The stock market in early September did not have the refreshing atmosphere of autumn. Instead, the continuously falling market index brought a chill to investors. However, one sector bucked the trend and continued to rise with a turnover of over 1 trillion yuan.

This is the third-generation semiconductor sector. Encouraged by the news that the entire industry is about to enter the national strategic planning, the third-generation semiconductor technology has once again become a hot topic online. Gallium nitride (GaN), one of the industry's twin stars, has also attracted attention again because of its performance in the 5G and power markets.

Breaking the Circle in 2020

A press conference held by Xiaomi in early 2020 changed the fate of GaN. Lei Jun demonstrated the 65W GaN charger developed by Xiaomi, and GaN material became famous. Although it has been regarded as the chosen one in the industry, GaN has never received such high treatment.

Under the media's intensive bombardment, the advantages of GaN have become well known: larger bandgap width, higher critical breakdown electric field, higher thermal conductivity, higher saturated electron rate and electron mobility, etc. Because of its qualitative leap in performance compared to the first and second generation semiconductor materials, GaN has become the only choice for making short-wavelength light-emitting devices, photodetectors, and high-temperature, high-frequency, and high-power electronic devices.

LED lighting, lasers and detectors are currently the largest application markets for GaN, with revenue reaching $40 billion in 2019. However, the industry hopes that GaN will achieve breakthroughs in 5G RF and power devices because there is a larger market space there.

5G systems require higher peak power, wider bandwidth and higher frequency, all of which have contributed to the acceptance of GaN devices. Industry insiders told reporters that GaN has won a good reputation in the RF field with its higher power output and smaller board area at high frequencies. According to Yole's forecast, the GaN RF market will grow from US$645 million in 2018 to about US$2 billion in 2024, mainly driven by applications in telecommunications infrastructure and defense.

There are currently three categories of commercial GaN RF device products: one is the high-power PA (power amplifier) used in 4G macro base stations and other systems, with a saturated power level of 100 to 300 W or even higher; the other is the GaN PA used in 5G macro base stations at 0.5 to 6 GHz, with a single module output average power of 5 to 10 W, requiring high integration and small size; the third is the GaN monolithic integrated circuit (MMIC) used in the 5G high-frequency band, with a saturated output power of 2 to 10 W, mainly used in places with a large number of people.

PA is a key component in RF systems, and GaAs (gallium arsenide) PA is currently the mainstream. However, with the advent of 5G, GaAs devices will not be able to maintain high integration at such a high frequency, and GaN will be able to show its strength.

5G macro base stations are mainly based on 64-channel large-scale array antennas. Based on three sectors, the demand for PAs for a single base station will be as high as 192. According to the forecast of TrendForce, the construction of 5G macro base stations in China will reach its peak around 2023, with an annual increase of more than 1.15 million, and the corresponding PA demand will be as high as 221 million. With the decline in GaN device costs and the maturity of technology, the penetration rate of GaN PA will continue to increase. TrendForce estimates that the proportion of GaN in 5G macro base station PAs will be around 50% in 2019, and it is expected to reach 80% by 2023.

Compared with optoelectronics and RF, GaN’s application in power devices exploded the latest, and it can be said that it has accumulated a lot of experience. “In the past three years, the cost has been declining by 20% to 30% each year, finally bringing GaN to the critical node of explosive growth.” said Cha Yingjie, general manager of Navitas China.

GaN power devices have high switching frequency, low on-resistance and low capacitance, and can maintain high efficiency at high frequencies. In addition, due to their planar architecture, GaN power devices can integrate peripheral drive and control circuits, making ICs smaller and significantly reducing costs.

As mobile phone manufacturers such as Apple, Samsung, Huawei, and Xiaomi have all entered the GaN power adapter market, the global GaN power semiconductor market size is expected to exceed US$750 million in 2024.

From optoelectronics to radio frequency devices and then to power devices, GaN has undergone a process of continuous expansion and breakthroughs in its applications.

