Every day or two, we hear some news about Tesla batteries.

Panasonic, CATL, LG Energy Solution, BYD...these global battery giants are all "obsessed" with Tesla and are reluctant to accept it.

Tesla is undoubtedly the "King of the Sea", and the girls he flirts with are all extremely beautiful women.

Tesla is always playing it safe, but what are its real thoughts on power batteries?

In terms of batteries, Tesla's battery strategy is to use the huge demand as a bargaining chip, on the one hand, to gradually reduce costs by producing 4680 by itself; on the other hand, to mobilize external supplier resources to meet the requirements of vehicle manufacturing in terms of price and production capacity. Tesla's self-production posture is a bargaining chip.

In the upstream of batteries, Tesla's strategy is to cover not only the battery research and development stage, but also material research and development, resource procurement and material recycling, giving it extremely strong supply and R&D capabilities.

Specifically, how does Tesla implement this strategy?

01

The self-produced 4680 has reached 1 million pieces

Tesla announced through its official social media platform on February 19 that it had produced its one millionth 4680 battery in January.

Previously, Tesla CEO Musk stated in a conference call that the 4680 battery will be first used in the Model Y in the first quarter of 2022.

Research on the 4680 battery began in 2019. It was initially a conceptual design proposed by Panasonic and the European Chemical Laboratory. From what we have learned before, the 4680 battery was not well integrated with the process during the development process. According to the time plan promoted in Tesla's Battery Day, it is planned to achieve large-scale mass production in 2022.

Due to the late timing of large-scale mass production, Tesla currently continues to use the 2170 and CATL iron-lithium solutions, and the overall battery update speed is slower than other automakers.

At this point in time, sending this signal - 4680 has produced 1 million units - is for investors on the one hand, and for its own battery suppliers on the other.

It is very difficult to bargain with Tesla on price. After Tesla achieves self-supply, battery suppliers must be stable and appropriate in terms of quantity and price during the bargaining process.

Figure 1 Tesla's 1 million 4680 batteries roll off the production line

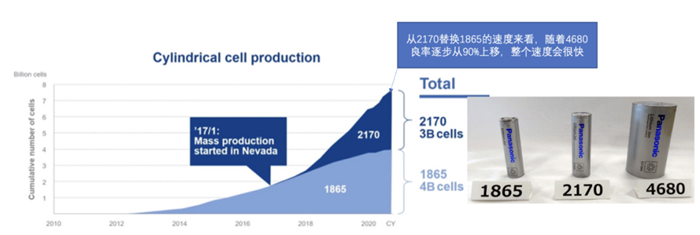

Data from 2020 shows that Panasonic produced 3 billion 2170 cells and 4 billion 1865 cells. If 4680 is calculated based on 1,000 cells per car, that means Tesla needs 10 million cells for 10,000 cars, and 100 million 4680 cells for 100,000 cars.

In other words, the current 1 million are just flares.

Figure 2 Tesla's demand for cylindrical batteries

02

Tesla's battery needs

At Battery Day, Tesla proposed a target of 20 million vehicles by 2030, corresponding to a demand for 10TWh of power batteries.

Of course, this is a cumulative concept. The forecast for 2022 is: 60,000 Model S/X units, with a power battery demand of 6GWh; 1.5 million Model 3 and Y units, with a cumulative demand of 105GWh.

The corresponding battery supplies are: Tesla produces 5-10GWh, Fudi 10GWh, LG Energy provides 15-20GWh, CATL provides 30-40GWh based on last year, plus Panasonic's basic base of 40GWh.

Tesla's continued vehicle development will also bring new demands.

Currently, the standard range version of Tesla Model 3 is equipped with 60kWh, and the high range version is equipped with 80kWh. Upgrading to 4680 can increase it to around 92-97kWh.

Especially in 2023, a low-priced version of Model 2 will be launched to meet lower market demand, and CyberTruck will also begin to be delivered in the North American market.

The cumulative demand of 10TWH is Tesla's confidence. Coupled with the self-produced 4680, Tesla can flexibly configure the purchase of high- and low-end versions of batteries at each base.

