The pressure of automotive chip shortage is facing increasing uncertainty as electrification and intelligence advance. If our observation of the automotive industry is still at the level of model competition, we will be far behind the times.

Three days ago, Malaysian Prime Minister Muhyiddin Yassin submitted his resignation to the King, becoming the shortest-serving prime minister in the country's history. After a chaotic term, Malaysia is still in the midst of the COVID-19 pandemic. With the resignation of the ruling party, the country has once again been thrown into new political turmoil.

At present, the number of newly confirmed cases in Malaysia has reached 19,700. Although Malaysia's vaccination rate is already at a relatively high level in Southeast Asia, it is not enough to resist the rampant spread of the Delta strain. According to the data of 20,000 new cases per day, it is higher than that of the United States, making it the most severely affected area in Southeast Asian countries.

It is this country that has made the current chip shortage even worse. In the past decade, Southeast Asia has played an important role in the technology supply chain, especially Malaysia, which has undertaken the production of electronic components from automobiles to digital products.

Malaysia is the world's seventh largest exporter of semiconductor products. As of now, more than 50 semiconductor manufacturers have set up factories locally. In just a few years, it has attracted semiconductor giants such as Intel, Infineon, STMicroelectronics, NXP, and Texas Instruments to set up factories locally.

Due to the latest circle of friends of Bosch China's senior executives, Malaysia's chip supply has once again been pushed to the forefront of industry opinion. Affected by the shutdown of Malaysia's chip factory, Bosch's subsequent chips in August are basically in a state of supply shortage. Interestingly, Tesla's head Musk directly named Bosch and Renesas last week, saying that they have the greatest impact on its chip supply.

Since the massive chip shortage, three countries or regions have attracted the most attention from the world.

The first is the United States, where the snowstorms in the first half of the year forced many chip factories to press the pause button; the second is Taiwan, China, which first suffered from drought and water shortage, and then repeated epidemics. The arrival of each uncertain factor tests the response capabilities of TSMC and King Yuan Electronics; the third is Malaysia. We will slowly talk about the impact of this country on the entire semiconductor industry chain below.

Chip town suffered a critical blow

Public data shows that Southeast Asia’s semiconductor packaging and testing business has accounted for 27% of the global market share, nearly one-third, and Malaysia’s packaging and testing capacity accounts for 13% of the global capacity, which is of great importance. Take Intel for example, the capacity of its packaging and testing plant in Malaysia once accounted for 50% of the total capacity, and the capacity utilization rate has been saturated for a long time.

This also means that once Malaysia is hit by force majeure, the global chip supply will be greatly affected. Now, the new crown pneumonia has become a black swan among force majeure factors, forcing the suspension of many important production lines in Malaysia, especially the impact of the Delta virus, which directly caused the epidemic in the country to get out of control, and the crisis of chip production suspension continued to spread.

Due to the epidemic, Malaysia has closed its borders for three consecutive times.

In May this year, Malaysia announced a national lockdown; in early June, the epidemic spread again and Malaysia had to close the country again; at the end of June, the epidemic was on the verge of being out of control, and the government announced that it would continue to close the country, and has not yet specified a specific date for lifting the lockdown.

In the first half of the year, when Malaysia announced its first lockdown, the industry became anxious about chip supply, and uneasy emotions began to brew quietly in many mainstream foreign media. Once the lockdown becomes long-term, its uncertainty will add more variables to the global semiconductor market.

It is worth mentioning that Malaysia is a major producer of passive components. Goku lHariharan, head of technology for Asia at JPMorgan Chase, previously told foreign media such as the Financial Times that Southeast Asia, led by Malaysia, plays an important role in the manufacture of passive components (including resistors and capacitors used in smartphones and other products).

About 15% to 20% of the world's passive components are manufactured in Malaysia, which will subsequently exacerbate supply constraints in the entire industry. Kaimei Electronics, the Taiwanese parent company of resistor manufacturer Ralec, previously predicted that the company's production capacity would drop by 30% in July.

Currently, Infineon has three factories in Malaysia, which suspended production for about two weeks in early June this year. Although local chip production has now returned to normal, according to external reports, the suspension of production has caused Infineon tens of millions of euros in economic losses.

"More than 20 of the 3,000 employees at the Muar factory died due to the epidemic, and hundreds were infected."

