Compiled from eetimes

Micron Technology executives discussed the company's momentum at its investor day last week, unveiling plans to add sixth-generation 232-layer NAND flash memory manufacturing by the end of 2022, among other related updates.

Micron has been trying to consolidate its position as a leader in DRAM and NAND flash development over the past few years. The company announced at the end of 2020 that its 176-layer NAND based on replacement gate (RG) technology and CMOS array architecture was available, and launched its 1-alpha node DRAM in early 2021, with a 40% increase in memory density compared to its 1z node DRAM. However, Micron chose not to continue the 3DXpoint market and instead focused on the development of CXL.

NAND Technology Roadmap

Micron expects to have sixth-generation 232-layer flash memory ready for manufacturing by the end of 2022, according to Scott DeBoer, executive vice president of technology and products.

"Relative to our 176-layer node, this node will provide higher density, power and bandwidth." He said external and internal controllers remain an important part of Micron's vertical integration focus.

Micron also continues to focus on QLC NAND while expanding its CMOS array-under-and-dual stack process architecture, which stacks two 3D NAND dies on top of each other. The process, also known as "string stacking," solves semiconductor manufacturing challenges such as connecting holes through multiple layers of etching. This is because as the hole depth increases, the sides of the hole will deform and prevent the NAND cell from working properly.

DRAM Advances

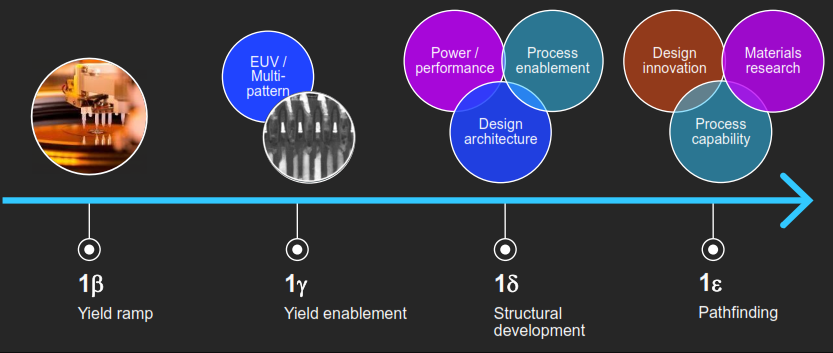

On the DRAM side, DeBoer said Micron will ramp up its 1-beta node using its advanced CMOS technology in late 2022, with 1-gamma expected to follow in 2024 using extreme ultraviolet (EUV) lithography. The company is expanding its planar DRAM roadmap while continuing to invest in 3D DRAM R&D.

Micron's DRAM roadmap will see the company ramp up its 1-beta node using its advanced CMOS technology in late 2022, with the 1-gamma node expected to follow in 2024. (Source: Micron)

Micron CEO Sanjay Mehrotra explained that the company has made tremendous progress in the past five years in building competitive advantages in technology, products, and manufacturing. This has prepared the company for what he called the "next era of leadership" as digital transformation is creating more opportunities for data creation, which has been accelerated by the pandemic and the hyper-connectivity enabled by 5G across data centers, intelligent edge devices, and intelligent user devices.

Add to that the amount of data generated by artificial intelligence (AI) and machine learning (ML), and the amount of data created is expected to double by 2025. “As AI algorithms become more sophisticated, they are processing more data, and then they need more memory to process and derive insights,” Mehrotra said.

At the same time, he stressed that the "5G train" is driving more use of DRAM content in smartphones, which use AI algorithms for computational photography and advanced video editing. As self-driving cars become data centers on wheels, these AI algorithms also increase the demand for memory content.

Demand for DRAM and NAND

Even more exciting, Mehrotra explained, is that demand for memory and storage is spread across multiple large end markets. “This diversity across large end markets has a favorable impact on the stability of the demand environment.”

PC growth is no longer demand-based; it is also driven by mobile and data centers, and the PC market has seen a recovery with the sudden shift to remote work. Data centers are growing faster than the industry average due to cloud and the adoption of artificial intelligence to support new business models, he said. This will drive growth in DRAM and NAND, the latter of which will also remain high in demand in the industrial and automotive sectors, but slightly below the industry average for PCs and mobile devices, as smartphone sales have stabilized on a global total sales basis.

Mehrotra explained that all these diversified opportunities in memory and storage mean they will grow faster than the broader semiconductor industry, while industry profitability will continue to strengthen. Demand is driving healthier industry fundamentals, while the slowdown in Moore's Law is strengthening industry supply discipline. The capital intensity required to implement new nodes increases because more expensive equipment is involved, and advanced tools are needed to implement increasingly complex functions, as well as all material and structural aspects.

Looking ahead

Mehrotra said Micron's strategy is to increase base supply in line with demand and maintain the discipline it has demonstrated over the past few years, while also requiring significant investments and keeping in mind rising industry complexities.

Micron executive vice president and chief business officer Sumit Sadana also stressed the company's focus on driving its overall supply growth in line with market demand. "Our overall supply share will be flat over time, but we are focused on driving priority share gains and a significant portion of the market."