Figure 3 Tesla’s battery demand in 2022

03

Tesla's self-produced battery production capacity allocation

Tesla's 4680 batteries are most in demand in North America, and there are four factories producing 4680 batteries for Tesla:

(1) Pilot Plant in California, USA (also the development base of 4680 battery cells): It is the beginning of Tesla's battery development and the first battery production line attempted. The current production capacity is 1 million per month, corresponding to 1,000 vehicles, about 0.1GWh, and the goal is to increase it to 10GWh.

(2) Texas Plant: Equipment has begun to enter the production line, and the construction capacity is relatively high. In conjunction with the 600,000 production capacity of the Texas Auto Plant, trial production is expected to begin in Q2 2022. Based on the current quantity estimates, at least 50GWh of production capacity is configured. On the one hand, it is prepared to supply Model Y, and on the other hand, it also needs to be allocated to Cyber Truck.

(3) Berlin, Germany: This production line runs from the 1st floor to the 3rd floor. It is planned to cooperate with the production capacity of Germany's automobile factories, estimated at 20-30Gwh. The actual production capacity will be gradually released after Q2-Q3 2022.

During this process, Tesla also needs external suppliers to provide different LFP and NCM/NCA production capacities to help the factory realize the launch of vehicle models.

In other words, Tesla's battery self-sufficiency will increase at a certain rate.

Figure 4 Tesla's models and corresponding factory batteries & production capacity

04

Mileage configuration strategy

In 2022, Tesla will accelerate the production of 4680.

Tesla is trial-producing 4680, and at the same time urging Panasonic and LG to start production of 4680 in Japan and South Korea. After ramping up, the combination will be replaced with 4680+CTC on a large scale. With the acceleration in 2022, the mid-term goal of self-producing 4680 in 2023 is 100-200Gwh.

Figure 5 Selection of different chemical systems

With so much preparation and choices, Tesla's battery strategy can be summarized as follows: backed by its own huge demand, on the one hand, it achieves the goal of mass production of 4680 through its own investment, and then gradually reduces costs; on the other hand, it mobilizes external supplier resources to achieve the goal of rapidly increasing vehicle sales, which requires meeting the requirements of vehicle manufacturing in terms of procurement price and procurement capacity.

Currently, the industry's leading battery companies are facing rising prices of upstream materials. Tesla has adopted this stance in order to gain a better bargaining position.

05

Battery cost control

For electric vehicles with large-capacity batteries, the battery system cost accounts for 40% of the total vehicle cost. In the value chain of battery cells, 20% of the cost is battery cell production (the value of the battery cell factory, including production and quality costs), and 80% of the cost is battery materials.

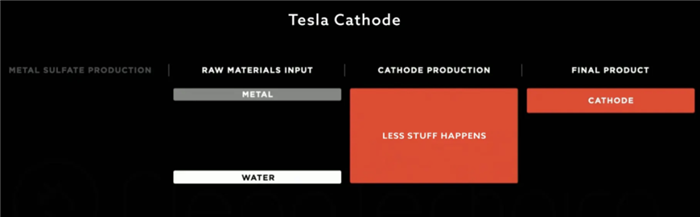

In order to reduce costs, Tesla must further enter the field of upstream battery materials. For example, Tesla, which has built a giant factory building in the Texas Super Factory Park, has proposed to expand the factory with the goal of producing battery positive electrodes.

Figure 6 Tesla builds upstream layout for battery positive electrode production

Tesla is currently doing what a battery company does - looking for Ganfeng Lithium and Ya'an Lithium to buy the lithium hydroxide it currently uses, starting to purchase spodumene concentrate in the second half of 2022, and locking in upstream resource supplies for cobalt and nickel respectively, and also starting a round of layout on negative electrode products.

Figure 7 Tesla's upstream material layout

Tesla's upstream battery strategy can be summarized as: it not only covers the battery research and development stage, but also includes material properties, chemical system development, formula development, performance and safety testing, failure analysis, etc.

