EVAL-L9963E-MCUAs electric vehicles become cheaper, cost constraints become more important. Chips that are powerful but too expensive will lose most of their appeal. Uniquely, the L9963E offers rich functionality without increasing the die size, continuing to be cost-effective. In addition, traditional BMS chips require an external Zener diode to be connected in parallel with each battery cell. During the assembly process, the system has no way of knowing which battery cell will contact the connector first, and this is always a random event, so the Zener diode on each battery cell must protect the battery management chip. The L9963E's hot-swappable and robust architecture allows engineers to do without these Zener diodes, thereby simplifying the printed circuit board layout and reducing overall cost.

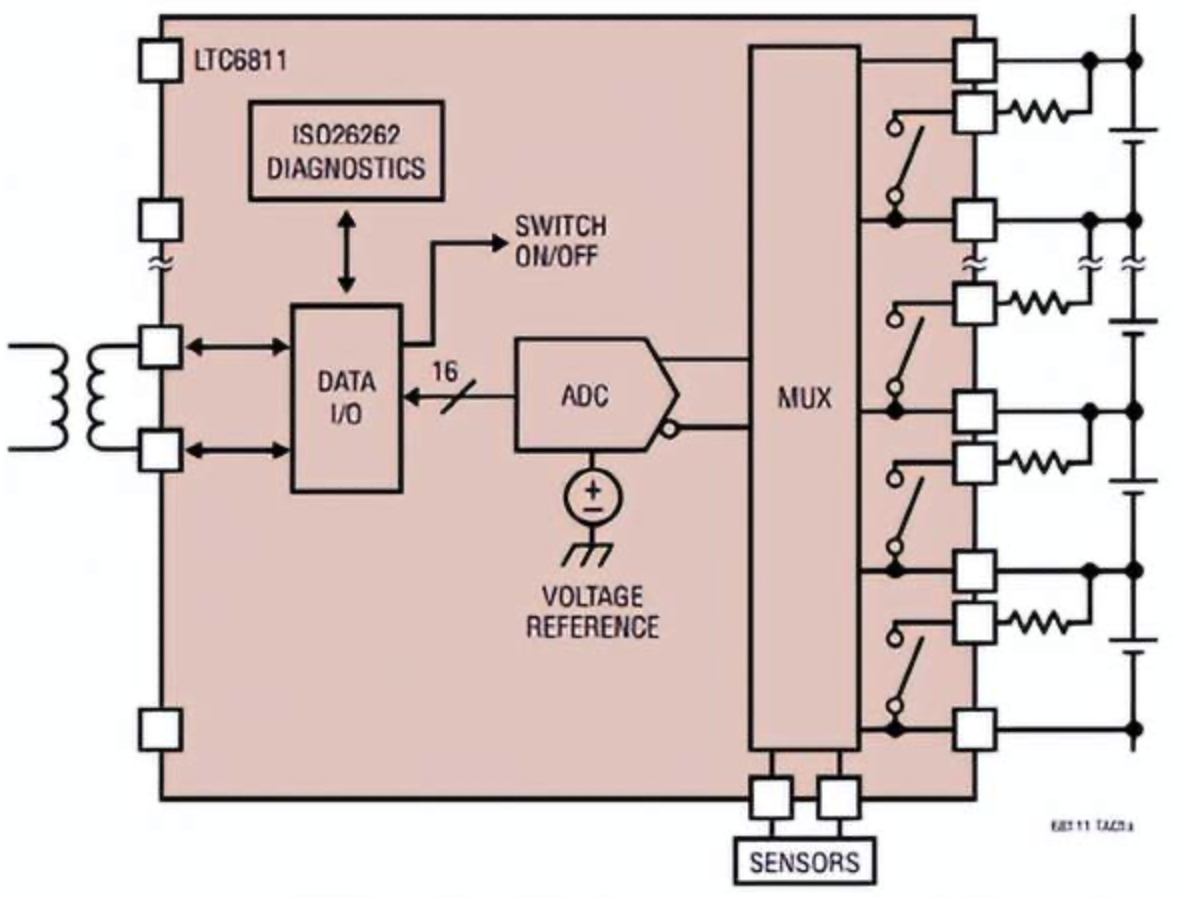

ADI 12-Channel Battery MonitorAccording to ADI's official website, the company launched its first integrated high-voltage battery stack monitor as early as 2008. It has been updated to the fourth generation so far, and the fifth generation is still in the research and development stage.LTC6811-1 Block Diagram Source: ADILTC6811-1 is ADI's fourth-generation BMS IC, a battery pack monitor that can detect the voltage of up to 12 batteries in series. The measurement accuracy is higher than that of ST L9963, and the total measurement error is less than 1.2mV. It only takes 290μs to complete the detection of 12 batteries. LTC6811-1 can connect multiple batteries in series, so the chip can complete real-time monitoring of battery status in high-voltage battery strings. The chip also has an ISOSPI interface, which can realize high-speed remote communication with devices. LTC6811-1 can connect 12 groups of batteries through a daisy chain to realize multi-channel communication functions, monitor battery status, and suspend and start operations according to the current status of the battery. The chip is powered by an isolated power supply.Infineon Multi-Channel Battery Monitoring and Balancing System ICInfineon Technologies has launched two battery management ICs, TLE9012DQU and TLE9015DQU, which provide optimized solutions for battery monitoring and balancing. The new battery management IC can achieve higher measurement accuracy and excellent application robustness, and provide system solutions for battery topologies of battery modules, module-free battery technology and battery chassis integration technology, so that the automotive battery management system (BMS) solution can meet the requirements of the highest level of automotive functional safety ASIL-D and comply with the ISO26262 standard.Infineon's IC products are suitable for industrial, consumer and automotive applications such as mild hybrid electric vehicles (MHEV), hybrid electric vehicles (HEV), plug-in hybrid electric vehicles (PHEV) and pure electric vehicles (BEV), as well as energy storage systems, battery management systems for two-wheeled and three-wheeled electric vehicles. The IC series includes two models, TLE9012DQU and TLE9015DQU.Among them, the TLE9012DQU is a multi-channel battery monitoring and balancing system chip that can perform highly accurate voltage measurements to estimate the battery state of charge (SoC) and battery state of health (SoH), which is also a key requirement that all battery management systems must meet.The TLE9015DQU is a battery monitoring transceiver chip used to connect multiple TLE9012AQU in a lithium battery in a daisy chain structure. It supports ring communication through two pairs of UART and iso UART interfaces, reducing costs and improving system efficiency. By integrating a fault management unit, the module can also achieve bidirectional information flow.What about domestic BMS chips?At present, the domestic BMS chip market is worth billions of chips per year, of which only 20% are from domestic brands, and even fewer can be used in electric vehicles. Most of them are monopolized by foreign manufacturers, and domestic BMS companies only carry out secondary development on this basis, including hardware design and software construction.However, domestic semiconductor companies have already made some arrangements in the field of BMS chips. Affected by the new crown, the growth rate of the global BMS market size declined in 2020, but my country's BMS market still occupies an important position. According to the China Economic Industry Research Institute, the scale of my country's BMS market demand in 2020 was 