Yole recently released the 2021 MEMS market report and gave specific manufacturer rankings. The following is a summary of the report.

MEMS sensors and actuators have become part of everyday life and are found in a wide variety of systems.

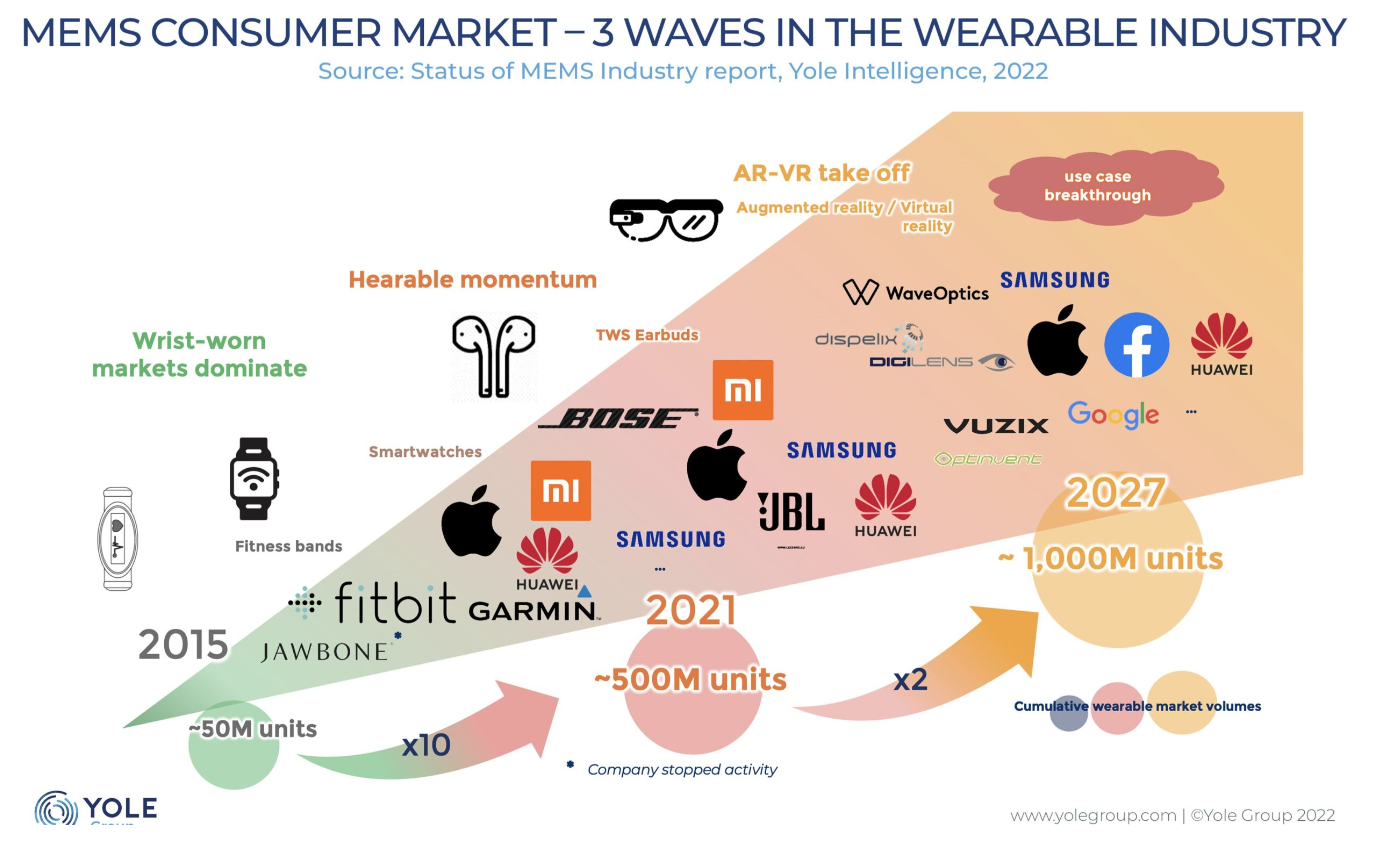

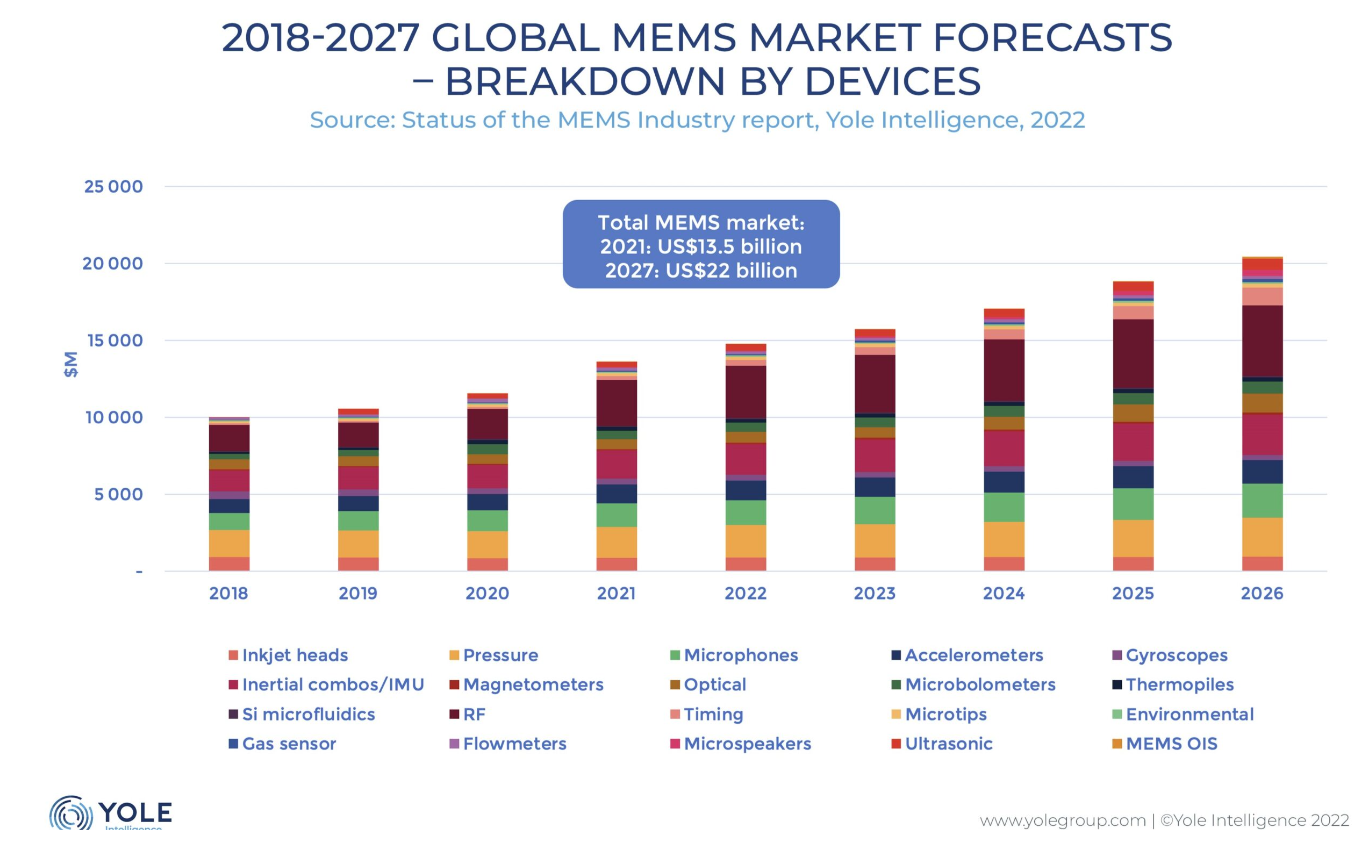

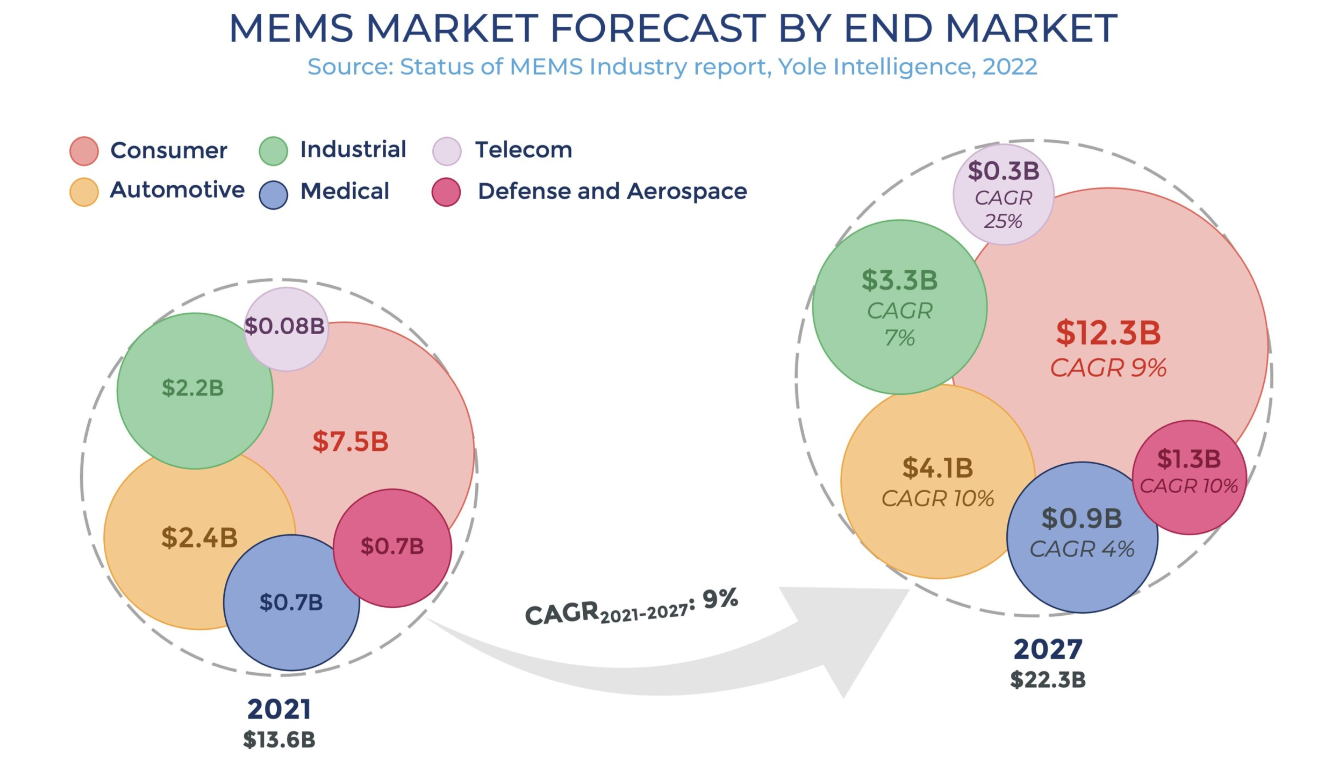

