After nearly a year of slumping demand, the global semiconductor technology industry chain has been struggling with order cuts, price cuts, breach of contract compensation, and even losses from large profits. The dark tunnel of chaos is coming to an end, and the dawn of recovery has finally emerged.

According to semiconductor industry players, in addition to the performance and capacity utilization rates of TSMC and World Advanced Semiconductor Manufacturing Co., Ltd., which are expected to pick up ahead of schedule, there are rumors that TSMC intends to raise quotations for popular processes in the second half of the year, and there is another glimmer of hope.

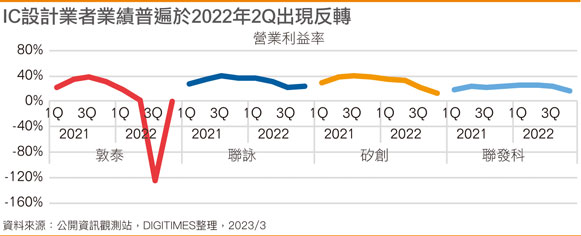

The performance of IC design companies generally reverses in 2Q 2022

It is reported in the market that Novatek and Silicon Microelectronics, the major driver IC manufacturers that were the first to operate and have plummeted to the bottom, will increase the quotations of some driver ICs in April due to the slowdown in terminal demand, customer replenishment of inventory and the launch of new products. ~15%.

Affected by many pressures such as the fading benefits of the epidemic, the Russia-Ukraine war, blockades, and rising global inflationary pressures, global semiconductor technology supply and demand reversed rapidly in the second quarter of 2022. In addition to industrial control and automotive applications, everything from terminal agents to brands to IC design, inventory water level alarms are raised one after another, and supply links continue to enter the minefield.

The driver IC industry was the first to collapse. It plummeted and suffered heavy losses. In order to quickly stop the bleeding, it had to cancel orders and break contracts. The amount of compensation paid to TSMC and UMC exceeded expectations.

For example, Duntai, which made a lot of money in 2021, suffered a huge loss for the whole year in 2022 due to an inventory depreciation loss of nearly 2.5 billion yuan in the third quarter; the leading factory Novatek suffered a lighter decline, with an annual profit decrease of 28.04% in 2023. %. In addition, the MCU industry has quickly returned to its original shape, with prices and volumes plummeting significantly, and inventories have not yet been cleared.

In addition, although MediaTek, Taiwan's leading IC design leader, has not seen a decline in its performance in 2022, its previous performance in 2023 has become significantly more conservative. The market previously believed that due to the adjustment of mobile phone inventory by many customers for at least half a year, MediaTek's performance in 2023 should decline significantly. .

In terms of terminal PC brands, Acer and Asus both suffered losses in the fourth quarter of 2022, and are still conservative about the first half of 2023.

As for wafer foundries, the last group in the semiconductor industry to collapse, including TSMC, their performance will decline in the first quarter of 2023, and they have previously been very cautious and conservative about the timing of the economic recovery.

However, according to semiconductor industry players, the recent semiconductor downturn has shown signs of improvement, and there have even been several signs of recovery. One is that the worst situation for wafer foundry is about to pass. In addition to the accelerated inventory depletion of some end products, the U.S.-China conflict has also The transfer order effect will also ferment, and capacity utilization and performance in the second quarter may stop falling and rebound.

Among them, it is rumored that TSMC’s 28nm 28nm will still be fully loaded until the end of the year, and with the capacity utilization rate of popular processes such as 5/4nm also rising quarter by quarter, TSMC has begun to evaluate the second increase in foundry quotations for some processes in the second half of the year. If TSMC The success of another strong increase will make the quotations of wafer OEMs more firm.

It is worth noting that another ray of light is that the driver IC industry, which was the earliest in operation and has plummeted to the bottom, has come to an end and prices have stopped falling.

Recently, it has been reported that as terminal demand slows down, customers replenish inventory and new products are launched, Novatek and Silicontronics will unexpectedly increase the quotations of some driver ICs in April, with an increase of 10~15%. At the same time, they will also re-intensive Wafer foundry’s wafer production capacity.

Semiconductor industry players expect that as inventories decrease and demand recovers, the supply chain will also recover one by one based on strength. Strong manufacturers will be the first to bid farewell to the trough and restart growth momentum.