9.7 billion yuan. In the future, as the scale of the electric vehicle market expands and battery efficiency requirements increase, the scale of the BMS market is expected to achieve stable growth. According to Business Wire estimates and the Forward-looking Industry Research Institute, the global BMS market size is expected to be US$6.512 billion in 2021 and is expected to reach US$13.1 billion by 2026, with a CAGR of 15%. According to Mordor Intelligence, the global battery management chip market size is expected to reach US$9.3 billion in 2024, and the market space is broad.Where do used electric car batteries go?my country's electric vehicle sales began to increase in 2015. As the number of electric vehicles in use continued to grow, as of the end of March 2022, the number of electric vehicles in the country reached 8.915 million, accounting for 2.90% of the total number of vehicles.Although BMS chips are constantly being upgraded and can better optimize battery performance and extend battery life, once the capacity of the power battery decays to 80%, it must be replaced with a new battery. With the development of electric vehicles in recent years, the number of retired power batteries has been increasing year by year.In 2020, the cumulative number of retired power batteries in China exceeded 200,000 tons. In 2021, the number was about 320,000 tons, a year-on-year increase of 60%. The industry predicts that power batteries will usher in a large-scale retirement wave in the next 2-3 years. After 2025, the number of retired batteries will increase by millions each year.How to deal with retired batteries has become an imminent development problem for the electric vehicle industry. According to statistics, the current recycling rate of power batteries in my country is only about 10%, so the demand for recycling and utilization of waste power batteries is becoming increasingly urgent.The Ministry of Industry and Information Technology, the Ministry of Science and Technology, the Ministry of Ecology and Environment, the Ministry of Commerce, and the State Administration for Market Regulation recently jointly issued the "Management Measures for the Secondary Utilization of Power Batteries for New Energy Vehicles" (hereinafter referred to as the "Measures"). The "Measures" propose to encourage secondary utilization enterprises to cooperate with electric vehicle manufacturers, power battery manufacturers, and scrapped motor vehicle recycling and dismantling enterprises to strengthen information sharing, use existing recycling channels, and efficiently recycle waste power batteries for secondary utilization. Encourage power battery manufacturers to participate in the recycling and secondary utilization of waste power batteries.On June 17, the Ministry of Ecology and Environment and seven other departments jointly issued the "Implementation Plan for Coordinated Efficiency Improvement of Pollution Reduction and Carbon Reduction", which clearly stated that the energy supply system should be clean and low-carbonized and the terminal energy consumption should be electrified. By 2030, the sales of new electric vehicles in key areas for air pollution prevention and control will account for about 50% of the sales of new vehicles. Among them, it mentioned "promoting the recycling of new waste such as retired power batteries, photovoltaic components, and wind turbine blades."It is understood that there are two main directions for power battery recycling: cascade utilization and recycling. When the capacity of retired power batteries is in the range of 20%-80%, cascade utilization is the first choice. When the battery capacity drops to 20% or below and has no cascade utilization value, it can be recycled.Countries and regions such as Europe, the United States, and Japan, which developed electric vehicles earlier, have established relatively complete power battery recycling systems. At the same time, more and more car companies and equipment companies have begun to use retired batteries as energy storage equipment to provide support for energy storage systems. Volkswagen's Skoda, Renault, Nissan and other car companies have cooperated with energy companies to make retired batteries play a "waste heat" role in energy storage.

Electric Vehicle Wireless Battery Management Revolution Has Begun and the ROI Potential Is Huge

Electric Vehicle Wireless Battery Management Revolution Has Begun and the ROI Potential Is Huge

京公网安备 11010802033920号

京公网安备 11010802033920号