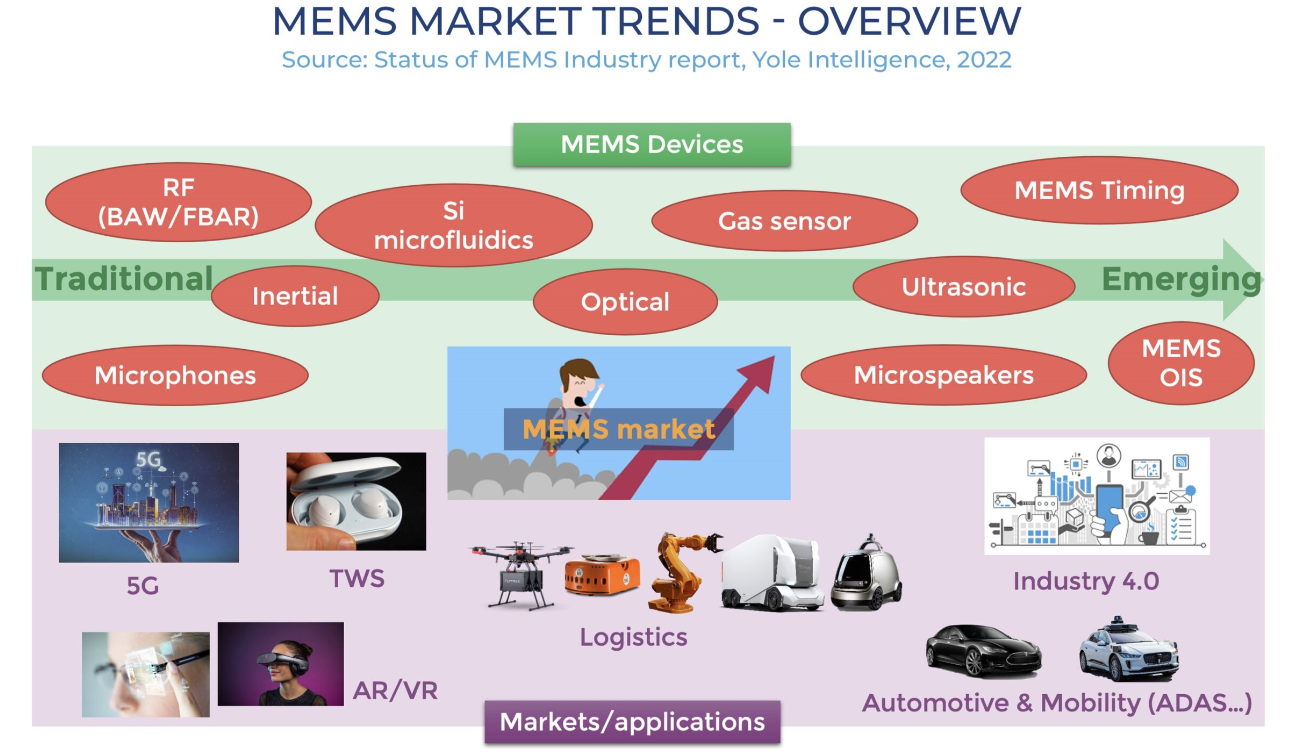

The MEMS industry is expected to surpass the $22 billion mark in five years, growing at approximately 9% per year between 2021 and 2027.

