In recent years, the global IoT industry situation has undergone tremendous changes. On the one hand, due to the business challenges brought about by the epidemic and geopolitics, most companies are actively integrating emerging technologies such as the Internet of Things, artificial intelligence, big data, and cloud computing to accelerate digital transformation, whether it is cultivating and developing advanced computing power, algorithmic processing, etc. Effective analysis and application of data, or integration and interconnection, we have all seen the acceleration of this process; on the other hand, because IoT technology will bring several times the value increase to traditional hardware terminals, IoT devices and even platforms It has also become a key link in the industrial chain, exerting three major advantages at the hardware level: "helping customers quickly complete equipment intelligence, increasing the competitiveness and brand value of products, and making products oriented to larger sales channels and markets."

Therefore, in terms of integration, with the development of the market and the exponential growth of access devices, the Internet of Things is no longer a loose interconnected sensor network, but a fully distributed network that requires computing power. So while the core feature of IoT applications is connectivity, another fundamental feature of it, information management, is also increasingly important. As endpoints proliferate and sensors become more sophisticated, the amount of data that needs to be processed increases dramatically. , we can even clearly see the market’s desire for more advanced processing capabilities. In his latest research report "Application Processors in the Internet of Things - 2022 Research Analysis", Edward Wilford, senior principal analyst of Omdia IoT, focuses on the overall market size and specific IoT applications from the perspective of application processors. The size, growth forecast, and competitive landscape of the market, including automotive electronics, consumer electronics, industrial electronics, and wired and wireless communications application markets. This article only lists some of the highlights. For more trend analysis and competitive landscape of the report, please contact Fasiha (Fasiha.Khan@informa.com) to inquire about the full report.

Transitioning from connectivity to information management, application processors are indispensable in the development of the Internet of Things

The Internet of Things is often viewed as a combination of endpoints, but as the endpoints themselves and the amount of data that needs to be processed increase dramatically, it means that the devices generating the data must be able to process the data and even perform some other operations, which is a powerful micro-control It is also difficult for a processor to do this. Therefore, application processors are becoming indispensable in IoT applications.

This can be clearly seen from the shipments and revenue of application processors in the global Internet of Things. Omdia sees a rebound in IoT application processor shipments in 2021 and 2022 due to the pandemic and the resulting (and to some extent ongoing) supply chain disruptions in subsequent years through 2026. Showing steady growth.

Figure 1. Overview and future forecast of application processor shipments in the Internet of Things

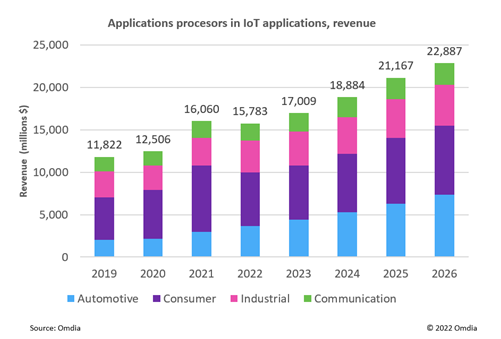

Returning to revenue, in 2022, only the application processor revenue in the consumer field will decline significantly, while the communications market will remain basically flat. At the same time, the industrial and automotive markets continue to grow, and Omdia pointed out that the demand for computing power in these two market segments will continue to increase and will inevitably become the main focus of the IoT application processor industry.

Figure 2. Overview and future forecast of application processor revenue in the Internet of Things

Omdia highlights: automotive and industrial will lead future IoT application processor market growth

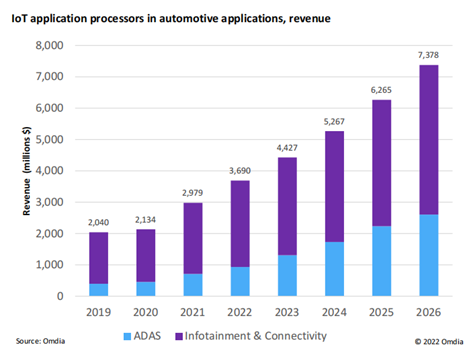

ADAS applications, infotainment and connectivity drive the growth of application processors in automobiles: In recent years, new energy vehicles have grown beyond expectations, and the automobile industry continues to be booming. Driven by the changes in the electrification, intelligence, and connectivity of the automobile industry, various Advanced functions are introduced, and they all require stronger computing power to support them. According to Omdia analysis, application processors are an important growth area for automotive chips, and the two most important segments are advanced driver assistance system (ADAS) applications and infotainment and connectivity.

