Japanese auto parts maker Denso said late last month it would build a major power chip production plant with Taiwanese foundry UMC, a move that highlights growing demand for power semiconductors used in everything from electric cars to trains to wind turbines.

The announcement also highlights what the Japanese government and industry experts say is a major weakness of Japan's chip industry: fragmentation.

Denso has chosen to partner with a Taiwanese chipmaker, while four other Japanese semiconductor companies are investing in their own production plants.

Power chips are semiconductors used to regulate electric current and are used in everything from electric vehicles and air conditioners to data center servers and factory robots.

The power management market will account for nearly 10% of the $555 billion global chip industry by 2021, according to World Semiconductor Trade Statistics, and demand is expected to grow along with the broader semiconductor market. “They are indispensable devices for the global transition from fossil fuels to renewable energy,” said Hideki Wakabayashi, a professor at Tokyo University of Science and a member of an advisory panel to the Ministry of Economy, Trade and Industry (METI).

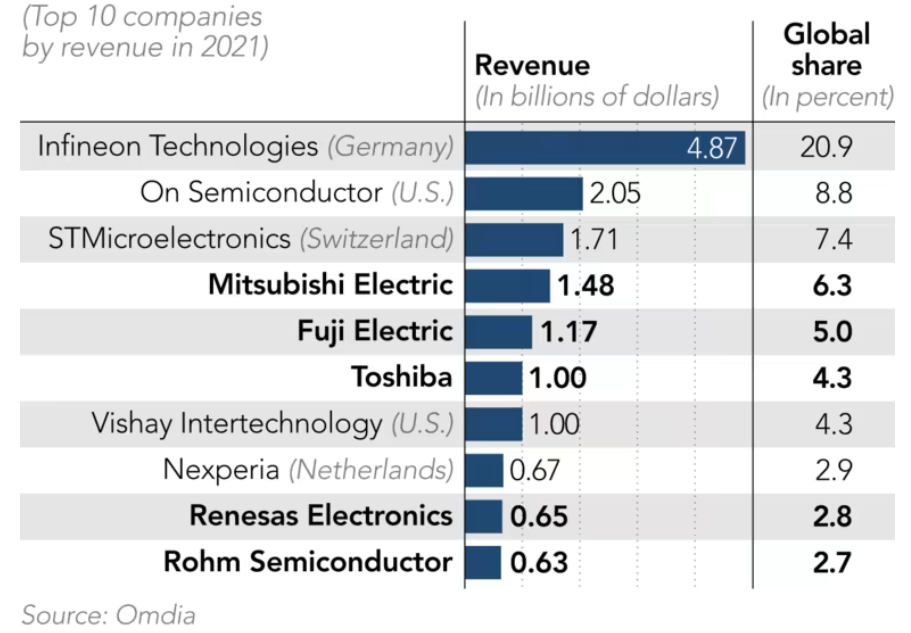

Japanese chipmakers currently have a global market share in power devices, but the question is whether they can maintain that niche. The world's largest power chip maker, Germany's Infineon Technologies, has a 21% global market share, equal to the combined share of the top five Japanese companies.

Experts say Japan's chipmakers are relatively small, making it difficult to expand production and marketing, and are also cautious about making big investments to avoid a similar oversupply.

Experts say Japan's power market needs to consolidate before its global market share declines further - data shows Japan's market share fell by 1.2 percentage points from 2020 to 2021.

Some are trying to turn words into action.

Fumiaki Sato, co-founder of investment bank Sangyo Sosei Advisory, aims to build a chip foundry that will provide manufacturing services to all Japanese power chipmakers. Fumiaki Sato said the idea is to create a power semiconductor foundry similar to TSMC, the world's largest foundry.

"Every company invests in its production capacity. If they need more, they can come to us," Sato told Nikkei Asia. Building a chip factory costs up to 100 billion yen ($765 million), he said. "Companies see it as a risk, and there is always a risk of oversupply, even at a time when demand is widely expected to grow."

Sato is considering buying an old chip plant in Niigata, central Japan, from U.S. chipmaker Onsemi, a move that won government subsidies last year. But so far, the plan has not moved forward.

Sato cited challenges such as obtaining more funding and potential customers.

One factor holding back capacity expansion is the nature of power semiconductors themselves. They are designed to handle high voltages and are typically manufactured to individual product specifications rather than in large volumes.

But Masao Taguchi, former head of Fujitsu's semiconductor business, said the industry could undergo a fundamental shift as mass production of electric vehicles begins, requiring cheaper, standardized chips. "Power semiconductors could become more standardized, allowing companies that continue to scale up production to dominate the market," he said. "This is what happened in the DRAM market. Japanese chipmakers lost the memory chip market to South Korea."

Germany's Infineon Technologies leads the race for scale. It operates two large 300mm wafer fabrication plants, one in Dresden and the other in Villach, Austria. Denso's facility won't come online until the first half of next year.

Toshiba is building two 300mm production facilities, with one scheduled to start production this fiscal year and the other in fiscal 2024. Mitsubishi Electric will start mass production of 300mm wafers only in fiscal 2024.

Fuji Electric, a major supplier to Toyota and Honda, said it is not chasing market share but is keeping a tight rein on its capital investments. Fuji Electric said it is preparing to embark on 300mm facility construction but declined to elaborate on the time frame.

“Unless there is a real need, consolidation is unlikely to happen,” said an industry official.

Meanwhile, policymakers are watching the situation closely.