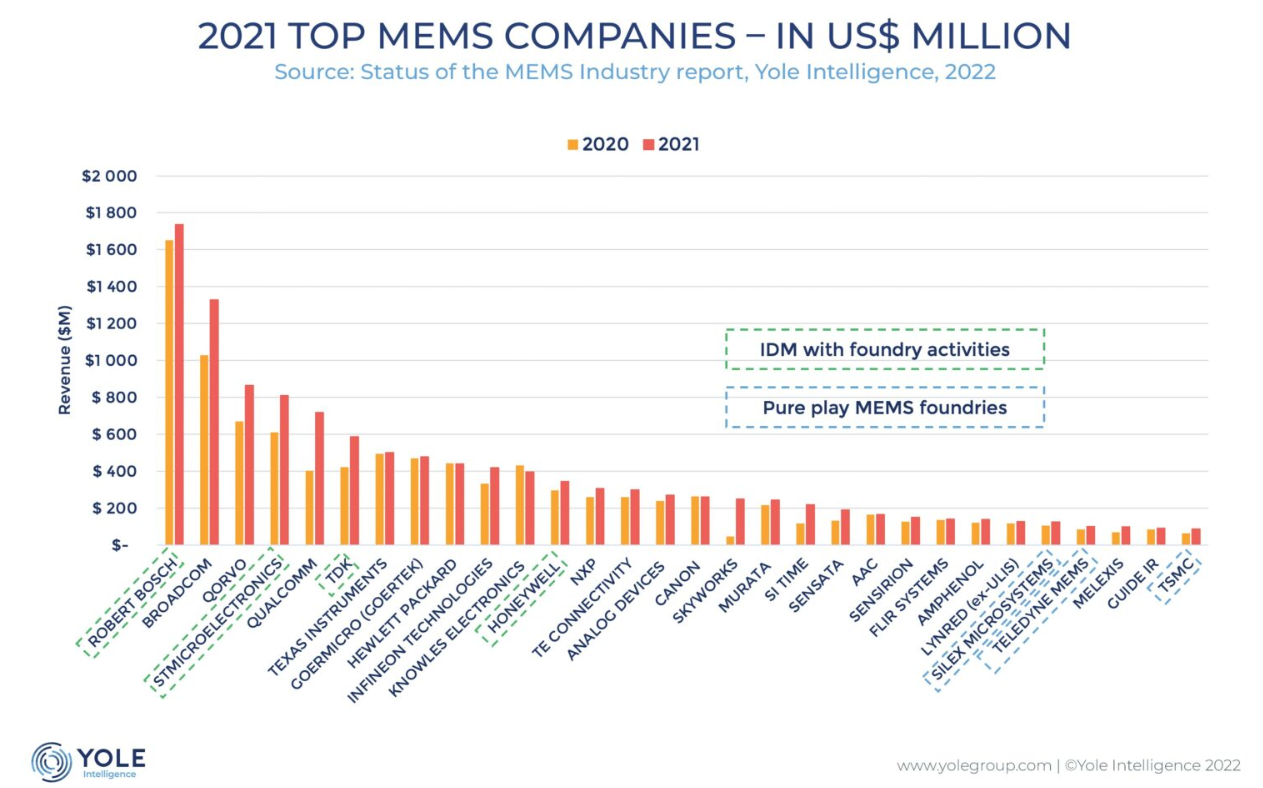

Among them, Bosch continued to be the MEMS leader with its excellent business and growth. Similarly, STMicroelectronics and TDK also saw significant sales growth in 2021.

Broadcom, Qorvo and Skyworks RF MEMS filters are also growing rapidly.

2021 is an extraordinary year for MEMS companies. First, revenues are growing from continued value-added in consumer and automotive applications, and medical and industrial end markets and related applications are also progressing. Second, due to chip shortages and global stocking issues, the ASP of some MEMS devices such as inertial and pressure MEMS has increased slightly in 2021, creating additional revenue growth for the market.