According to Omdia's forecast, the revenue of ADAS application processors will achieve a compound growth rate of 30% by 2026, while the market size of infotainment processors will grow at a rate of slightly more than 16% per year. Although ADAS and autonomous driving have attracted more attention from the industry and even consumers in recent years, infotainment and connectivity are still leading the development of the automotive application processor market. Omdia also said that this phenomenon will remain in the foreseeable future. .

Figure 3. IoT application processor revenue analysis in automotive applications

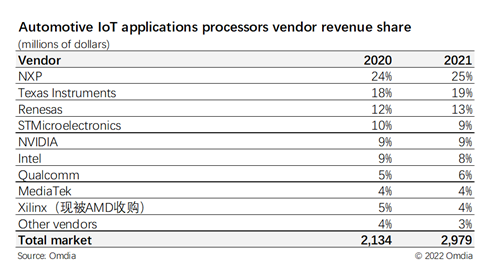

In the field of automotive IoT application processors, NXP, STMicroelectronics, Qualcomm, Renesas, NVIDIA and Intel are the absolute leading suppliers. Taking NXP as an example, its products include not only application processors, but also MCUs, General-purpose SoCs as well as other logic and analog ASSPs. Omdia said that application processor suppliers in the IoT field are usually deeply involved in this market. 80% of application processor suppliers are also important suppliers of IoT MCUs, sensors and connected devices. This vertical integration helps suppliers Increase equipment sales.

Figure 4. Competitive Landscape of Automotive IoT Application Processors - Supplier Revenue Statistics (Millions of U.S. Dollars)

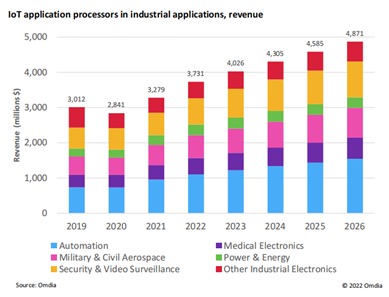

The growth of application processors in industry is steady, with automation being its largest segment: Although the market size is small, the growth of IoT application processors in the industrial market is more stable. From 2021 onwards, automation will be the largest segment among them in terms of scale. In particular, advances in locally controlled robotics, motion control, human machine interfaces (HMI) and other areas that add computing power are driving industrial automation. The development of the field, as well as the addition of AI and machine learning (ML), require more application processors to manage the collected data, and Omdia also expects this situation to continue until 2026.

It is worth mentioning that since edge computing has significant advantages in reducing latency, improving security, and reducing data processing costs, migrating data processing from the cloud to the edge is becoming a general trend, especially as smart buildings and smart cities have shifted from the cloud. The edge thus requires more powerful local processors, a macro trend that has also contributed significantly to the overall growth of industrial IoT application processors.

Figure 5. Revenue analysis of IoT application processors in industrial applications

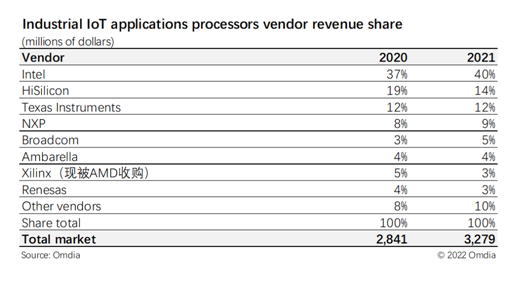

As another stable growth segment besides automobiles, the competitive landscape of industrial physics network application processors is also worthy of attention. Intel is the clear leader in this area, largely because developers typically require x86-based Windows or Linux to avoid the risk of complex system incompatibilities. In addition, HiSilicon, Texas Instruments, NXP, Broadcom, etc. are all at the forefront. To learn more about the competitive landscape of this report, please contact Fasiha (Fasiha.Khan@informa.com) to inquire about the full report.

Figure 6. Competitive Landscape of Industrial Internet of Things Application Processors - Supplier Revenue Statistics (Millions of U.S. Dollars)

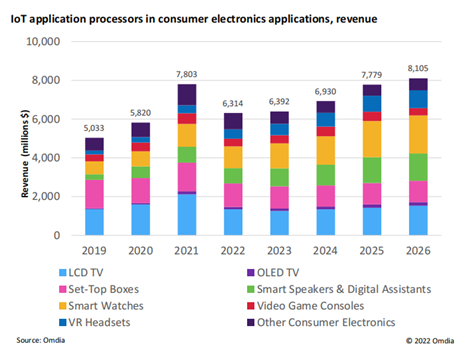

Omdia is optimistic about the demand for application processors in the smart watch consumer market segment: As the largest segment of the IoT application processor market, the scale of IoT application processors in consumer electronics has reached US$7.803 billion in 2021, but this It is also due to the unprecedented increase in average selling prices and demand caused by the epidemic. Starting in 2022, with the downturn in the entire consumer market, we can see that it will be difficult to reach the peak of 2021 in the next few years. Omdia also estimates that the revenue peak in 2021 will not be broken until 2025 at the earliest.