A full-scale outbreak? We have to wait

"The third-generation semiconductor industry is now thriving, and you can receive BPs (project plans) in this regard wherever you go." Chen Lizhi, partner of Shengshi Investment Management, who served as a commentator for the Core Power Cloud Roadshow, once expressed such emotion.

With media hype, capital chasing, and projects popping up everywhere, both GaN and SiC give people the impression that the industry has entered a "blowout state."

In fact, GaN itself is still on the eve of an explosion. Taking the extremely popular GaN fast charger as an example, Lao Zhou (pseudonym), a senior investor in the semiconductor industry, did the math for the reporter: "The unit price of Xiaomi GaN fast charger is 149 yuan, and the annual sales target is 1 million units, which means 150 million yuan in sales. For a product, this is a very good result. But if the GaN chips used are converted into wafers, it is 300 to 500 pieces. For the wafer factory, this is not mass production, at most it is a sample production stage."

Lao Zhou has been paying close attention to the status of the GaN power market. According to his observations over the past five years, the entire market has not really taken off.

Ren Mian, general manager of Suzhou Energizer, also believes that power GaN is still a highly competitive field with relatively high cost requirements. It needs to compete with silicon materials in cost and performance, and its industry development is not yet mature enough.

The same is true for the 5G market. According to industry consensus, GaAs PAs are mainly used in scenarios below 2W, while LDMOS (laterally diffused metal oxide semiconductor) PAs and GaN PAs are used in scenarios above 2W. GaAs is more suitable for micro base stations, while GaN technology is suitable for high-power output scenarios in macro base stations.

LDMOS is GaN's main rival in macro base stations. The 5G spectrum is distributed in the millimeter wave bands below 6GHz and above 28GHz. The higher the frequency, the more the performance of LDMOS process devices decreases, so it is mainly used in low-frequency band deployment.

Zhao Lin (pseudonym), head of a domestic company that makes macro base station PAs, said: "In 5G macro base stations, GaN is replacing LDMOS above 3GHz, but LDMOS is still the main one below 3GHz."

Price is an important factor. According to the upstream procurement price of 5G base stations, Toppu analyzed that the price of a single sector PA using LDMOS technology for 5G macro base stations in the 3.5GHz band is more than $400, while the price of a PA using GaN technology is more than $700.

However, the demand for high-density, small-size antenna arrays in 5G infrastructure has greatly increased the difficulty of power and thermal management in RF systems. GaN has high energy efficiency and power density, can adapt to a wider frequency range, and is capable of coping with the trend of miniaturization of 5G base stations.

Therefore, the trend of GaN dominance is becoming more and more obvious. Domestic base station equipment manufacturers have adopted a large number of GaN PAs when deploying 5G, and base station manufacturers in other countries are also following suit in PA technology.

Although the situation is good, due to the maturity of technology and 5G deployment, "this market will not really take off until next year," Lao Zhou judged.

GaN-on-Si or GaN-on-SiC

The GaN industry chain includes upstream materials (substrates and epitaxy), midstream devices and modules, and downstream systems and applications.

The preparation of GaN materials mainly includes two steps: substrate preparation and epitaxial process. The substrate is a wafer made of semiconductor single crystal material. It can directly enter the wafer manufacturing link to produce semiconductor devices, or it can be processed by epitaxial process to produce epitaxial wafers. Epitaxy refers to the process of growing a new single crystal on a single crystal substrate. The new single crystal can be made of the same material as the substrate or a different material. Epitaxy can produce a wider variety of materials, giving device design more options.

Sapphire is the original substrate material used for GaN and is also the most mature material. Most GaN devices for optoelectronic applications are manufactured using this substrate. The two emerging substrates are Si and SiC, namely GaN-on-Si (gallium nitride on silicon) and GaN-on-SiC (gallium nitride on silicon carbide).