As the domestic lockdown measures were lifted at the beginning of the year and work and life returned to normal, the second quarter entered the May Day and June 18 shopping festivals. Operator promotions, as well as government subsidies such as home appliances going to the countryside and new energy vehicles will be on the road. Terminal inventory is expected to be Accelerate decomposition.

As domestic consumer demand that has been suppressed for a long time is expected to burst out, the semiconductor technology industry's prosperity in the second half of the year is expected to be better than expected. Major manufacturers should not be so pessimistic, and the decline for the whole year is expected to converge.

Previous article:The second phase of the big fund takes action again, targeting semiconductor materials

Next article:Why can Texas Instruments China achieve annual revenue of tens of billions of dollars?

Recommended ReadingLatest update time:2024-11-23 03:32

- STMicroelectronics discloses its 2027-2028 financial model and path to achieve its 2030 goals

- Chuangshi Technology's first appearance at electronica 2024: accelerating the overseas expansion of domestic distributors

- Europe's three largest chip giants re-examine their supply chains

- Future Electronics held a Technology Day event in Hangzhou, focusing on new energy "chip" opportunities

- It is reported that Kioxia will be approved for listing as early as tomorrow, and its market value is expected to reach 750 billion yen

- The US government finalizes a $1.5 billion CHIPS Act subsidy to GlobalFoundries to support the latter's expansion of production capacity in the US

- SK Hynix announces mass production of the world's highest 321-layer 1Tb TLC 4D NAND flash memory, plans to ship it in the first half of 2025

- Samsung Electronics NRD-K Semiconductor R&D Complex to import ASML High NA EUV lithography equipment

- A big chip war is about to start: Qualcomm and MediaTek are involved in notebooks, and AMD is reported to enter the mobile phone market

- Intel promotes AI with multi-dimensional efforts in technology, application, and ecology

- ChinaJoy Qualcomm Snapdragon Theme Pavilion takes you to experience the new changes in digital entertainment in the 5G era

- Infineon's latest generation IGBT technology platform enables precise control of speed and position

- Two test methods for LED lighting life

- Don't Let Lightning Induced Surges Scare You

- Application of brushless motor controller ML4425/4426

- Easy identification of LED power supply quality

- World's first integrated photovoltaic solar system completed in Israel

- Sliding window mean filter for avr microcontroller AD conversion

- What does call mean in the detailed explanation of ABB robot programming instructions?

- STMicroelectronics discloses its 2027-2028 financial model and path to achieve its 2030 goals

- 2024 China Automotive Charging and Battery Swapping Ecosystem Conference held in Taiyuan

- State-owned enterprises team up to invest in solid-state battery giant

- The evolution of electronic and electrical architecture is accelerating

- The first! National Automotive Chip Quality Inspection Center established

- BYD releases self-developed automotive chip using 4nm process, with a running score of up to 1.15 million

- GEODNET launches GEO-PULSE, a car GPS navigation device

- Should Chinese car companies develop their own high-computing chips?

- Infineon and Siemens combine embedded automotive software platform with microcontrollers to provide the necessary functions for next-generation SDVs

- Continental launches invisible biometric sensor display to monitor passengers' vital signs

- #idlemarket# nRF6936 Nordic IOT Sensor Kit Thingy: 52 Bluetooth module nRF52832

- Can NXP's crossover processor RT1052 execute code in RAM?

- Several Issues in PIC Microcontroller Development

- What are the consequences of not connecting high-power wireless data transmission equipment to an antenna?

- 【Application Case】How to implement anti-lost device with Bluetooth BLE

- How do C1 and C2 supercapacitors work?

- What is the difference between an industrial 4G router and a regular 4G router? Which one have you used?

- Download the information and watch the video to win a prize! Tektronix Automotive Electronics Test Solutions

- In 2009, the scale of my country's automotive electronics will reach 143.41 billion yuan

- Circuit Diagram

Optimized drivetrain and new semiconductor technologies enable the design of energy-efficient electr

Optimized drivetrain and new semiconductor technologies enable the design of energy-efficient electr Talk about chips

Talk about chips

京公网安备 11010802033920号

京公网安备 11010802033920号