Ranking and share of power device manufacturers in 2021

The Ministry of Economy, Trade and Industry held another Semiconductor Industry Strategy Group meeting on April 14 to discuss strengthening the strategic position of the power semiconductor industry.

Kazumi Nishikawa, director of IT industry at the Ministry of Economy, Trade and Industry, said demand for such semiconductors is expected to "grow rapidly" and "outstrip supply."

The ministry recently offered subsidies to Japanese chipmakers to help them upgrade aging factories, but Nishikawa said that was a short-term solution, not a long-term one. “As the top producer of power semiconductors, Japan has a responsibility to supply the rest of the world,” he said.

He said the government is expected to outline specific support measures for the industry once a bill to strengthen the country's economic security is passed. Such measures are expected to be part of next year's budget.

Last year, Japan's Ministry of Economy, Trade and Industry helped convince TSMC to build a chip plant in Kumamoto, southern Japan, a victory, but the ministry said there is more work to do. "We have had a successful start," Nishikawa said of the TSMC collaboration. "The chip industry is advancing very fast, and once you stop, you will fall behind."

One of the industry’s biggest tasks will be to untangle Japan’s keiretsu system, in which companies form tight ties and focus more on serving each other than the broader market. Breaking up that system will be key to reorganizing Japan’s fragmented chip industry.

Taguchi, a former Fujitsu executive, credits Toshiba with being a leader in creating Kioxia, the world's second-largest flash memory maker. "Toshiba has a high profile globally. It can be a rallying point for Japan's semiconductor industry," he said.

Wakabayashi, a professor at Tokyo University of Science and a member of the Ministry of Economy, Trade and Industry's strategy panel, also stressed the importance of Japan being globally competitive.

“The main customers for power semiconductors are likely to be global automotive suppliers – Denso, Bosch and Continental,” Wakabayashi said. “Denso is maintaining a good fighting capacity, but the others are all European companies.”

Previous article:Samsung reportedly breaks through low yield rate barrier, 3nm GAA process goes into mass production as planned

Next article:TSMC's price hike puts chip companies in a dilemma

Recommended ReadingLatest update time:2024-11-22 12:54

- Popular Resources

- Popular amplifiers

- Chuangshi Technology's first appearance at electronica 2024: accelerating the overseas expansion of domestic distributors

- Europe's three largest chip giants re-examine their supply chains

- Future Electronics held a Technology Day event in Hangzhou, focusing on new energy "chip" opportunities

- It is reported that Kioxia will be approved for listing as early as tomorrow, and its market value is expected to reach 750 billion yen

- The US government finalizes a $1.5 billion CHIPS Act subsidy to GlobalFoundries to support the latter's expansion of production capacity in the US

- SK Hynix announces mass production of the world's highest 321-layer 1Tb TLC 4D NAND flash memory, plans to ship it in the first half of 2025

- Samsung Electronics NRD-K Semiconductor R&D Complex to import ASML High NA EUV lithography equipment

- A big chip war is about to start: Qualcomm and MediaTek are involved in notebooks, and AMD is reported to enter the mobile phone market

- Exynos 2600 chip is the key, Samsung is reportedly going to launch a 2nm chip counterattack

- Intel promotes AI with multi-dimensional efforts in technology, application, and ecology

- ChinaJoy Qualcomm Snapdragon Theme Pavilion takes you to experience the new changes in digital entertainment in the 5G era

- Infineon's latest generation IGBT technology platform enables precise control of speed and position

- Two test methods for LED lighting life

- Don't Let Lightning Induced Surges Scare You

- Application of brushless motor controller ML4425/4426

- Easy identification of LED power supply quality

- World's first integrated photovoltaic solar system completed in Israel

- Sliding window mean filter for avr microcontroller AD conversion

- What does call mean in the detailed explanation of ABB robot programming instructions?

- STMicroelectronics IO-Link Actuator Board Brings Turnkey Reference Design to Industrial Monitoring and Equipment Manufacturers

- Melexis uses coreless technology to reduce the size of current sensing devices

- Melexis uses coreless technology to reduce the size of current sensing devices

- Vicor high-performance power modules enable the development of low-altitude avionics and EVTOL

- Chuangshi Technology's first appearance at electronica 2024: accelerating the overseas expansion of domestic distributors

- Chuangshi Technology's first appearance at electronica 2024: accelerating the overseas expansion of domestic distributors

- "Cross-chip" quantum entanglement helps build more powerful quantum computing capabilities

- Ultrasound patch can continuously and noninvasively monitor blood pressure

- Ultrasound patch can continuously and noninvasively monitor blood pressure

- Europe's three largest chip giants re-examine their supply chains

- 【NUCLEO-L552ZE Review】-3: Arduino vs. Mbed?

- What is the reason why IIC fails when the MSP430FR2311 power supply voltage rises to 3.5V? How to solve it?

- Design of short circuit protection circuit in power conversion device

- A brief discussion on how to play with timers (time polling method)

- Using AD7008 to construct a programmable sine wave signal generator

- Signal linear transformation problem

- DfuSe firmware download software button description

- [GD32E231 DIY Contest] Part 4: Summary

- MSP430 microcontroller peripheral crystal oscillator design selection and reference solution

- 【Gravity:AS7341 Review】+ Sensor Color Value Detection

Hardware Accelerators in Autonomous Driving

Hardware Accelerators in Autonomous Driving Digilent Vivado library

Digilent Vivado library

京公网安备 11010802033920号

京公网安备 11010802033920号