The century-old automobile industry is undergoing an era of great change. The transformation of automobiles to electrification and intelligence is an inevitable trend. The trends in the four areas of vehicle networking, new energy, intelligence, and autonomous driving have brought new chip demands, and also brought new industrial opportunities for domestic new chip companies to enter the automotive field.

01

What are automotive chips?

The automotive chips we often talk about, namely "automotive-grade chips", refer to chips that have reached automotive-grade technical standards and fully meet the specifications and "automotive-grade certification" of automotive electronic components. They are used in automotive control and are equivalent to the "brain" of modern cars. Many people's understanding of the importance of chips may come from consumer-grade electronic products. A small chip can achieve powerful functions. Today's cars are becoming more and more powerful and smarter, which can be attributed to the application of automotive chips. From the perspective of the grade classification of the entire chip industry, there are military-grade, automotive-grade, industrial-grade and consumer-grade chips. Among them, automotive-grade chips have higher requirements for reliability, consistency and stability, second only to military-grade. Automotive-grade chips are very different from consumer-grade chips. Automotive-grade chips need to face more severe environments, need to adapt to extreme temperatures of -40℃ to -150℃, high vibration, dust, electromagnetic interference, and humidity must adapt to 0%-100%. The design life of general automotive-grade chips is 15 years or 200,000 kilometers.

02

Automotive chips, the "brain" of modern cars

Automotive chips have been widely used in many fields such as power systems, car bodies, cockpits, chassis and safety. Unlike computing and consumer electronics chips, automotive chips rarely appear alone. They are embedded in major functional units and are the core in most cases. From the application link, automotive chips can be roughly divided into the following categories: main control chips, storage chips, power chips, signal and interface chips, sensor chips, etc. The main control chip is responsible for calculation and control, including MCU chips and SoC chips, such as engine, chassis and body control, as well as central control, assisted driving (ADAS) and automatic driving systems; IGBT power chips responsible for power conversion are generally used in the power supply and interface of electric vehicles; sensor chips are mainly used for various radars, airbags, and tire pressure monitoring.

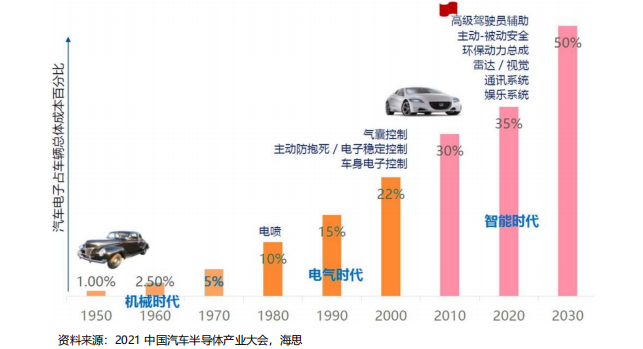

According to data released by HiSilicon at the 2021 China Automotive Semiconductor Industry Conference, the era of automotive intelligence and electrification has begun, driving the increase in both quantity and price of automotive chips. It is estimated that automotive semiconductors will account for 50% of the total cost of automobiles in 2030. Under the trend of electrification and intelligence, chips such as main control chips, storage chips, power chips, communication and interface chips, and sensors have developed rapidly, the unit value of chips has continued to increase, and the total value of vehicle chips has continued to rise.

Assume that traditional cars require 500 to 600 semiconductor chips per vehicle, and new energy vehicles require 1,000 to 2,000 semiconductor chips per vehicle.

Based on the estimated sales of 72.76 million traditional cars and 3.24 million new energy cars in 2020, the global demand for automotive chips is 43.9 billion per year. It is estimated that the annual sales of traditional cars will reach 67.8 million and the annual sales of new energy cars will reach 44.2 million in 2026, and the global demand for automotive chips will increase to 90.3 billion per year. It is estimated that the annual sales of traditional cars will reach 24 million and the annual sales of new energy cars will reach 96 million in 2035, and the global demand for automotive chips will increase to 128.5 billion per year.

