01#

Overview

Inverters play an important role in electric and hybrid vehicles. Their main function is to convert the DC power provided by the onboard battery pack into three-phase AC power for the vehicle's motor. In addition, during regenerative braking, the inverter converts AC power into DC power to charge the battery pack.

Having an efficient and lightweight inverter can extend driving range and enable faster charging of electric vehicles. It can also reduce the size of the battery pack, saving costs for electric vehicles. The inverter has a component called a power module with a semiconductor switching device that turns on and off to change the direction of the current to produce AC power. The inverter is essential to electric vehicles.

02#

System voltage architecture

The choice of switchgear technology is largely determined by the voltage architecture, so it is important to understand what this means and how it will affect the requirements for the various types of inverters.

Light vehicles powered by conventional internal combustion engines

Traditional internal combustion engine-powered light passenger vehicles use 12V or occasionally 24V systems to power in-vehicle circuits such as electronic controllers, lights, and infotainment systems. To improve efficiency and emissions control, 48V architecture systems have been developed.

Mild and full hybrid powertrains

Using electric drive, the motor/generator can assist the internal combustion engine or directly power the axles. Certain auxiliary systems - such as air conditioning, forced induction and start-stop functions - can be run from the 48V auxiliary battery pack, significantly reducing fuel consumption. With the ability to generate electricity to support the vehicle's mild hybrid function, 48V systems will become a common configuration in hybrid vehicles in the next few years.

All electric and full hybrid powertrains

Full electric and full hybrid powertrains use high voltage architectures, typically between 300V and 600V, or even higher in some cases. EV drive motors typically operate at high voltages to extract enough power to achieve performance and drivability comparable to or superior to that of gasoline-powered vehicles.

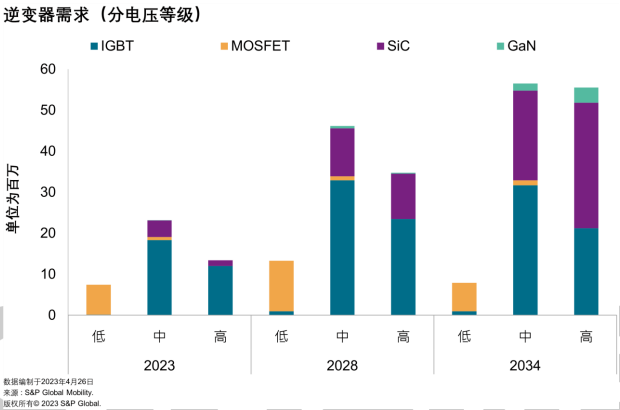

The system voltage of the electric drive system is divided into three levels - up to 48V is low voltage; above 48V to 450V is medium voltage; above 450V to 1,000V is high voltage.

System voltages up to 48V are used in mild hybrid applications

48V to 400V is used in hybrid and most BEV architectures on the market.

400V to 650V for high-performance full hybrid, BEV and FCEV architectures

Voltages above 650V are more suitable for luxury and sports car applications.

In terms of the inverters used, there are expected to be large differences between the three voltage classes. In the low-voltage category, silicon (Si) metal oxide semiconductor field effect transistor (MOSFET) is the most commonly used inverter type, while insulated gate bipolar transistor (IGBT) inverters are most commonly used in medium and high voltage classes. Although this hierarchy will not change in the low-voltage and medium-voltage categories during the years covered by this forecast, in the high-voltage category, SiC inverters will become the most commonly used inverter.

Currently, IGBT inverters account for nearly 90% of the high-voltage inverter market, with SiC inverters accounting for the remaining 10%. However, by 2034, this will change significantly, with SiC inverters expected to account for 55% of the market share, while IGBT inverters are expected to drop to 38%. In addition, GaN inverters are expected to account for 7% of the high-voltage inverter category.

The use of GaN inverters in the automotive industry is also likely to accelerate in the second half of this decade. However, the technology is still in its infancy and it is difficult to predict how it will develop. According to S&P Global Mobility, GaN inverters are expected to account for 7% of the high-voltage inverter category (3.7 million units).

