This article aims to make some preliminary analysis of the Shanghai new energy vehicle registration status released in July, as well as the new energy vehicle data in various dimensions in July.

Since 2021, new energy vehicles have reached a very strong state, and there are many points worthy of our attention.

1. Registration of new energy vehicles in Shanghai

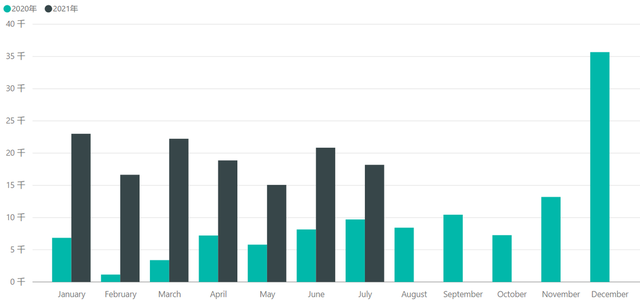

As shown in the figure below, the number of new energy vehicles registered in July was 18,181, an increase of 81% year-on-year, continuing to maintain a high level. The registration data last month was 20,833. Although it decreased month-on-month, it can be seen that the overall demand for new energy vehicles remains high. From January to July 2021, the total number of new energy vehicles registered in Shanghai reached a record high of 135,400, which has completely surpassed the 117,000 units in 2020. According to this demand trend forecast, the total number of new energy vehicles in Shanghai in 2021 will reach 200,000+.

Figure 1: Registration of new energy vehicles in Shanghai

Compared with the overall license data, the number of cars registered in Shanghai in July was 49,116, down 12.66% from June and 15.17% from the same period last year. We can see that there is a year-on-year differentiation between new energy vehicles and traditional cars, which objectively reflects that many consumers in Shanghai have failed to bid for license plates many times and have turned to new energy vehicles as their regular cars. This mentality of no longer focusing on buying traditional cars and consumption conversion is more obvious in Shanghai.

Figure 2 Overall registration situation in Shanghai

II. Overview of the overall data of the China Passenger Car Association and certificates of conformity

1. China Passenger Car Association data

Here we can refine the data of the China Passenger Car Association: wholesale sales were 246,000 units, retail sales were 222,000 units, and the export data showed a difference of 24,000 units between these two data. However, the detailed items include Tesla exporting 24,347 units and SAIC Passenger Car exporting 4,407 units, which adds up to 29,000 units. This data does not seem to match.

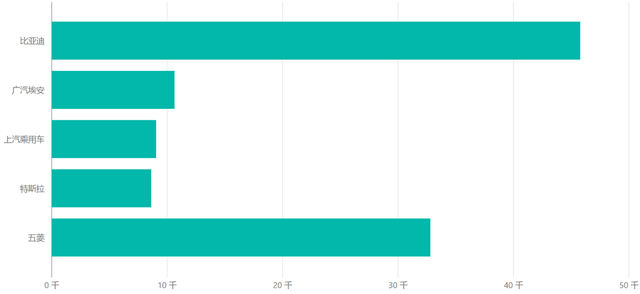

From the wholesale data of automakers, the top ones are BYD with 50,387 units, Tesla China with 32,968 units, SAIC-GM-Wuling with 27,347 units, SAIC Passenger Car with 13,454 units, and GAC Aion with 10,506 units. Correspondingly, BYD sold 45,782 units, SAIC-GM-Wuling sold 32,800 units, and GAC Aion sold 10,604 units in retail sales. It can be inferred that Tesla's retail sales in July were only 8,621 units, no wonder it did not hesitate to lower the price.

Figure 4 New energy vehicle retail sales in July 2021

2. Certificate data

The data given by the China Passenger Car Association is 265,000 units, which should include all production. The domestic certificate data is 220,800 new energy passenger cars, including 44,000 BYD (22,400 pure electric and 21,000 hybrid), 31,900 Wuling, and 12,400 Changan. Compared with the above data, BYD's wholesale sales are higher than the production in July, and retail sales are also higher than the actual production in July. Changan's cars may gradually increase in the future.

As shown below, 2021 is indeed different from previous years in terms of reliance on subsidies and various constraints. The total output of new energy vehicles in 2021 is 1.456 million units. Based on an estimate of 250,000 units per month, this year's conservative estimate is 2.7 million units. If we are more optimistic (currently there is still a shortage of batteries), we can expect a higher number.

Figure 5 New energy vehicle production from 2015 to 2021

summary:

I think the next thing to focus on is where are all these cars sold to? What is the driving force behind their purchase? Can they continue to grow steadily?

Previous article:What are the difficulties in deploying autonomous driving?

Next article:The race to vehicle electrification: What are the paths to winning?

- Popular Resources

- Popular amplifiers

- Huawei's Strategic Department Director Gai Gang: The cumulative installed base of open source Euler operating system exceeds 10 million sets

- Analysis of the application of several common contact parts in high-voltage connectors of new energy vehicles

- Wiring harness durability test and contact voltage drop test method

- Sn-doped CuO nanostructure-based ethanol gas sensor for real-time drunk driving detection in vehicles

- Design considerations for automotive battery wiring harness

- Do you know all the various motors commonly used in automotive electronics?

- What are the functions of the Internet of Vehicles? What are the uses and benefits of the Internet of Vehicles?

- Power Inverter - A critical safety system for electric vehicles

- Analysis of the information security mechanism of AUTOSAR, the automotive embedded software framework

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

- Innolux's intelligent steer-by-wire solution makes cars smarter and safer

- 8051 MCU - Parity Check

- How to efficiently balance the sensitivity of tactile sensing interfaces

- What should I do if the servo motor shakes? What causes the servo motor to shake quickly?

- 【Brushless Motor】Analysis of three-phase BLDC motor and sharing of two popular development boards

- Midea Industrial Technology's subsidiaries Clou Electronics and Hekang New Energy jointly appeared at the Munich Battery Energy Storage Exhibition and Solar Energy Exhibition

- Guoxin Sichen | Application of ferroelectric memory PB85RS2MC in power battery management, with a capacity of 2M

- Analysis of common faults of frequency converter

- In a head-on competition with Qualcomm, what kind of cockpit products has Intel come up with?

- Dalian Rongke's all-vanadium liquid flow battery energy storage equipment industrialization project has entered the sprint stage before production

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- How does the MK60 serial port receive a string of indefinite length?

- STM32L431 strange assignment problem?

- Activate the new generation of video doorbell! Let your eyes and ears be close to you

- Ask about inductor winding

- MSP430F5529 ADC Reference Sampling Example

- Implementation of HPI Boot Mode in TMS320C62x

- Detailed explanation of MSP430F149 serial port receiving and sending program

- Those power supply test issues we ignore

- New OBD device with intelligent brake light control system

- GD32VF103V_EVAL uses USB to serial port function

Optimized drivetrain and new semiconductor technologies enable the design of energy-efficient electr

Optimized drivetrain and new semiconductor technologies enable the design of energy-efficient electr Considerations for ground wire protection in electric vehicles

Considerations for ground wire protection in electric vehicles

京公网安备 11010802033920号

京公网安备 11010802033920号