03

Analysis of Automotive Main Control Chip

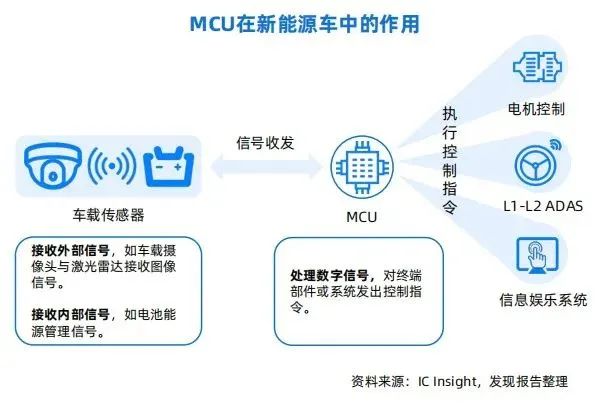

The main control chip of the car is used to generate the calculation and generation functions of the main control signals of the car. The main control chip receives the signals collected by various sensors, calculates the corresponding processing measures, and sends the drive signal to the corresponding control module. Therefore, the main control chip is equivalent to the "center" of the car chip group. (1) Main control chip - MCU chip: the core component of the automotive electronic control unit ECU MCU (Microcontroller Unit) is a microcontroller, also known as a single-chip microcomputer. It integrates the CPU, memory, I/O port, serial port, timer, interrupt system, special function register, etc. contained in the computer on a chip, and applies it to different products to realize the calculation and control of the product. The on-board MCU is the core component of the automotive electronic control unit (ECU), responsible for the calculation and processing of various information, and is mainly used for body control, driving control, infotainment and driving assistance systems.

