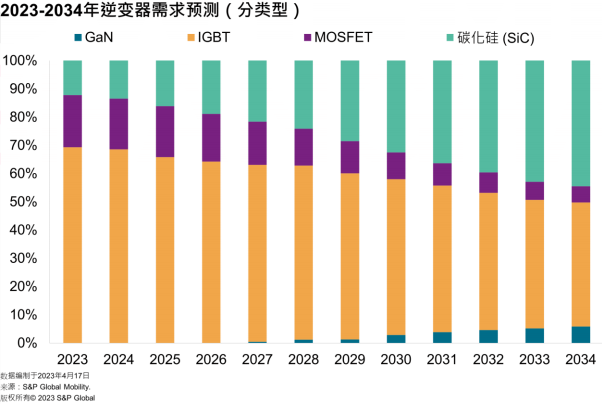

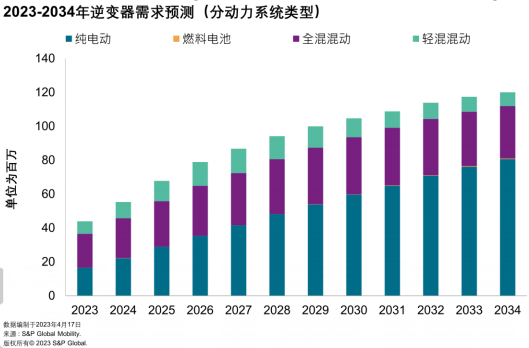

By power type, BEVs will account for 67% of total inverter demand by 2034, followed by full hybrid vehicles at 26%.

06#

Regional demand for inverters

Demand for inverters in the major automotive regions is directly related to the number of alternative-powered vehicles produced in the region. Greater China leads in overall inverter demand and will continue to lead during the years covered by this forecast.

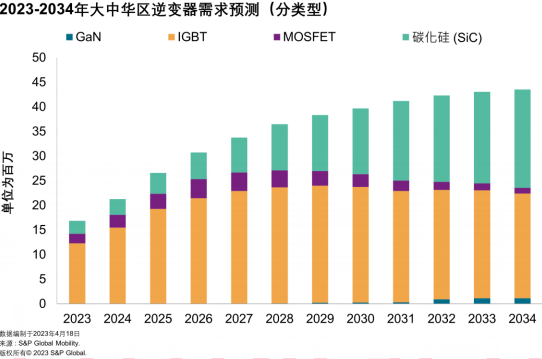

Greater China

In 2022, a total of 12.5 million inverters were used in Greater China. By 2023, the inverter demand in Greater China reached 16.88 million units, and the demand is expected to grow at a compound annual growth rate of 9% to 43.5 million units. A large part of the inverter demand will come from BEVs, followed by full hybrid vehicles. In 2034, BEVs will account for 68% of the total inverter demand in Greater China. Currently, IGBT inverter types account for a large part of the inverter demand in Greater China, but by 2034, with the growth of BEVs, SiC inverters will become the most popular inverter type in Greater China.

Europe

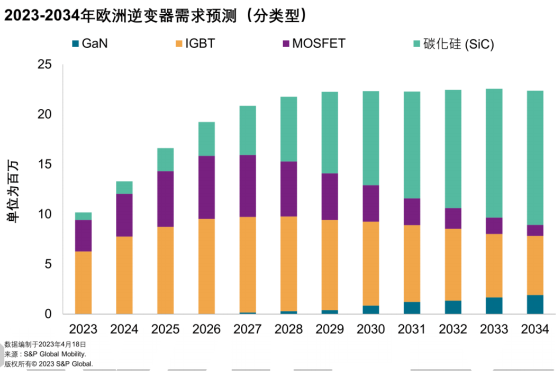

In 2022, the demand for inverters is 7.24 million units. By 2023, the demand for inverters in Europe is 10.2 million units and will grow to 22.4 million units, with a compound annual growth rate of 7.4%. Currently, the most popular inverter type in the European market is the IGBT inverter type, with a market share of 61%, and the MOSFET inverter type is 31%. The demand for IGBT inverters is driven by full hybrid vehicles, accounting for 37% of the demand.

Demand for SiC inverter types is sluggish, accounting for only 8% of total European inverter demand in 2023. Nevertheless, demand for SiC will rise, accounting for more than 60% of total European inverter demand by 2034. The growth in European inverter demand will come from increased demand for BEVs, which will account for 89% of total European inverter demand by 2034.

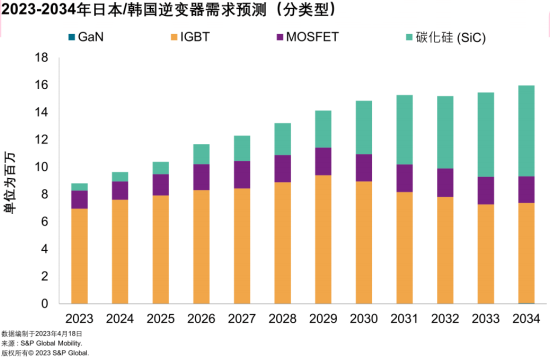

Japan/Korea

Inverter demand in Japan/Korea is 8.81 million units by 2023 and will grow to 15.95 million units by 2034. IGBT inverter types account for a large proportion of demand in Japan/Korea and this trend will continue until 2034. Demand for IGBT inverter types is mainly driven by the growth in demand for full hybrid vehicles. Full hybrid vehicles will dominate inverter demand in Japan/Korea until 2032. From 2033 onwards, demand for inverters from BEVs will exceed demand for inverters from full hybrid vehicles. By 2034, BEVs will account for 48% of total inverter demand in Japan/Korea and full hybrid vehicles will account for 43%. In 2034, SiC will account for 42% of total inverter demand in Japan/Korea and IGBT will account for 46%.

