Let's briefly summarize the BEV sales data disclosed by the main result countries in November, mainly including the main BEV sales in Norway, the Netherlands, Spain, Italy, Sweden and France. The overall impression is that this wave of traditional car companies in Europe are still working hard to sell BEVs, showing a relatively decentralized feature. Europe has suddenly increased the sales volume to more than 1.2 million annual sales in several major countries, but the models are scattered, and each BEV car has not shown agglomeration in various market segments.

1) Norwegian market

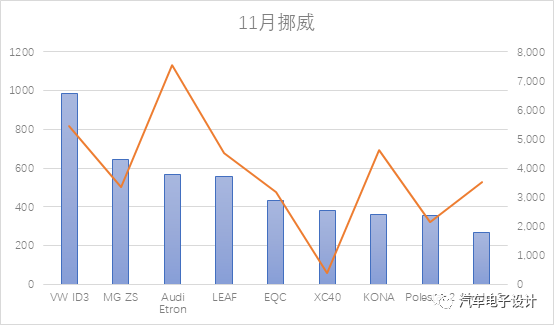

The best performing car in the Norwegian market is ID3, with sales of 986 units in November. It took Volkswagen several months to increase the sales of ID3 to 5,446 units, which is higher than the 4,762 units of E-golf, which was the main sales in the first half of the year. Currently, the Audi Etron has the highest cumulative sales in Norway, with a total of 7,543 units. After the overall BEV penetration rate reaches a certain level, the performance of Model 3 seems to be overdrawn, with sales of 267 units in November and a total of 3,538 this year, which is a huge contrast compared to last year. It is worth mentioning in this market that MG ZS, with sales of 644 units in November and a total of 3,362 units in 2020, the performance of Chinese electric vehicles exported is still very good.

Figure 1 Norwegian market

The overall situation in November and 2020 is that with sufficient supply, as the craze for Model 3 disappears, Tesla's sales performance in this market this year is really unsatisfactory. Of course, there may be a big improvement in December. As of the 6th, 371 units have been registered.

Figure 2 Model 3 sales in the Norwegian market

2) Dutch market

The Dutch market is similar to the Norwegian market. In November, ID3 sold 1,485 units, ranking first. In just a few months in 2020, it sold 4,884 units, ranking second. XC40 sold 826 units this month, ranking second; NIRO sold 749 units, ranking first with a total of 5,787 units. Model 3 sold 91 units this month, with a total of 4,315 units, which can be said to be completely incomparable with last year.

Figure 3 Sales of major BEV models in the Dutch market

In 2020, Tesla's performance in these third-party markets was actually quite mediocre. In December, cars were delivered to Shanghai, and 502 units have been delivered so far, and the number will increase later.

Figure 4: Model 3 in the Dutch market

3) Spanish market

The Spanish market is a niche market. The current sales situation is as follows. It is mainly dominated by small vehicles. ZOE ranks first with a cumulative sales of 2,000 units.

Figure 5 Sales volume in the Spanish market

4) Italian Market

The Italian market is more of a typical small car market, with Smart EV ranking first in sales in November, followed by KONA and ID3.

Figure 6 Sales volume in the Italian market

5) Swedish market

In the Swedish market, Model 3 ranks first in total sales, and the overall sales volume is shown in the figure below.

Figure 7 Sales volume in the Swedish market

6) French market

The French market only has data up to October 2020. As shown below, ZOE ranks first, E-208 ranks second, then Peugeot's 3008 PHEV, and Model 3 has sales of nearly 5,000.

Figure 8 Cumulative sales of new energy vehicles in the French market from January to October 2020

Summary: In this wave of electrification in Europe, European car companies are actually not bad at increasing their sales, and the overall BEV sales are also growing relatively fast. According to expectations for 2021, there will be a more substantial increase.

Previous article:Li Shaohua of China Automobile Association: Chip supply shortage is expected to continue until the first quarter of next year

Next article:New energy vehicle companies are engaged in a super charging station war to seize the market

- Popular Resources

- Popular amplifiers

- Why software-defined vehicles transform cars from tools into living spaces

- How Lucid is overtaking Tesla with smaller motors

- Detailed explanation of intelligent car body perception system

- How to solve the problem that the servo drive is not enabled

- Why does the servo drive not power on?

- What point should I connect to when the servo is turned on?

- How to turn on the internal enable of Panasonic servo drive?

- What is the rigidity setting of Panasonic servo drive?

- How to change the inertia ratio of Panasonic servo drive

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

- LED chemical incompatibility test to see which chemicals LEDs can be used with

- Application of ARM9 hardware coprocessor on WinCE embedded motherboard

- What are the key points for selecting rotor flowmeter?

- LM317 high power charger circuit

- A brief analysis of Embest's application and development of embedded medical devices

- Single-phase RC protection circuit

- stm32 PVD programmable voltage monitor

- Introduction and measurement of edge trigger and level trigger of 51 single chip microcomputer

- Improved design of Linux system software shell protection technology

- What to do if the ABB robot protection device stops

- Why software-defined vehicles transform cars from tools into living spaces

- How Lucid is overtaking Tesla with smaller motors

- Wi-Fi 8 specification is on the way: 2.4/5/6GHz triple-band operation

- Wi-Fi 8 specification is on the way: 2.4/5/6GHz triple-band operation

- Vietnam's chip packaging and testing business is growing, and supply-side fragmentation is splitting the market

- Vietnam's chip packaging and testing business is growing, and supply-side fragmentation is splitting the market

- Three steps to govern hybrid multicloud environments

- Three steps to govern hybrid multicloud environments

- Microchip Accelerates Real-Time Edge AI Deployment with NVIDIA Holoscan Platform

- Microchip Accelerates Real-Time Edge AI Deployment with NVIDIA Holoscan Platform

- 【NUCLEO-WL55JC2 Review 2】Introduction to NUCLEO-WL55JC2 Development Board

- Award-winning live broadcast: Keysight Technologies 100G/400G optical communication test solutions

- [Full cash back for orders, capped at 300 yuan] MPS Mall Power Design Products Recommendation, Huge Discount Experience Season!

- [CH549 Review] Part 4 Low-Level Driver Software Review - Touch Button Driver

- 【AT32F421 Review】+ DHT22 Temperature and Humidity Detection

- Crazy Shell AI open source drone GPIO (remote control indicator light control)

- Where can I get an evaluation board for Toshiba's rice-sized Bluetooth module?

- 16. Low-power intelligent TWS in-ear detection chip VK233DS, Shenzhen Yongjia Microelectronics is the first choice

- 30V8A stepper motor driver, step angle 1.8 degrees, required accuracy 0.1 degrees, should I choose chip or H bridge

- Can the 66AK2L06 SoC enable miniaturization of test and measurement equipment?

ADA4922-1ACPZ-R2

ADA4922-1ACPZ-R2

京公网安备 11010802033920号

京公网安备 11010802033920号