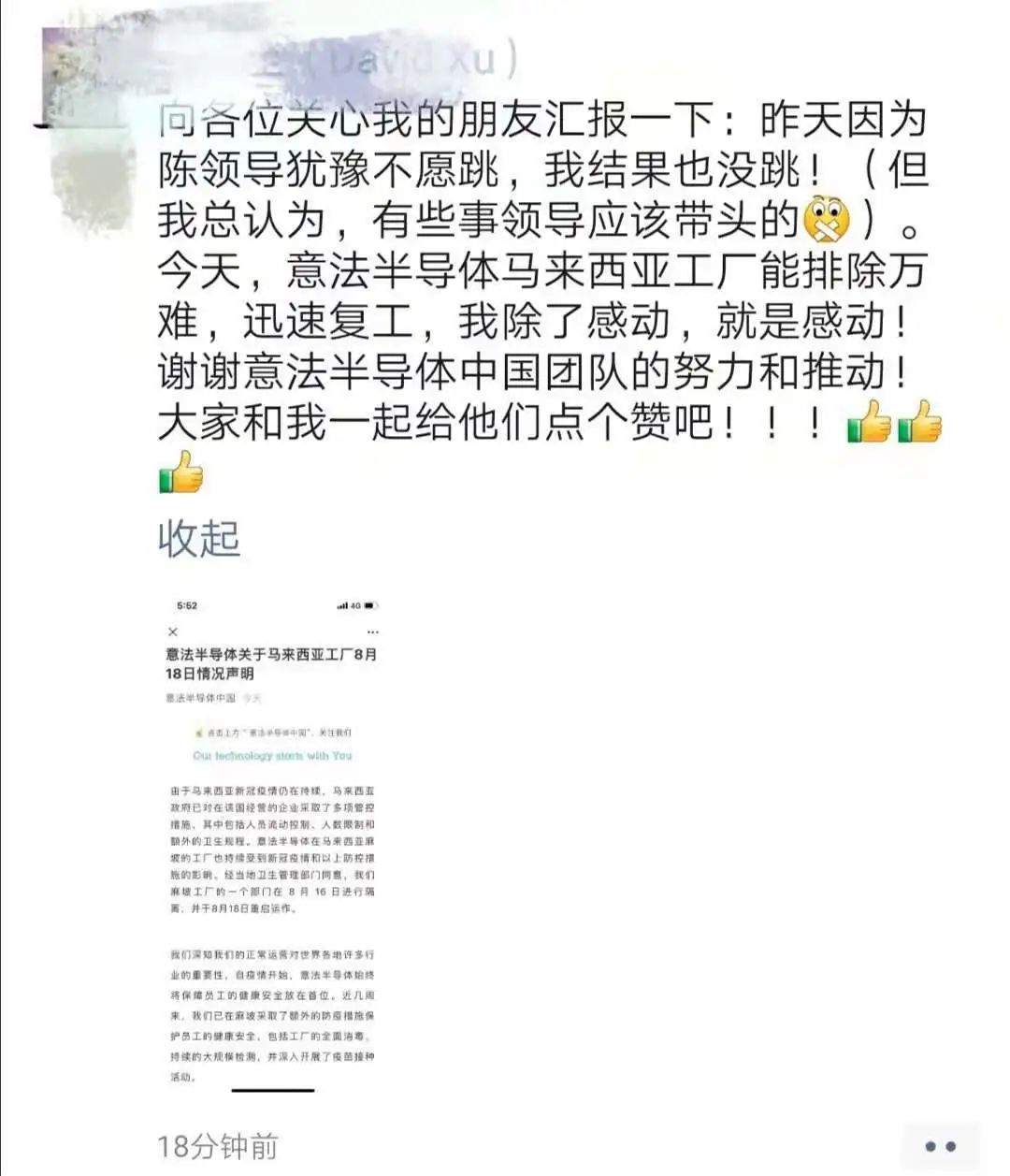

On the afternoon of August 17, a post by Xu Daquan, executive vice president of Bosch China, an automotive electronics giant, instantly set off the mood of the industry. The "semiconductor chip supplier" mentioned in Dr. Xu Daquan's post refers to STMicroelectronics (ST), one of the important suppliers of Bosch Group's automotive parts business. According to 2019 data, ST Group ranked fourth in the global automotive chip list, with a market share of 8%.

Fortunately, STMicroelectronics issued the latest announcement on August 18, stating that with the consent of the local health management department, a department of the Muar factory had been quarantined on August 16 and resumed operations on August 18.

The chip crisis may be seriously underestimated

"The supply cut is even more painful, drinking to relieve sorrow is even more sorrowful."

He Xiaopeng, chairman of Xpeng Motors, recently reposted a screenshot of Bosch China Vice President Xu Daquan's WeChat Moments and used Li Bai's poetry to express his feelings about the chip shortage.

Yes, the chip suspension in Malaysia has directly affected the normal production of automakers. Take the information mentioned in Xu Daquan's Bosch circle of friends as an example. The ESP chip that was cut off from Bosch this time is the electronic stability system, IPB is the intelligent integrated braking system, VCU is the vehicle control unit, and TCU is the automatic transmission control module of the car.

All of this sends a message that the world's most influential automaker is facing a supply shortage risk in its key component chips. And these risks will be passed on to downstream customers, namely automakers who are currently waiting for chips.

Previously, the automotive industry generally believed that the second quarter would be the period when chip shortages would be the most severe, but judging from the current situation, the supply in the third quarter is not optimistic.