03#

Types of Inverters

There are four types of drive inverters used in electric vehicles, depending on the semiconductor switch technology. This section looks at how these technologies stack up against each other and how they are being used by the electric vehicle industry.

Metal Oxide Semiconductor Field Effect Transistor (MOSFET)

Si MOSFET inverters are mainly used for mild hybrids, but are also used in low-voltage hybrids. MOSFETs have three terminals, namely source, drain and gate terminals. MOSFETs are more efficient in low-voltage applications up to 100V and peak power of 20 kW. This is because of smaller conduction losses and low voltage drop, which enable them to operate at high frequencies. However, as the system voltage increases, high conduction losses make Si MOSFET inverters less efficient. As automakers shift their product lineups to higher levels of electrification, such as full hybrid vehicles and plug-in hybrid vehicles as well as BEVs, Si MOSFETs will lose their market share.

According to S&P Global Mobility forecasts, demand for Si MOSFET inverters will grow by 2027, but at a lower rate than IGBT or SiC inverters. After 2027, demand for Si MOSFETs will begin to decline. Demand for Si MOSFETs will drop from 14.1 million units in 2027 to 8.2 million units in 2034, a decrease of 7.4%. During the same period, the production of mild hybrid vehicles is also expected to drop from 12.5 million units to 5.45 million units.

Insulated Gate Bipolar Transistor (IGBT)

IGBTs essentially combine the physical properties of bipolar transistors and MOSFETs, giving them the higher current carrying capability and high switching frequency of MOSFETs. IGBTs are a three-phase silicon-based switching device, but instead of source, drain and gate terminals, IGBTs have emitter, collector and gate terminals. IGBTs have proven to be much more efficient in full hybrids and BEVs because IGBTs are rated at over 1,200V, compared to 600V for MOSFETs. The switching device is best suited to powering drive motors between 35kW and 85kW, making it ideal for entry- to mid-range BEVs. IGBTs have lower switching frequencies than Si MOSFETs, but are more tolerant to electrostatic discharge. IGBTs also have lower conduction losses at higher voltages.

The demand for IGBT inverters reaches 30.5 million units by 2023. Of the total demand for IGBT inverters in 2023, 63% will come from full hybrid vehicles and 36.5% from BEVs.

Demand for IGBT inverters will continue to grow to 58.9 million units through 2029. After 2029, demand will decline to 53.8 million units. At the same time, demand for SiC inverters will also grow.

Currently, IGBT inverters are most widely used in hybrid vehicles, but by the end of the 2030s, as demand for pure electric vehicles increases, BEV will become the main market segment for IGBT inverters. IGBT inverters are the backbone of the current BEV market segment, accounting for 67% of inverters used in BEVs in 2023, but as SiC technology matures and becomes more accessible, IGBT's share will drop significantly in the next 10 years, and in the next 10 years, IGBT's top spot in the BEV market segment will be replaced by SiC.

Gallium Nitride (GaN)

GaN is another wide bandgap semiconductor technology being investigated by automotive and inverter manufacturers. One of the main advantages of GaN over SiC is the bandgap of 3.4 volts (eV), which is higher than 3eV for SiC and 1.1eV for Si. The inherent properties of GaN enable faster switching capabilities, further improving the performance of the inverter. In certain voltage architectures, GaN is even more efficient than SiC. GaN is still a relatively new technology and its use in EV inverters is still under investigation. They are not yet available in commercially available EVs and are expected to be available at a later date. GaN technology still faces some technical limitations in terms of its suitability for high-voltage applications (around 400V automotive architectures) that need to be addressed before it can become a mainstream technology. As the system voltage increases, the size of the GaN chip also needs to become larger to maintain efficiency. This is not an ideal situation in applications such as EVs where space is limited. Given GaN's optimal operating voltage range, it will most likely be considered a replacement for Si rather than SiC.