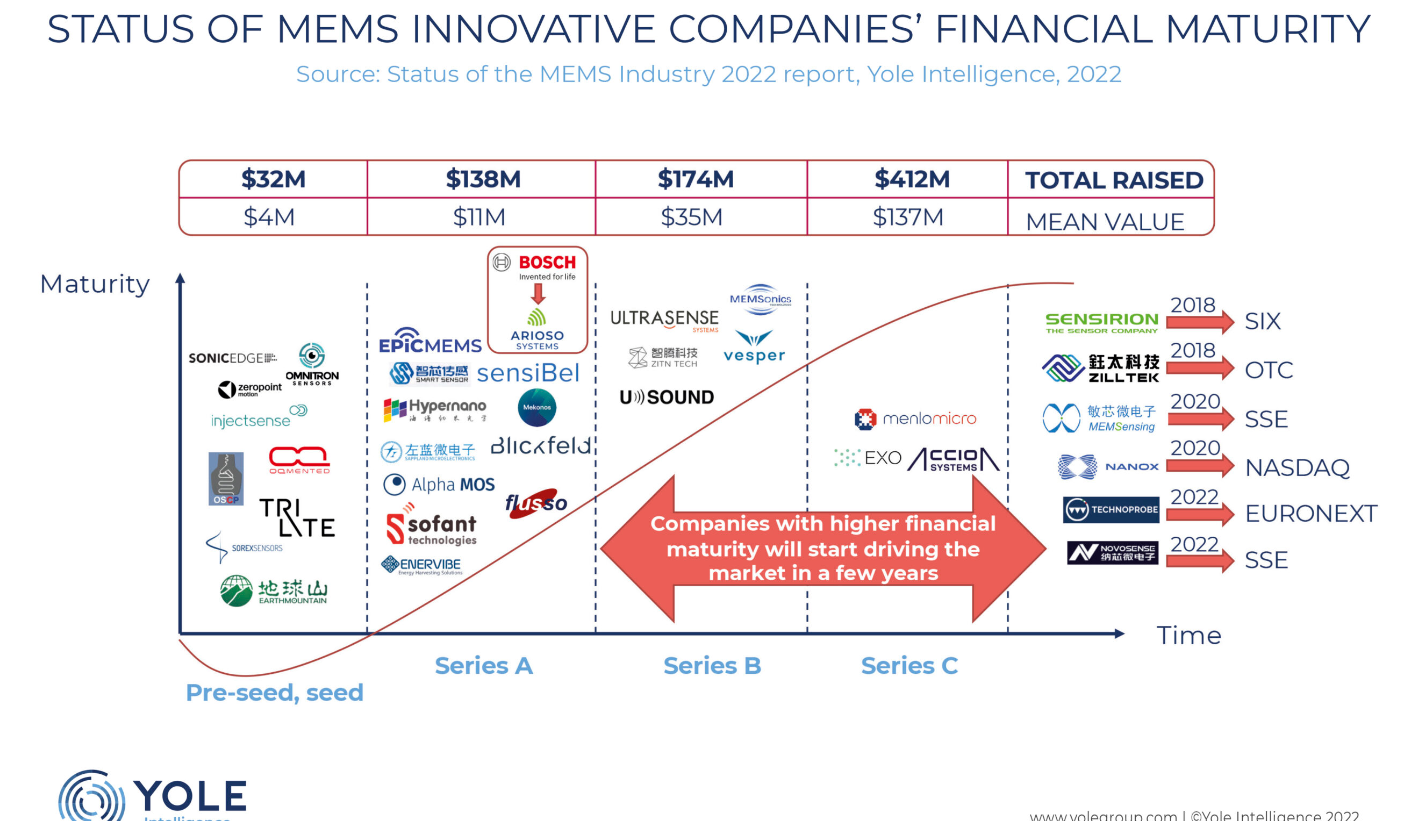

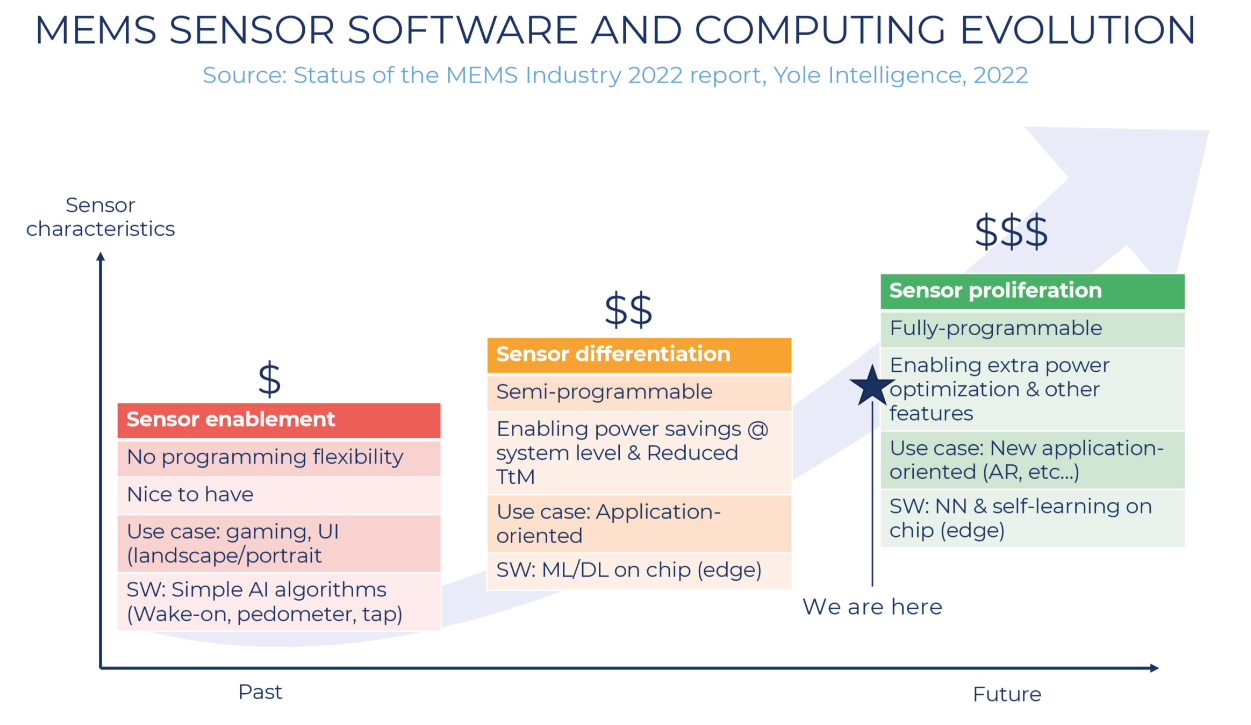

Against this highly dynamic backdrop, Yole Intelligence, part of the Yole Group, today announced the release of its best-selling annual MEMS report. This new edition details the latest updates on MEMS sales, ASPs and revenues for 2021. It outlines the best growth opportunities and key market drivers for MEMS over the next 5 years. This new edition also details the evolution of the ecosystem from the perspective of products and funding, as well as the key stakeholders involved. A detailed analysis of MEMS market shares as well as an analysis of the foundry business are included, providing a comprehensive view of the MEMS ecosystem.