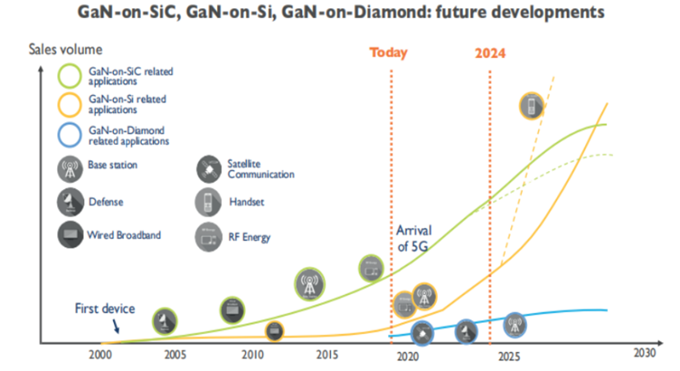

Figure GaN-on-SiC, GaN-on-Si, GaN-on-Diamond development forecast (from Yole Développement)

Most manufacturers use GaN-on-SiC to produce GaN RF devices. SiC and GaN have good lattice matching, and SiC also has high thermal conductivity, which facilitates the rapid heat dissipation of high-power density GaN RF devices.

The rising star Si substrate has a lower price, but at the same time its thermal conductivity is also lower than that of SiC. With mature Si technology, GaN-on-Si can process larger wafers with standard technology, which greatly reduces production costs. Its wafer cost is only one percent of that of SiC.

The mainstream size of SiC substrates is 4 to 6 inches, and 8-inch substrates have been successfully developed by II-VI and Cree. Among them, semi-conductive SiC substrates are mainly n-type substrates, which are mainly used for optoelectronic devices, power electronic devices, etc. Semi-insulating SiC substrates are mainly used for epitaxial manufacturing of GaN high-power RF devices.

In comparison, the performance of GaN-on-Si is slightly inferior to that of GaN-on-SiC, but devices manufactured at the current process level can achieve 5 to 8 times the original power density of LDMOS. When operating at frequencies above 2 GHz, the cost is not much different from that of LDMOS with the same performance.

MACOM has released a set of data showing that if designed properly, the performance of Si-based GaN can be as reliable as that of SiC-based GaN.

ST (STMicroelectronics) is a leader in the GaN-on-Si RF industry. It is currently working with MACOM to expand 6-inch GaN-on-Si production capacity and plans to further expand to 8-inch wafers. The two parties are building RF amplifier wafer fabs in Catania, Italy and Singapore, mainly 6-inch/8-inch GaN-on-Si products. The output value of the two bases is expected to reach US$3 billion in 2022, and the process technology has evolved from 0.5μm to 0.25μm and 0.15μm.

Optimistic about the prospects of GaN, giants such as TSMC and Intel have also begun to get involved in this field and develop GaN-on-Si foundry. As these companies have mastered advanced process technology and huge resources, the balance of the entire industry has begun to tilt towards GaN-on-Si.

Competition is more intense at the same starting line

Since the two-step growth method was used to obtain high-quality GaN external delay in 1986, this material has gone through more than 30 years of development in Europe, the United States, Japan and other countries, and has formed a relatively mature industrial system.

Large-scale formal research on GaN in China began after 2008, with government departments taking the lead and carried out in the form of special projects. After more than ten years of development, it has now begun to take shape. Especially in recent years, due to the high enthusiasm for industrial investment, the industry has developed rapidly. In 2019, according to statistics from CASA (the Third Generation Semiconductor Industry Technology Entrepreneurship Strategic Alliance), there were three major investments related to GaN, involving an amount of 4.5 billion yuan.

Compared with foreign companies, Chinese local companies have a large gap in technology accumulation. However, both sides are now on the same starting line. "The entire market has just started. For example, in the mobile phone fast charging market, local manufacturers have more opportunities to enter, so they can get a lot of opportunities for verification and iteration." Lao Zhou believes that local manufacturers are closer to the terminal market and have many opportunities to close the gap. "If local companies can coordinate their strategies with terminal manufacturers, they have every chance to become a world-class gallium nitride device company."

