Not long ago, the automotive lighting system consisted of headlights, taillights, turn signals and a few cabin lights. But now, automotive lighting has been extended to the front grille with a sophisticated "lighting signature", to the customizable "mood lighting" in the cabin, and to the width light bar at the rear of the car, like a "Christmas tree" hung with colorful lights. Christophe Perillat, CEO of Valeo, calls it "Lighting everywhere".

The automotive lighting market will continue to grow until 2030

In the past few years, with the development of the wave of automobile electrification and intelligence, automobile design has also introduced features such as comfort and safety, and "ubiquitous lighting" has come into being.

For example, exterior lighting now includes a center brake light, illuminated badges and grilles, small turn indicators on the mirrors, daytime running lights, and automatic high beams. Inside the cabin, lighting has expanded from simple dome and glove box lights to area lights that softly illuminate the cabin, lights embedded in the door fabric, and even "starry night" lights (ambience lighting).

“We are seeing more and more innovative applications of LED technology and matrix headlights in cars, which is why the automotive lighting segment will continue to grow,” said Pierrick Boulay, senior technology and market analyst at Yole specializing in lighting and displays.

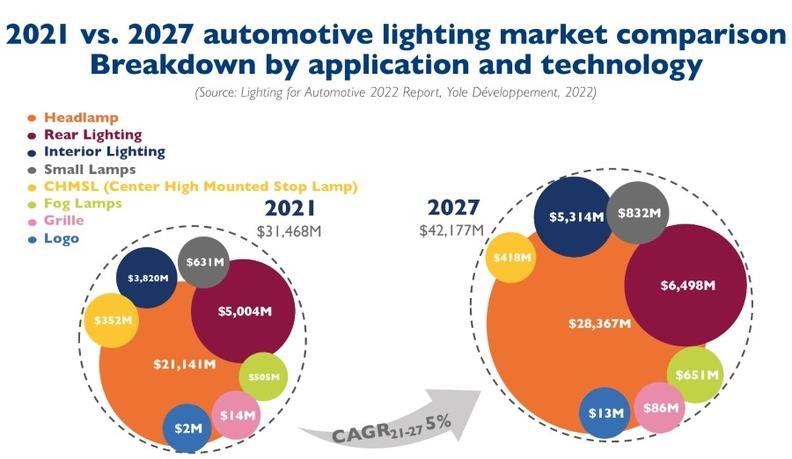

French consulting firm Yole Group predicts that the automotive lighting market will grow at an annual rate of 5% from 2021 to 2027, while automobile production will only increase by 2% per year. The development of the automotive lighting industry is expected to exceed the growth rate of automobile production. In terms of market size, Boulay predicts that the size of the automotive lighting market will increase from US$31.5 billion in 2021 to US$42.2 billion by 2027. Boulay also revealed that LED headlights are gradually becoming popular from high-end and luxury cars to mainstream cars, which will help maintain the growth rate of the automotive lighting market.

Future development trends of the automotive lighting market; Image source: Yole

A February 2022 report by Fortune Business Insights also predicts that the automotive lighting market will grow faster by 2028, from $30.19 billion in 2021 to $57.01 billion, a compound annual growth rate of 9.5%.

Automotive lighting will bring new development opportunities to Tier 1 giants

According to Yole data, there are currently about five suppliers dominating the automotive lighting market. Japanese company Koito led in 2021 with a 21% market share; Magneti Marelli and Valeo ranked second with 12% market share; followed by Hella and Stanley, with market shares of 11% and 9% respectively.

Among them, Magneti Marelli and Hella focus on the high-end car market, while Koito, Valeo and Stanley focus on mainstream models. "Hella and Magneti Marelli are technology leaders, they mainly focus on the high-end car market, and it is in high-end cars that we see more innovations in the field of automotive lighting; other Tier 1s usually cooperate with automakers who want to achieve the best combination of cost and performance." Boulay said.

French auto parts suppliers such as Valeo and Freia (formerly Faurecia) and Plastic Omnium have invested heavily in automotive lighting over the past few years to seize lighting market share amid megatrends such as electrification, increased safety regulations and advanced driver assistance systems, thereby outperforming the overall automotive market.

At the same time, the automotive lighting industry has seen strong M&A activity. In 2018, Calsonic Kansei acquired Magneti Marelli from the former Fiat Chrysler (FCA) for $7 billion, and a year later, Austrian sensor company AMS acquired Osram for $3.2 billion. In 2021, Plastic Omnium acquired Osram Automotive Lighting Systems for €65 million.

In the same year, Hella also launched a bidding war among auto parts giants such as Faurecia, Plastic Omnium and Mahle. In the end, Faurecia won the bid with a price of 6.8 billion euros and successfully acquired Hella. In April this year, Plastic Omnium was not to be outdone and acquired the key business unit of Indian supplier Varroc for 600 million euros. Varroc occupies 3% of the lighting market.

As cars become more complex, the automotive lighting market also has lucrative and higher profit prospects, which makes it easy to understand the intention of the above mergers and acquisitions. Currently, Freya, Valeo and Plastic Omnium account for more than 25% of the automotive lighting market.

Plastic Omnium CEO Laurent Favre expects the company's new lighting business unit to generate 1 billion euros in revenue per year and double-digit profit margins, with the key being the integration of lights into Plastic Omnium's exterior panels, bumpers and front-end module businesses. Favre also said that Plastic Omnium will be able to offer a complete lighting range, including interior lights from Osram and headlights, taillights and turn signals from Varroc.