Dimitrios Damianos, senior technology and market analyst at Yole Intelligence, said that globally, MEMS manufacturers' revenue increased by 17% year-on-year, from US$11.5B in 2020 to approximately US$13.6B in 2021.

Currently, the top 10 established companies that dominate the MEMS market have not changed much in the past few years: Bosch, Broadcom, STMicroelectronics, Qorvo, TDK, Goertek, Texas Instruments, HP, Infineon, Knowles Electronics, etc. But let us not forget the long tail of other small specialized MEMS players that are also expected to grow due to emerging MEMS devices and applications: SiTime, USound, xMEMS, OQmented, Sensirion, etc.

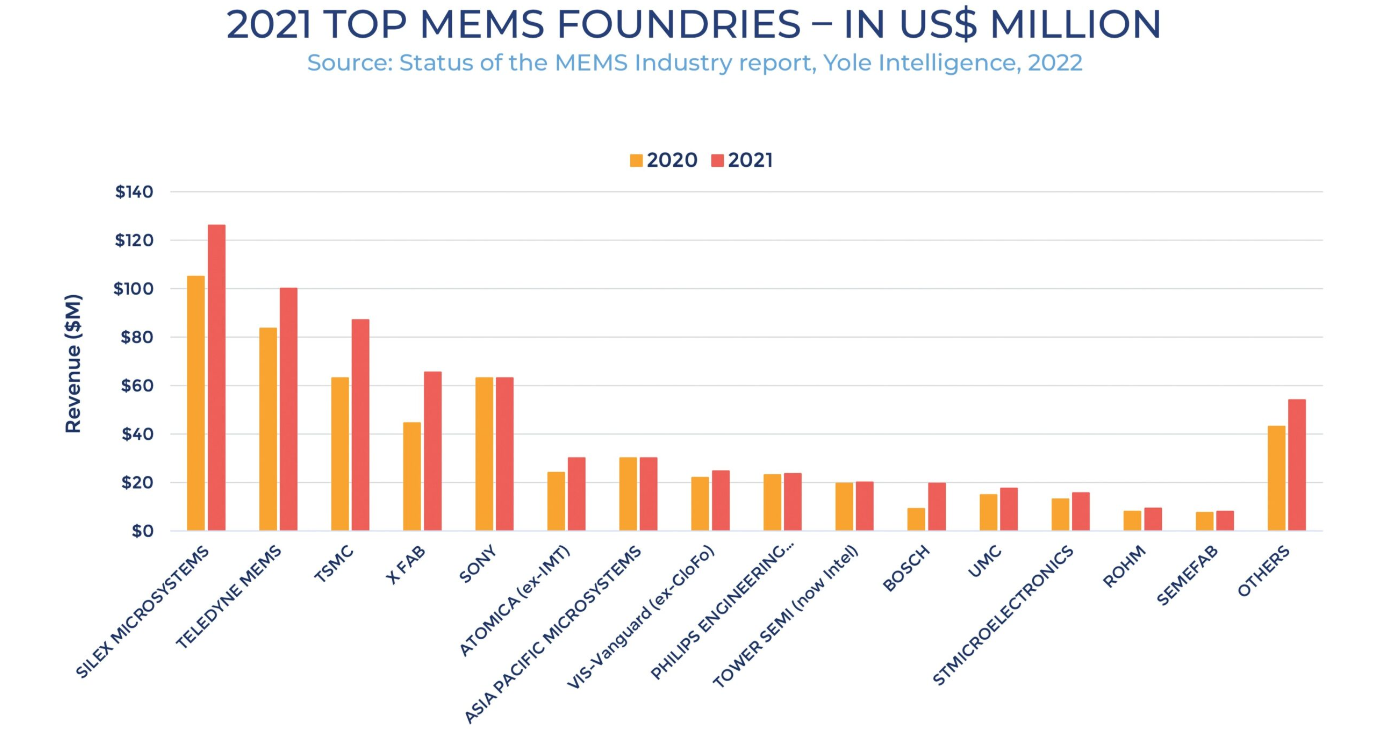

Of the total revenue, $570 million in 2020 and $690 million in 2021 will come from manufacturing for fabless companies and those that cannot do 100% of their manufacturing in-house. Until a few years ago, the top MEMS foundries had very little revenue (typically less than $60 million). Now, as new companies are emerging with interest in outsourcing MEMS manufacturing, MEMS foundries are reaping the fruits, with strong revenue growth. Silex, Teledyne MEMS, and TSMC belong to this space.