Opportunities are always accompanied by challenges. Due to the evolution of technology and the entry of giants, the entire GaN industry is also undergoing differentiation. The coexistence of the traditional IDM model and the emerging Fabless+ foundry model has also brought some confusion to the path selection of domestic manufacturers.

On the GaN RF side, suppliers are mainly IDM companies, including SEDI (Sumitomo Electric Device Innovations) under Japan's Sumitomo Electric Industries, Infineon (the RF department has been sold to Cree), Wolfspeed under Cree of the United States, Qorvo, MACOM, Ampleon, South Korea's RFHIC, etc.

Figure 2 Major global RF GaN manufacturers (from Yole Développement)

The advantage of the IDM model is that the entire production chain is self-controlled, which can reduce risks. Especially for the base station and automotive industry markets, products tend to be customized, with long replacement cycles, higher requirements for product performance reliability and stability, and high technical difficulty. In addition, the market space is small, and it is difficult to have enough profit space for design companies and manufacturing companies to share. The IDM model can better guarantee product performance and profits.

Ren Mian, general manager of Suzhou Enerxun, said that the IDM model is that the growth of epitaxial materials, device design, and process manufacturing are basically completed independently by one factory. This is equivalent to integrating the traditional materials, design, and processes in the past. However, in such a context, the large-scale shipment of RF devices poses a major challenge to supply chain operations.

However, as the integration of products increases, the foundry model has naturally emerged in the GaN industry. Especially in the field of power devices, GaN is more cost-sensitive and requires larger wafers to reduce costs, which can only be achieved by foundries.

Win Semiconductors in Taiwan is targeting 5G base stations, focusing on the GaN-on-SiC field. Huanyu also has 4-inch GaN-on-SiC high-power PA production capacity, and its 6-inch GaN-on-SiC wafer foundry capacity has been certified.

In terms of GaN-on-Si, TSMC currently provides small-volume 6-inch GaN-on-Si wafer foundry services, and 650V and 100V GaN chip technology platforms are expected to be developed this year. World Advanced will also deliver small-volume samples of GaN products in 2020.

In addition, early players among GaN market startups such as EPC, GaN Systems, Transphorm, and VisIC have formed alliances with established silicon power semiconductor manufacturers, such as the ties between Transphorm and Fujitsu, and GaN Systems and ROHM Semiconductor.

In mainland China, Sanan Integrated Circuit and HiWafer have the ability to mass-produce GaN power devices. Sanan Integrated Circuit is a subsidiary of Sanan Optoelectronics, mainly engaged in GaN and GaAs technology-related businesses, and is a foundry specializing in compound semiconductor manufacturing. HiWafer is the first domestic manufacturer to provide pure wafer foundry services for 6-inch GaAs/GaN microwave integrated circuits (GaAs/GaN MMICs). It is reported that the company's gallium nitride has successfully broken through the 6-inch GaN wafer bonding technology.

There is no definitive answer to whether to choose the IDM or OEM model. Ultimately, it depends on the company's position in the market and its own level. The most critical thing for the entire industry at present is whether it can break out of the encirclement after the start.

Ren Mian believes: "Compared with foreign companies, domestic enterprises have gaps in terms of comprehensive technology, production capacity, supply chain operation level, solution implementation capabilities, customer channels, etc. Therefore, we cannot overtake them quickly, and we should face this reality."

"The technology level cannot be caught up in a day or two. In recent years, there have been frequent calls for overtaking in the industry, but I personally don't agree with it. The company still needs to absorb talents, endure loneliness, continue to accumulate, and practice internal skills, so as to continuously narrow the gap with international manufacturers." Zhao Lin said.

