not burn

- LED transparent screen signal transmission method

- The compiler keeps reporting an error, saying there is an error here. I have looked at it many times but can't find where the problem is.

OPA4342EA/2K5

OPA4342EA/2K5

京公网安备 11010802033920号

京公网安备 11010802033920号