Valeo CEO Perillat revealed that increased lighting content is key to future profits for Valeo's lighting division, driven by the transition to electrification and other trends. "Electrification is bringing new opportunities in car design, one of which is to install more lights in the front of the car because there is no longer a grille in front of the car," Perillat said.

Perillat also said that the stable income of the automotive lighting industry will support Valeo's future development in driver assistance and other high-tech fields. "We don't see that kind of amazing growth in ADAS and electrification, and the cash flow generated by the automotive lighting business can support the group's overall strategy."

Three development paths of automotive lighting

Looking into the future, how will the automotive lighting market develop? It is certain that automotive lighting will be more than just “lighting”.

One possibility is that automotive lighting will be combined with the growing interest in lidar sensors for autonomous driving. Boulay said many lidar companies have partnered or merged with Tier 1 lighting suppliers to help them enter the automotive market. Lidar sensors can be integrated into corner lighting to provide more field of view coverage, although Boulay noted that the additional cost compared to carrying a central lidar unit may outweigh the benefits.

Tier 1 giants have already taken action in this direction. Koito is particularly active in this field, and the company has reached cooperation with lidar manufacturers Blickfeld, Quanergy and Cepton. Valeo is a unique supplier, which is a leader in both automotive lighting and lidar. Magneti Marelli demonstrated its "smart corner" technology, which can integrate autonomous driving sensors, including lidar.

In addition, automotive lighting will increasingly be used as a communication medium. For example, ADAS sensors can detect the presence of a cyclist around a parking car and send a signal to activate the red light, warning the car driver not to open the door to avoid hitting the cyclist.

Another recent safety innovation in automotive lighting is the Adaptive Driving Beam (ADB) system, which eliminates the distinction between low-beam and high-beam, using ADAS sensors to control high-definition LED matrix headlights (more than 100 LED units in total). Adaptive headlights have been legal in Europe for several years, but were only approved in the U.S. this year.

Sensors identify oncoming vehicles at night and automatically dim part of the light beam to avoid glare in the driver's eyes, while still illuminating the sides of the car to avoid so-called "dark zones". Yole said that compared with traditional low/high beam, adaptive headlights can give drivers 2.2 seconds more reaction time at 80 kilometers per hour.

“The need for automotive lighting will always exist,” Boulay said. “In the beginning it was used to help drivers see better at night, but now it’s used as a safety feature. With adaptive high-beam systems, you can always drive with high beams on.”

Previous article:How to quickly debug the design of TLD6098-X

Next article:wBMS Technology: A New Competitive Advantage for Electric Vehicle Manufacturers

- Popular Resources

- Popular amplifiers

- A new chapter in Great Wall Motors R&D: solid-state battery technology leads the future

- Naxin Micro provides full-scenario GaN driver IC solutions

- Interpreting Huawei’s new solid-state battery patent, will it challenge CATL in 2030?

- Are pure electric/plug-in hybrid vehicles going crazy? A Chinese company has launched the world's first -40℃ dischargeable hybrid battery that is not afraid of cold

- How much do you know about intelligent driving domain control: low-end and mid-end models are accelerating their introduction, with integrated driving and parking solutions accounting for the majority

- Foresight Launches Six Advanced Stereo Sensor Suite to Revolutionize Industrial and Automotive 3D Perception

- OPTIMA launches new ORANGETOP QH6 lithium battery to adapt to extreme temperature conditions

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions

- TDK launches second generation 6-axis IMU for automotive safety applications

- LED chemical incompatibility test to see which chemicals LEDs can be used with

- Application of ARM9 hardware coprocessor on WinCE embedded motherboard

- What are the key points for selecting rotor flowmeter?

- LM317 high power charger circuit

- A brief analysis of Embest's application and development of embedded medical devices

- Single-phase RC protection circuit

- stm32 PVD programmable voltage monitor

- Introduction and measurement of edge trigger and level trigger of 51 single chip microcomputer

- Improved design of Linux system software shell protection technology

- What to do if the ABB robot protection device stops

- Wi-Fi 8 specification is on the way: 2.4/5/6GHz triple-band operation

- Wi-Fi 8 specification is on the way: 2.4/5/6GHz triple-band operation

- Vietnam's chip packaging and testing business is growing, and supply-side fragmentation is splitting the market

- Vietnam's chip packaging and testing business is growing, and supply-side fragmentation is splitting the market

- Three steps to govern hybrid multicloud environments

- Three steps to govern hybrid multicloud environments

- Microchip Accelerates Real-Time Edge AI Deployment with NVIDIA Holoscan Platform

- Microchip Accelerates Real-Time Edge AI Deployment with NVIDIA Holoscan Platform

- Melexis launches ultra-low power automotive contactless micro-power switch chip

- Melexis launches ultra-low power automotive contactless micro-power switch chip

- #Servo What is a servo?

- Allegro differential pair equal length setting

- Questions about rotary transformers

- Help, the turn-off speed problem related to the MOS tube drive resistor

- SIwave Chinese Training Manual

- Job hunting after the epidemic

- What are the advantages of machine vision defect detection systems?

- Happy New Year to everyone!

- How can a car's keyless entry system be hacked?

- What is a battery monitoring system (BMS)? What are its main functions? What is the BMS architecture? This article explains

LH2310D/A+

LH2310D/A+

京公网安备 11010802033920号

京公网安备 11010802033920号