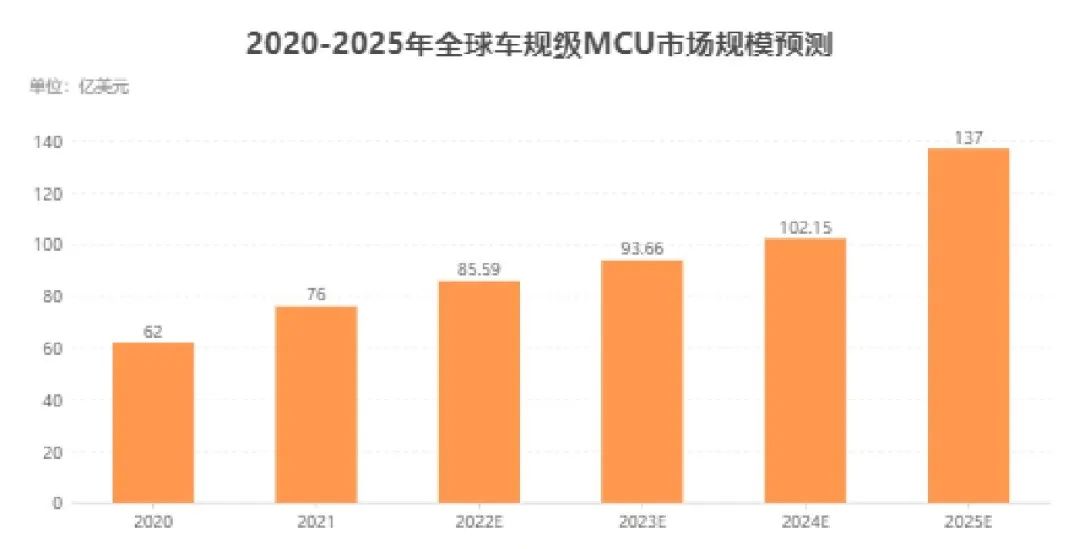

With the acceleration of automobile electronicization and intelligence, the number of automobile ECUs is also increasing rapidly, driving the growth of MCU market demand. The computing power continues to increase with the improvement of intelligence, from L1 (autonomous driving level) <1TOPS computing power to L5 (autonomous driving level) 1000+TOPS computing power, which drives the rapid growth of main control chips. MCU chips are required in ECUs. Usually, an ECU in a car is responsible for a single function and is equipped with one MCU. There are also cases where one ECU is equipped with two MCUs. Compared with traditional fuel vehicles, new energy vehicles have richer functions and higher requirements for MCU performance, power consumption, and quantity. Traditional cars use an average of about 70, while new energy vehicles need more than 300. Automotive MCU chip market size forecast As the penetration rate of new energy vehicles continues to rise, the global automotive-grade MCU market size will also grow accordingly. The global automotive MCU market size was US$6.2 billion in 2020. In 2021, the demand for automotive MCUs was strong, and the market size increased significantly by 23% to US$7.61 billion. It is expected that in 2025, the market size is expected to reach nearly US$12 billion, corresponding to a compound average growth rate of 14.1% from 2021 to 2025. The market size of automotive-grade MCUs in my country also maintained steady growth. In 2021, the market size of automotive-grade MCUs in my country reached US$3.001 billion, a year-on-year increase of 13.59%. It is expected that the market size will reach US$4.274 billion in 2025.

(2) Main control chip - SoC: System-on-a-Chip with AI accelerators, used in smart cockpits and autonomous driving. The full name of SoC chip is: System-on-a-Chip, which means "making the whole system on one chip" in Chinese. Automotive electronic functions rely on on-board chips. With the implementation of ADAS and the maturity of L3 and above autonomous driving, traditional central computing CPUs cannot meet the computing power requirements of smart cars. System-on-chips (SoCs) that integrate CPUs with general/special chips such as GPUs, FPGAs, and ASICs and integrate AI accelerators have emerged. They are mainly divided into smart cockpit chips and autonomous driving chips. According to IHS data, the global automotive SoC market size is expected to reach US$8.2 billion in 2025, and L3 and above autonomous driving is expected to enter the market on a large scale after 2025. The matching high-computing power and high-performance SoC chips will bring extremely high added value, which is expected to drive the rapid expansion of the main control chip market.

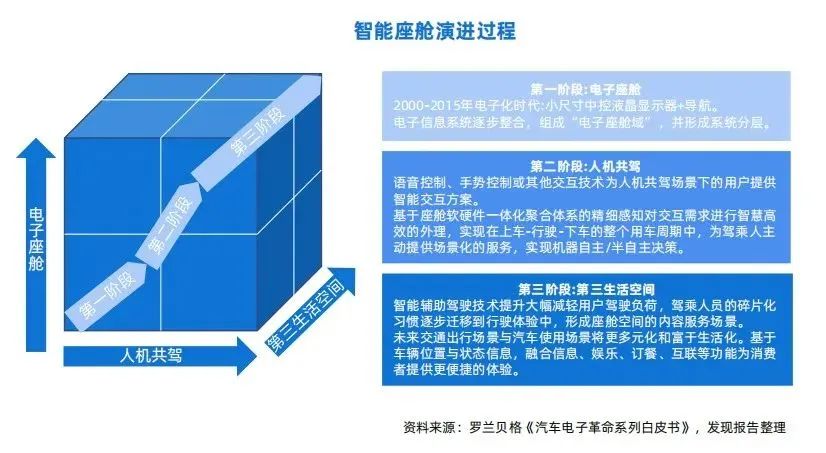

Smart cockpit chip: strong support for future "one chip, multiple screens" technology

According to the analysis report, the global smart cockpit market is expected to reach US$43.8 billion in 2022. As the smart cockpit gradually evolves from an electronic cockpit to a third living space, the "one chip, multiple screens" cockpit solution has become a future trend. In line with the evolutionary trend of multi-sensor fusion, multi-mode interaction, and multi-scenario mode development in the smart cockpit, the cockpit SoC as the processing center needs to continue to develop and break through. Therefore, the computing power of the cockpit SoC will continue to increase. According to IHS Markit, it is expected that the cockpit NPU computing power demand in 2024 will be ten times that of 2021, and the CPU computing power demand will be 3.5 times that of 2022. At the same time, the chip itself will also develop in the direction of miniaturization, integration, and high performance.