Previous article:UnitedSiC and EDOM Technology join forces to accelerate the adoption of silicon carbide technology

Next article:A new direction for integrated circuits in the future? Carbon-based transistors

Recommended ReadingLatest update time:2024-11-24 18:56

- Popular Resources

- Popular amplifiers

-

Introduction to Internet of Things Engineering 2nd Edition (Gongyi Wu)

Introduction to Internet of Things Engineering 2nd Edition (Gongyi Wu) -

Intelligent computing systems (Chen Yunji, Li Ling, Li Wei, Guo Qi, Du Zidong)

Intelligent computing systems (Chen Yunji, Li Ling, Li Wei, Guo Qi, Du Zidong) -

Optimization research on low-power power system design based on 5G communication technology

Optimization research on low-power power system design based on 5G communication technology -

Research on power supply and distribution technology for 5G communication base stations_Gou Zengjie

Research on power supply and distribution technology for 5G communication base stations_Gou Zengjie

- STMicroelectronics discloses its 2027-2028 financial model and path to achieve its 2030 goals

- Chuangshi Technology's first appearance at electronica 2024: accelerating the overseas expansion of domestic distributors

- Europe's three largest chip giants re-examine their supply chains

- Future Electronics held a Technology Day event in Hangzhou, focusing on new energy "chip" opportunities

- It is reported that Kioxia will be approved for listing as early as tomorrow, and its market value is expected to reach 750 billion yen

- The US government finalizes a $1.5 billion CHIPS Act subsidy to GlobalFoundries to support the latter's expansion of production capacity in the US

- SK Hynix announces mass production of the world's highest 321-layer 1Tb TLC 4D NAND flash memory, plans to ship it in the first half of 2025

- Samsung Electronics NRD-K Semiconductor R&D Complex to import ASML High NA EUV lithography equipment

- A big chip war is about to start: Qualcomm and MediaTek are involved in notebooks, and AMD is reported to enter the mobile phone market

- Intel promotes AI with multi-dimensional efforts in technology, application, and ecology

- ChinaJoy Qualcomm Snapdragon Theme Pavilion takes you to experience the new changes in digital entertainment in the 5G era

- Infineon's latest generation IGBT technology platform enables precise control of speed and position

- Two test methods for LED lighting life

- Don't Let Lightning Induced Surges Scare You

- Application of brushless motor controller ML4425/4426

- Easy identification of LED power supply quality

- World's first integrated photovoltaic solar system completed in Israel

- Sliding window mean filter for avr microcontroller AD conversion

- What does call mean in the detailed explanation of ABB robot programming instructions?

- STMicroelectronics discloses its 2027-2028 financial model and path to achieve its 2030 goals

- 2024 China Automotive Charging and Battery Swapping Ecosystem Conference held in Taiyuan

- State-owned enterprises team up to invest in solid-state battery giant

- The evolution of electronic and electrical architecture is accelerating

- The first! National Automotive Chip Quality Inspection Center established

- BYD releases self-developed automotive chip using 4nm process, with a running score of up to 1.15 million

- GEODNET launches GEO-PULSE, a car GPS navigation device

- Should Chinese car companies develop their own high-computing chips?

- Infineon and Siemens combine embedded automotive software platform with microcontrollers to provide the necessary functions for next-generation SDVs

- Continental launches invisible biometric sensor display to monitor passengers' vital signs

- Three design challenges that the new generation of SimpleLink Wi-Fi devices will help you solve

- Does anyone know the operating voltage and current range of the IGBT tube APT20GF120BR? Is there any Chinese documentation for it?

- Weird problems caused by improper FSMC configuration

- Bluetooth debugging process

- MSP430f5529 PWM control servo program

- Find similar objects in schematics

- [Repost] What are the conditions that affect crystal oscillation, and how to maintain oscillation?

- TI AM335x linux-3.14.43 Development Guide Manual

- Plug-in pad display problem

- [Atria AT32WB415 Series Bluetooth BLE 5.0 MCU] Resource Overview

Introduction to Internet of Things Engineering 2nd Edition (Gongyi Wu)

Introduction to Internet of Things Engineering 2nd Edition (Gongyi Wu)

京公网安备 11010802033920号

京公网安备 11010802033920号