In terms of battery cell trial production, we began to prepare to adjust the new production process and directly cooperate with our own equipment suppliers to improve the entire 4680 production.

Then, further upstream, in addition to the mining and purification of raw materials in the short term, the mass production of subsequent materials, battery cell development, battery cell mass production, battery module development and mass production, battery factory commissioning, battery secondary use and decomposition, material recycling, etc., are all Tesla's business scope.

06

Summarize

From the current situation, Tesla is the first vehicle manufacturer in the world to successfully enter the production of battery cells, and has defined a new generation of 4680 standard battery cells, using large cylindrical cells as the next generation of standard batteries to promote the development of this industry. I actually look forward to the 4680 battery being adopted on a large scale by other automobile companies.

Previous article:Energy density of 450Wh/kg? Behind it is another emerging new material!

Next article:Gree's titanium battery technology with a lifespan of 30,000 cycles may become a disruptive technology

- Popular Resources

- Popular amplifiers

- A new chapter in Great Wall Motors R&D: solid-state battery technology leads the future

- Naxin Micro provides full-scenario GaN driver IC solutions

- Interpreting Huawei’s new solid-state battery patent, will it challenge CATL in 2030?

- Are pure electric/plug-in hybrid vehicles going crazy? A Chinese company has launched the world's first -40℃ dischargeable hybrid battery that is not afraid of cold

- How much do you know about intelligent driving domain control: low-end and mid-end models are accelerating their introduction, with integrated driving and parking solutions accounting for the majority

- Foresight Launches Six Advanced Stereo Sensor Suite to Revolutionize Industrial and Automotive 3D Perception

- OPTIMA launches new ORANGETOP QH6 lithium battery to adapt to extreme temperature conditions

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions

- TDK launches second generation 6-axis IMU for automotive safety applications

- LED chemical incompatibility test to see which chemicals LEDs can be used with

- Application of ARM9 hardware coprocessor on WinCE embedded motherboard

- What are the key points for selecting rotor flowmeter?

- LM317 high power charger circuit

- A brief analysis of Embest's application and development of embedded medical devices

- Single-phase RC protection circuit

- stm32 PVD programmable voltage monitor

- Introduction and measurement of edge trigger and level trigger of 51 single chip microcomputer

- Improved design of Linux system software shell protection technology

- What to do if the ABB robot protection device stops

- CGD and Qorvo to jointly revolutionize motor control solutions

- CGD and Qorvo to jointly revolutionize motor control solutions

- Keysight Technologies FieldFox handheld analyzer with VDI spread spectrum module to achieve millimeter wave analysis function

- Infineon's PASCO2V15 XENSIV PAS CO2 5V Sensor Now Available at Mouser for Accurate CO2 Level Measurement

- Advanced gameplay, Harting takes your PCB board connection to a new level!

- Advanced gameplay, Harting takes your PCB board connection to a new level!

- A new chapter in Great Wall Motors R&D: solid-state battery technology leads the future

- Naxin Micro provides full-scenario GaN driver IC solutions

- Interpreting Huawei’s new solid-state battery patent, will it challenge CATL in 2030?

- Are pure electric/plug-in hybrid vehicles going crazy? A Chinese company has launched the world's first -40℃ dischargeable hybrid battery that is not afraid of cold

- [CH579M-R1] + Help: Unable to drive LSM303DLH magnetic field sensor

- Soldering surface for printed circuit boards: HAL lead-free

- CMOS Low Dropout Linear Regulator

- What are the advantages and disadvantages of BMS controlling the positive end of the battery and controlling the negative end?

- FPGA embedded system design.part1.rar

- Come on Shenzhen

- Pingtouge RISC-V development board--STEP2--CDK environment construction learning, let the LED light start flashing

- Getting Started with MSP430F5529

- HPM6750 Evaluation of Pioneer Semiconductor Step 4 (FreeRTOS+TinyUSB+LVGL) Comprehensive Example

- Understanding the configuration of C2000 series CMD files

MCP6411T-E/OT

MCP6411T-E/OT

京公网安备 11010802033920号

京公网安备 11010802033920号