The demand for GaN inverters in the light vehicle segment will approach 5.5 million units by 2034. BEVs will be the largest user of GaN inverters, with a share of nearly 99.5% by 2034, and full hybrids will account for 0.5%. By 2034, GaN inverters will account for 4% of the total inverter market.

As for Tesla, demand for GaN inverters will reach 320,000 vehicles starting in 2027. By 2034, Tesla and Volkswagen together will account for nearly 80% of the total global demand for GaN inverters.

Several automotive companies and startups are working on GaN inverters:

In 2021, automotive powertrain technology company hofer powertrain and VisIC Technologies Ltd., a supplier of gallium nitride (GaN) solutions for high-voltage automotive applications, announced a partnership to jointly develop GaN inverters for 800V electric vehicles. In February 2023, VisIC Technologies successfully demonstrated its three-phase GaN inverter based on direct-drive D-mode gallium nitride (D³GaN) semiconductor technology for a mainstream automotive manufacturer, equipped with a PMSM motor. The company said that its three-phase GaN inverter system prototype will be tested at different customer locations by the end of the second quarter of 2023.

In September 2022, Marelli announced a collaboration with the Power Electronics Innovation Center (PEIC) of Politecnico di Torino to design a multi-level 900V high-power inverter prototype based on GaN technology for use in electric vehicles.

Previous article:Inventory of Typical Automotive Network System Architecture Design

Next article:The "three-electric" technology of new energy electric vehicles

- Popular Resources

- Popular amplifiers

- Huawei's Strategic Department Director Gai Gang: The cumulative installed base of open source Euler operating system exceeds 10 million sets

- Analysis of the application of several common contact parts in high-voltage connectors of new energy vehicles

- Wiring harness durability test and contact voltage drop test method

- Sn-doped CuO nanostructure-based ethanol gas sensor for real-time drunk driving detection in vehicles

- Design considerations for automotive battery wiring harness

- Do you know all the various motors commonly used in automotive electronics?

- What are the functions of the Internet of Vehicles? What are the uses and benefits of the Internet of Vehicles?

- Power Inverter - A critical safety system for electric vehicles

- Analysis of the information security mechanism of AUTOSAR, the automotive embedded software framework

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

- Innolux's intelligent steer-by-wire solution makes cars smarter and safer

- 8051 MCU - Parity Check

- How to efficiently balance the sensitivity of tactile sensing interfaces

- What should I do if the servo motor shakes? What causes the servo motor to shake quickly?

- 【Brushless Motor】Analysis of three-phase BLDC motor and sharing of two popular development boards

- Midea Industrial Technology's subsidiaries Clou Electronics and Hekang New Energy jointly appeared at the Munich Battery Energy Storage Exhibition and Solar Energy Exhibition

- Guoxin Sichen | Application of ferroelectric memory PB85RS2MC in power battery management, with a capacity of 2M

- Analysis of common faults of frequency converter

- In a head-on competition with Qualcomm, what kind of cockpit products has Intel come up with?

- Dalian Rongke's all-vanadium liquid flow battery energy storage equipment industrialization project has entered the sprint stage before production

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- [Erha Image Recognition Artificial Intelligence Vision Sensor] 3. General Settings and Face Recognition

- Prize-winning quiz: Find the "know-it-all" expert on Intel Vision Accelerated Design online

- 【ufun learning】Part 4: Serial port printing output

- TI Signal Chain and Power Q&A Series Live Broadcast - Gate Driver Special Live Broadcast with Prizes in Progress!

- Main application categories of millimeter wave radar

- pybL development board pinout

- Npn tube, Iceo is the reverse cutoff current, C and E are both N, where does the reverse come from, what does the reverse here mean...

- EEWORLD University ---- MSP CapTIvate Adaptive Sensor PCB Design Guide

- Children's Day is coming, what do you want to reminisce about?

- 【Running posture training shoes】No.009-Work submission

Battery Management Systems for Electric and Hybrid Vehicles

Battery Management Systems for Electric and Hybrid Vehicles

京公网安备 11010802033920号

京公网安备 11010802033920号