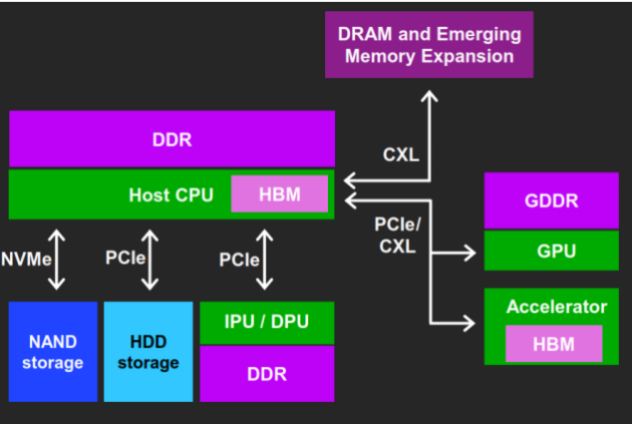

Addressing the data center market means understanding that current architectures can’t meet the needs of future workloads. As a result, the market becomes more diverse and bandwidth between processors and memory becomes more critical, Sadana explained. By bringing memory closer to the processor, more specialized processors and the CXL protocol can solve the data movement bottleneck—CXL will “open a whole new era of connectivity to memory,” Sadana said.

Micron expects CXL to usher in a new era of memory connectivity as customers seek more memory pooling and disaggregation and evolve toward more heterogeneous architectures. (Source: Micron)

A notable recent move by Micron was to exit the 3DXpoint market and focus on developing solutions for CXL. No details on specific products were provided, but Sadana said CXL1.1 will begin to be deployed later this year for proof of concept.

“Real deployment of memory on CXL will start in late 2024 with the introduction of CXL 2.0, and then will accelerate further when the CXL 3.0 standard enables memory pooling in a very real and practical way,” he said. “Memory pooling and memory disaggregation are key aspects that our customers are looking for.”

What's more important is the expansion of the amount of memory that can be connected to the processor, which is ultimately what CXL enables in a very important way. This will result in an increase in the average amount of DRAM content in the server.

The cost of DRAM could depend on different pricing from Micron's customers as the company rolls out a new pricing model called a forward pricing agreement (FPA). Rather than making long-term agreements based on volume rather than price, as is currently the case, FPAs will set prices based on both volume and price. The goal of the model is to reduce price volatility, even though profits have traditionally been made through price volatility.

Previous article:Western Digital and Kioxia optimize flash memory performance: QLC programming speed increased to 60MB/s

Next article:Micron Ventures announces second phase fund plan, will invest $200 million to support deep technology startups

Recommended ReadingLatest update time:2024-11-16 14:35

- Huawei's Strategic Department Director Gai Gang: The cumulative installed base of open source Euler operating system exceeds 10 million sets

- Analysis of the application of several common contact parts in high-voltage connectors of new energy vehicles

- Wiring harness durability test and contact voltage drop test method

- Sn-doped CuO nanostructure-based ethanol gas sensor for real-time drunk driving detection in vehicles

- Design considerations for automotive battery wiring harness

- Do you know all the various motors commonly used in automotive electronics?

- What are the functions of the Internet of Vehicles? What are the uses and benefits of the Internet of Vehicles?

- Power Inverter - A critical safety system for electric vehicles

- Analysis of the information security mechanism of AUTOSAR, the automotive embedded software framework

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

- Innolux's intelligent steer-by-wire solution makes cars smarter and safer

- 8051 MCU - Parity Check

- How to efficiently balance the sensitivity of tactile sensing interfaces

- What should I do if the servo motor shakes? What causes the servo motor to shake quickly?

- 【Brushless Motor】Analysis of three-phase BLDC motor and sharing of two popular development boards

- Midea Industrial Technology's subsidiaries Clou Electronics and Hekang New Energy jointly appeared at the Munich Battery Energy Storage Exhibition and Solar Energy Exhibition

- Guoxin Sichen | Application of ferroelectric memory PB85RS2MC in power battery management, with a capacity of 2M

- Analysis of common faults of frequency converter

- In a head-on competition with Qualcomm, what kind of cockpit products has Intel come up with?

- Dalian Rongke's all-vanadium liquid flow battery energy storage equipment industrialization project has entered the sprint stage before production

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- 【I-Prober 520】Unboxing and simple review

- EEWORLD University Hall----Live Replay: Maxim supports integrated digital IO technology for industrial systems

- Want to buy second-hand AM335x Starter Kit development board

- Emulating I2C communication using GPIO on C2000

- 【TouchGFX Design】Make a Rubik's Cube

- Two circuits for modeling the behavior of a two-input AND gate

- Circuit protection devices protect mobile devices from ESD

- Let's discuss some gadgets commonly used by RF engineers

- MSP430 interrupt vector table

- For thyristors, can digital resistors be used to control chopping in addition to optocouplers?

Chip Wars by Yu Sheng

Chip Wars by Yu Sheng

京公网安备 11010802033920号

京公网安备 11010802033920号