From the perspective of segmentation performance, smart watches will be the third largest consumer market segment in 2020 in terms of application processor revenue, second only to LCD TVs and set-top boxes. Currently, as more calculations are transferred from the cloud and mobile phones to watches, and as more and more sensor data and connection options need to be managed by watches, the computing tasks undertaken by smart watches are becoming increasingly heavy. Therefore, Omdia predicts that by 2026, smart watches will become the largest market segment by a huge advantage, and the revenue of its IoT application processor will exceed that of LCD TVs and OLED TVs combined.

Figure 7. Revenue analysis of IoT application processors in consumer electronics applications

The market size of IoT application processors in the communications field is stable and growing slightly: As the fourth largest market for IoT application processors, the communications field is stable and growing slightly. Among them, enterprise Ethernet routers are the largest market segment for communication and connection application processors, accounting for more than 40% of revenue. Additionally, while still niche for now, edge gateways and connectivity are showing strong year-over-year growth in this segment. Currently, edge gateways are undergoing a gradual transformation from simple devices that consolidate multiple local data streams into a cloud connection to advanced devices that perform calculations on collected data and even oversee AI and ML operations.

Previous article:Edge intelligence, software definition, this is how the future of automobiles should be

Next article:From "technological early adopters" to "experience dependence", urban intelligent driving begins the battle for mass production

- Popular Resources

- Popular amplifiers

- A new chapter in Great Wall Motors R&D: solid-state battery technology leads the future

- Naxin Micro provides full-scenario GaN driver IC solutions

- Interpreting Huawei’s new solid-state battery patent, will it challenge CATL in 2030?

- Are pure electric/plug-in hybrid vehicles going crazy? A Chinese company has launched the world's first -40℃ dischargeable hybrid battery that is not afraid of cold

- How much do you know about intelligent driving domain control: low-end and mid-end models are accelerating their introduction, with integrated driving and parking solutions accounting for the majority

- Foresight Launches Six Advanced Stereo Sensor Suite to Revolutionize Industrial and Automotive 3D Perception

- OPTIMA launches new ORANGETOP QH6 lithium battery to adapt to extreme temperature conditions

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions

- TDK launches second generation 6-axis IMU for automotive safety applications

- LED chemical incompatibility test to see which chemicals LEDs can be used with

- Application of ARM9 hardware coprocessor on WinCE embedded motherboard

- What are the key points for selecting rotor flowmeter?

- LM317 high power charger circuit

- A brief analysis of Embest's application and development of embedded medical devices

- Single-phase RC protection circuit

- stm32 PVD programmable voltage monitor

- Introduction and measurement of edge trigger and level trigger of 51 single chip microcomputer

- Improved design of Linux system software shell protection technology

- What to do if the ABB robot protection device stops

- Detailed explanation of intelligent car body perception system

- How to solve the problem that the servo drive is not enabled

- Why does the servo drive not power on?

- What point should I connect to when the servo is turned on?

- How to turn on the internal enable of Panasonic servo drive?

- What is the rigidity setting of Panasonic servo drive?

- How to change the inertia ratio of Panasonic servo drive

- What is the inertia ratio of the servo motor?

- Is it better for the motor to have a large or small moment of inertia?

- What is the difference between low inertia and high inertia of servo motors?

- Isolated Buck Converter PCB Layout Tips

- How GaN helps cable providers find the balance

- TI DaVinci Technology

- Award-winning review: Mir Allwinner automotive-grade CPU development board MYC-YT507

- [Evaluation of Anxinke Bluetooth Development Board PB-02-Kit] A/D data acquisition and testing

- MSP430 and ATK-NEO-6M GPS module

- LCD Double Buffering Implementation on S3C2410 Bare Metal

- Electromagnetic compatibility principles and design

- EEWORLD University Hall----Electronic Measurement and Intelligent Instruments (Zhejiang University)

- Controllable non-motor vehicle direction indicator based on LED dot matrix screen

JM38510/10104BHA

JM38510/10104BHA

京公网安备 11010802033920号

京公网安备 11010802033920号