With the unprecedented demand for MEMS sensors, MEMS manufacturers are currently investing in new production plants: Bosch, SilTerra, Silan Microelectronics, FormFactor, etc. However, with the shortage of chips, increasing production capacity is the current trend in the semiconductor field, and the equipment market is expensive and the delivery time exceeds 15 months. Acquiring MEMS business from other companies may be an option. Yole Intelligence analysts cite several important examples: Silex acquired Elmos' 200mm wafer production line, Mitsumi acquired Omron's MEMS business, and at the same time, Bosch announced the construction of a 300mm MEMS production line to be opened in 2026 to consolidate its leading position.

But what should we expect in 2022 and beyond? Well, currently, the market is driven by three forces:

Due to strong demand for MEMS, some MEMS foundries have schedules until the end of 2023.

The average selling prices of certain MEMS devices have increased as a result of higher operating costs and lower profit margins due to the current microeconomic and macroeconomic conditions.

And future inventory overhang caused by integrators hoarding chips (including MEMS) could lead to low MEMS player activity in 2023 and beyond.

So the message to players in the evolving MEMS industry is: tread carefully.

Previous article:Microchip PIC16F18x MCUs, Now Available at Mouser, Power Sensor Node Applications

Next article:Diamond quantum sensors can more accurately monitor electric vehicle batteries

Recommended ReadingLatest update time:2024-11-16 10:28

- Melexis launches ultra-low power automotive contactless micro-power switch chip

- Infineon's PASCO2V15 XENSIV PAS CO2 5V Sensor Now Available at Mouser for Accurate CO2 Level Measurement

- Milestone! SmartSens CMOS image sensor chip shipments exceed 100 million units in a single month!

- Taishi Micro released the ultra-high integration automotive touch chip TCAE10

- The first of its kind in the world: a high-spectral real-time imaging device with 100 channels and 1 million pixels independently developed by Chinese scientists

- Melexis Launches Breakthrough Arcminaxis™ Position Sensing Technology and Products for Robotic Joints

- ams and OSRAM held a roundtable forum at the China Development Center: Close to local customer needs, leading the new direction of the intelligent era

- Optimizing Vision System Power Consumption Using Wake-on-Motion

- Infineon Technologies Expands Leading REAL3™ Time-of-Flight Portfolio with New Automotive-Qualified Laser Driver IC

- Innolux's intelligent steer-by-wire solution makes cars smarter and safer

- 8051 MCU - Parity Check

- How to efficiently balance the sensitivity of tactile sensing interfaces

- What should I do if the servo motor shakes? What causes the servo motor to shake quickly?

- 【Brushless Motor】Analysis of three-phase BLDC motor and sharing of two popular development boards

- Midea Industrial Technology's subsidiaries Clou Electronics and Hekang New Energy jointly appeared at the Munich Battery Energy Storage Exhibition and Solar Energy Exhibition

- Guoxin Sichen | Application of ferroelectric memory PB85RS2MC in power battery management, with a capacity of 2M

- Analysis of common faults of frequency converter

- In a head-on competition with Qualcomm, what kind of cockpit products has Intel come up with?

- Dalian Rongke's all-vanadium liquid flow battery energy storage equipment industrialization project has entered the sprint stage before production

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- ADI Analog Dialogue magazine, if you are interested, come and get it~

- MSP430 Learning Core-Clock

- [NUCLEO-L552ZE Review] + Serial Printing Help

- Power supply learning sharing

- Notes and lessons about IAR installation

- [Open Source] Bluetooth module BT401 full set of information based on Bluetooth headset chip development ultra-low cost

- Microcontroller Programming Examples

- Please advise, the voltage of the 5V circuit drops after adding load

- Configuration example of ModbusTCP to Profinet gateway connecting to tightening shaft drive

- What books should Linux newbies read?

Sensor Principles and Applications (Yan Xin)

Sensor Principles and Applications (Yan Xin)

京公网安备 11010802033920号

京公网安备 11010802033920号