Due to the recurrence of the overseas epidemic, the delivery time of chips is still being extended. A few days ago, Bloomberg cited research data from Susquehanna International, finding that the global chip delivery cycle reached 20.2 weeks in July this year, an increase of 8 days from June, becoming the longest waiting time since the company began tracking relevant data in 2017.

Interestingly, Nissan temporarily closed a vehicle assembly plant in Tennessee, the United States, in early August and will not resume production until the end of the month. The main reason for the suspension of the production line is the shortage of chip supply, and the relevant suppliers are directly from Malaysia.

Also recently, a picture about the suspension of production of many of Audi's best-selling models due to chip shortages was widely circulated on the Internet. Judging from the information in the picture, it is suspected to be an internal plan released by FAW-Volkswagen Audi.

The document shows that due to the continued shortage of vehicle main control chips, the B9 product line will be discontinued from August 12, the Q5L PA product line will be discontinued from August 13, and the C8 product line will be discontinued from August 25. Within FAW-Audi, the entire series of models of the B9, C8, and Q5LPA production lines are mainly represented by A4L, A6L, Q5L and other products, all of which are the flagship models of FAW-Volkswagen Audi.

An insider of FAW-Volkswagen Audi told Auto Commune that the screenshots about the suspension of production were fake news. However, according to feedback from reporters during their visits to dealers in recent days, some of FAW-Volkswagen Audi's best-selling models are also struggling with inventory.

The chip shortage continues.

It is not like what some people believe, that the expansion of the 8-inch wafer production line will immediately alleviate the pressure on automotive-grade chips, or even lead to supply exceeding demand.

Foolish people are trapped in problems, smart people solve problems, and wise people turn problems into motivation. The pressure of automotive chip shortage is facing increasing variables with the advancement of electrification and intelligence. If our observation of the automotive industry is still at the level of model PK model, then we will be far behind the times.

It is precisely the huge variables that can dialectically switch to power and opportunity. The automotive industry, which is particularly suffering from the "chip shortage", will accelerate its transformation towards new technologies due to the spur of this disaster and become the "locomotive" that guides the entire society forward again after the era of internal combustion engines.

Previous article:Chaos is frequent, and OTA is completely put under a "tight ring"

Next article:Why are sensors so important for autonomous driving?

- Popular Resources

- Popular amplifiers

- Analysis of the application of several common contact parts in high-voltage connectors of new energy vehicles

- Wiring harness durability test and contact voltage drop test method

- Sn-doped CuO nanostructure-based ethanol gas sensor for real-time drunk driving detection in vehicles

- Design considerations for automotive battery wiring harness

- Do you know all the various motors commonly used in automotive electronics?

- What are the functions of the Internet of Vehicles? What are the uses and benefits of the Internet of Vehicles?

- Power Inverter - A critical safety system for electric vehicles

- Analysis of the information security mechanism of AUTOSAR, the automotive embedded software framework

- Brief Analysis of Automotive Ethernet Test Content and Test Methods

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

- LED chemical incompatibility test to see which chemicals LEDs can be used with

- Application of ARM9 hardware coprocessor on WinCE embedded motherboard

- What are the key points for selecting rotor flowmeter?

- LM317 high power charger circuit

- A brief analysis of Embest's application and development of embedded medical devices

- Single-phase RC protection circuit

- stm32 PVD programmable voltage monitor

- Introduction and measurement of edge trigger and level trigger of 51 single chip microcomputer

- Improved design of Linux system software shell protection technology

- What to do if the ABB robot protection device stops

- Analysis of the application of several common contact parts in high-voltage connectors of new energy vehicles

- Wiring harness durability test and contact voltage drop test method

- From probes to power supplies, Tektronix is leading the way in comprehensive innovation in power electronics testing

- From probes to power supplies, Tektronix is leading the way in comprehensive innovation in power electronics testing

- Sn-doped CuO nanostructure-based ethanol gas sensor for real-time drunk driving detection in vehicles

- Design considerations for automotive battery wiring harness

- Do you know all the various motors commonly used in automotive electronics?

- What are the functions of the Internet of Vehicles? What are the uses and benefits of the Internet of Vehicles?

- Power Inverter - A critical safety system for electric vehicles

- Analysis of the information security mechanism of AUTOSAR, the automotive embedded software framework

- Dot matrix display design based on msp430

- The largest semiconductor deal in history is born! $40 billion acquisition of ARM

- PCB design experience - for reference

- Confused, what is an oscilloscope with a Z axis? Don't worry, here is an introduction

- STM32 Hefei Seminar

- "Recommend Chinese Chip" + Minsilicon (ARM core 32-bit MCU)

- Wireless communication, 5G, RF, antenna and several concepts and indicators

- Happy Lantern Festival! Guess the lantern riddles and have fun

- How to make an automatic switch when there are 3 5V input ports on a circuit board?

- "Operational Amplifier Parameter Analysis and LTspice Application Simulation" Reading Notes Part 3 - Noise

TLE2061IP

TLE2061IP

京公网安备 11010802033920号

京公网安备 11010802033920号