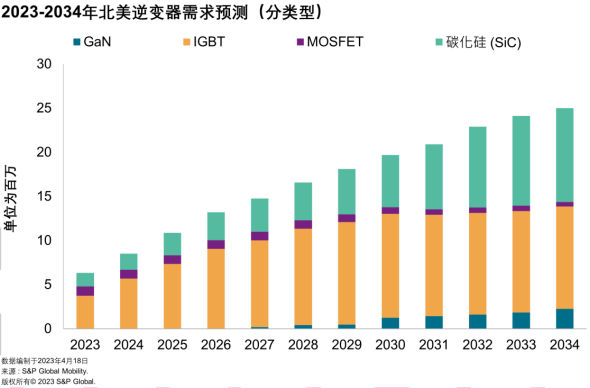

North America

IGBT inverter types account for a large portion of North American inverter demand. The demand for inverters is 6.3 million units by 2023 and is expected to reach 25 million units by 2034.

Conclusion

Compared to current demand in 2023, motor demand is expected to grow 14-fold by 2028 and 36-fold by 2034. In 2034, permanent magnet motors will continue to have a market share close to 79%, but their sales will increase to 95.6 million units. Given concerns about rare earth supply, some companies are working to develop motors that use rare earths or experiment with alternative motor types, such as induction motors and wound rotor synchronous motors. However, due to the lack of any commercially viable technology, we expect permanent magnet motors to continue to dominate the electric vehicle industry.

As the demand for increased efficiency and extended driving range continues, the automotive industry will witness the majority of automakers’ electric vehicles switching to 800V architectures. Due to the high switching efficiency and low losses of SiC inverters, the demand will be strong and they will be widely adopted. The widespread adoption of SiC inverters will lead many automakers and suppliers to choose to vertically integrate with semiconductor companies to secure the supply of SiC.

Previous article:Inventory of Typical Automotive Network System Architecture Design

Next article:The "three-electric" technology of new energy electric vehicles

- Popular Resources

- Popular amplifiers

- Huawei's Strategic Department Director Gai Gang: The cumulative installed base of open source Euler operating system exceeds 10 million sets

- Analysis of the application of several common contact parts in high-voltage connectors of new energy vehicles

- Wiring harness durability test and contact voltage drop test method

- Sn-doped CuO nanostructure-based ethanol gas sensor for real-time drunk driving detection in vehicles

- Design considerations for automotive battery wiring harness

- Do you know all the various motors commonly used in automotive electronics?

- What are the functions of the Internet of Vehicles? What are the uses and benefits of the Internet of Vehicles?

- Power Inverter - A critical safety system for electric vehicles

- Analysis of the information security mechanism of AUTOSAR, the automotive embedded software framework

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

- Innolux's intelligent steer-by-wire solution makes cars smarter and safer

- 8051 MCU - Parity Check

- How to efficiently balance the sensitivity of tactile sensing interfaces

- What should I do if the servo motor shakes? What causes the servo motor to shake quickly?

- 【Brushless Motor】Analysis of three-phase BLDC motor and sharing of two popular development boards

- Midea Industrial Technology's subsidiaries Clou Electronics and Hekang New Energy jointly appeared at the Munich Battery Energy Storage Exhibition and Solar Energy Exhibition

- Guoxin Sichen | Application of ferroelectric memory PB85RS2MC in power battery management, with a capacity of 2M

- Analysis of common faults of frequency converter

- In a head-on competition with Qualcomm, what kind of cockpit products has Intel come up with?

- Dalian Rongke's all-vanadium liquid flow battery energy storage equipment industrialization project has entered the sprint stage before production

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- Rambus Launches Industry's First HBM 4 Controller IP: What Are the Technical Details Behind It?

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- circuitpy compass

- In a blink of an eye, half of this year has passed.

- The shield affects the sensitivity, and the inductor close to the DCDC affects the sensitivity

- RK3288 open source motherboard is very powerful

- Is there any LDO chip with 3.3V5A output and input voltage around 5V?

- Teach you how to make a mini inverter 1.5V-220V at home

- The power plane is clearly more than adequate, so why is the DC voltage drop so critical?

- Asynchronous Timing Design in ASIC.pdf

- [Repost] "Very Silly" Circuit Problem

- Interface corresponding to SNVS_TAMPER3 signal

Battery Management Systems for Electric and Hybrid Vehicles

Battery Management Systems for Electric and Hybrid Vehicles

京公网安备 11010802033920号

京公网安备 11010802033920号