Now that cars are software-defined, especially as cockpit systems become increasingly open, mobile applications are migrating to cockpits in large numbers, so the number of operating systems on a single chip will be 3 to 5 times that of before. At the same time, because a central control may only run one system and support one screen in the past, and now the cockpit needs to support multiple operating systems and multiple screens, the benefit is that the entire application will be 50 to 100 times that of a traditional car, but it also leads to a geometric increase in the complexity of the entire software-defined car. The future smart technology cockpit scene includes traditional central control entertainment navigation, LCD instrument panel, driving recorder, independent rear entertainment, head-up display, 360-degree surround view + automatic parking assistance, voice assistant is also indispensable, there will also be driver monitoring system and passenger monitoring system, virtual air conditioning panel, etc. Autonomous driving chip: The computing power foundation determines the level of autonomous driving

Previous article:A brief discussion on the design of AUTOSAR electronic control unit (ECU)

Next article:Understanding the three major sensor systems for autonomous driving

- Popular Resources

- Popular amplifiers

- Huawei's Strategic Department Director Gai Gang: The cumulative installed base of open source Euler operating system exceeds 10 million sets

- Analysis of the application of several common contact parts in high-voltage connectors of new energy vehicles

- Wiring harness durability test and contact voltage drop test method

- Sn-doped CuO nanostructure-based ethanol gas sensor for real-time drunk driving detection in vehicles

- Design considerations for automotive battery wiring harness

- Do you know all the various motors commonly used in automotive electronics?

- What are the functions of the Internet of Vehicles? What are the uses and benefits of the Internet of Vehicles?

- Power Inverter - A critical safety system for electric vehicles

- Analysis of the information security mechanism of AUTOSAR, the automotive embedded software framework

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

- Innolux's intelligent steer-by-wire solution makes cars smarter and safer

- 8051 MCU - Parity Check

- How to efficiently balance the sensitivity of tactile sensing interfaces

- What should I do if the servo motor shakes? What causes the servo motor to shake quickly?

- 【Brushless Motor】Analysis of three-phase BLDC motor and sharing of two popular development boards

- Midea Industrial Technology's subsidiaries Clou Electronics and Hekang New Energy jointly appeared at the Munich Battery Energy Storage Exhibition and Solar Energy Exhibition

- Guoxin Sichen | Application of ferroelectric memory PB85RS2MC in power battery management, with a capacity of 2M

- Analysis of common faults of frequency converter

- In a head-on competition with Qualcomm, what kind of cockpit products has Intel come up with?

- Dalian Rongke's all-vanadium liquid flow battery energy storage equipment industrialization project has entered the sprint stage before production

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- A wrong partner will bury your genius ideas

- Automatic air conditioning comes in

- Solution to CCS8.1.0 not finding .h files

- EEWorld invites you to attend the 2019 STM32 Summit and Fan Carnival!

- Ask a question about the LM35CZ temperature sensor

- Functions of vent valve and drain valve of magnetic flap level gauge

- FatFs transplantation based on SPI for MSP430F5438A microcontroller

- Problem with STM32F767 timer overflow interrupt flag

- Comparison of the advantages of digital cameras and analog cameras in machine vision system design

- About the external interrupt of HAL library

Mission-oriented wireless communications for cooperative sensing in intelligent unmanned systems

Mission-oriented wireless communications for cooperative sensing in intelligent unmanned systems

京公网安备 11010802033920号

京公网安备 11010802033920号