As one of the three core electric systems of new energy vehicles, the "motor" is like the engine of a fuel vehicle, and is a core component of the vehicle, but it seems that consumers do not pay much attention to this aspect. Today we will talk to you about this core component! The component with the highest production cost of a new energy vehicle is the power battery, which accounts for about 30%, and the motor accounts for 10%. At present, many domestic manufacturers are producing and developing new energy vehicle motors. In this field, domestic technology is still relatively advanced, which is more advantageous than the engine of fuel vehicles, and there are fewer technical barriers, so the manufacturing level of domestic motors is not worse than that of overseas companies.

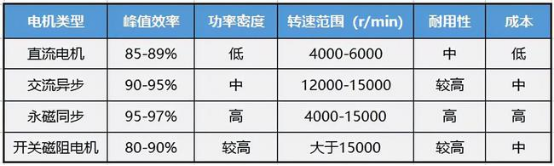

At present, there are four main types of electric motors for new energy vehicles, namely DC motors, AC asynchronous motors, permanent magnet synchronous motors and switched reluctance motors. The most common ones we see are AC asynchronous motors and permanent magnet synchronous motors. Below we briefly list the characteristics of the four types of motors.

Most of the popular models on the market, such as BYD Han, Model 3/Y, Ideal One, Xiaopeng P7, NIO ES6, EC6, Aion Y, LX, etc., use permanent magnet synchronous motors. Some models are equipped with front and rear dual motors, which use a combination of permanent magnet synchronous and AC asynchronous motors.

The reason why permanent magnet synchronous motors have become the mainstream of the market is closely related to their motor characteristics. Permanent magnet synchronous motors generate synchronous rotating magnetic fields by excitation of permanent magnets, thereby generating current, making the motor structure simpler, reducing processing and assembly costs, and eliminating collector rings and brushes that are prone to problems, thereby improving the reliability of the motor. At the same time, the motor generates less heat, so the cooling system can be relatively simplified, saving space and reducing weight. In terms of technical characteristics, advantages and costs, permanent magnet motors are currently the mainstream choice for new energy vehicles.

At present, the domestic new energy vehicle motor industry is mainly divided into three categories: automobile companies, new energy vehicle motor companies, and traditional motor manufacturers. For example, Founder Motor in China used to make motors for light industry and textile industry, but in recent years it has transformed into making motors for new energy vehicles. According to 2022 data, the top five domestic motor market shares are BYD (Fudi Power) (28.26%), Tesla (12.87%), Founder (5.60%), Nidec (5.27%), and Inovance (5.15%).

Industry experts predict that by 2025, the market size of new energy vehicle motors and electronic controls will exceed 300 billion yuan. From the development trend of the motor industry, domestic new energy vehicle companies have focused on independent research and development. BAIC, NIO, BYD, and Geely all have their own motor production plants or investments. Many car companies also choose to form joint ventures with motor plants. For example, GAC, FAW, and BAIC have established joint ventures with traditional motor plants such as Nidec and Dayang Motor to customize new energy vehicle motors and power systems for car companies. Although it is a joint venture, the car companies are the dominant party and have more say.

Whether it is independent research and development or joint venture production, it will promote the development of the domestic motor industry and the improvement of technology. In the domestic market, BYD and Tesla firmly occupy the first and second place. With their own technological advantages and supply chain resources, independent research and development and production of motors will help control costs and supply. According to the current development trend of the new energy vehicle industry, more and more car companies will turn to their own research and development and production of motors in the future, master the core technologies of the "three electrics" of new energy vehicles (batteries, motors, and electronic controls), and avoid repeating the difficulties encountered in the field of fuel vehicles.

Previous article:Introduction of Flat Wire Dual U-Pin High Efficiency Drive Motor

Next article:How to Supply More Than 100A of Current to ADAS Processors

- Huawei's Strategic Department Director Gai Gang: The cumulative installed base of open source Euler operating system exceeds 10 million sets

- Analysis of the application of several common contact parts in high-voltage connectors of new energy vehicles

- Wiring harness durability test and contact voltage drop test method

- Sn-doped CuO nanostructure-based ethanol gas sensor for real-time drunk driving detection in vehicles

- Design considerations for automotive battery wiring harness

- Do you know all the various motors commonly used in automotive electronics?

- What are the functions of the Internet of Vehicles? What are the uses and benefits of the Internet of Vehicles?

- Power Inverter - A critical safety system for electric vehicles

- Analysis of the information security mechanism of AUTOSAR, the automotive embedded software framework

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

- Innolux's intelligent steer-by-wire solution makes cars smarter and safer

- 8051 MCU - Parity Check

- How to efficiently balance the sensitivity of tactile sensing interfaces

- What should I do if the servo motor shakes? What causes the servo motor to shake quickly?

- 【Brushless Motor】Analysis of three-phase BLDC motor and sharing of two popular development boards

- Midea Industrial Technology's subsidiaries Clou Electronics and Hekang New Energy jointly appeared at the Munich Battery Energy Storage Exhibition and Solar Energy Exhibition

- Guoxin Sichen | Application of ferroelectric memory PB85RS2MC in power battery management, with a capacity of 2M

- Analysis of common faults of frequency converter

- In a head-on competition with Qualcomm, what kind of cockpit products has Intel come up with?

- Dalian Rongke's all-vanadium liquid flow battery energy storage equipment industrialization project has entered the sprint stage before production

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- MOSFET switching voltage Vgs

- High-precision electronic heartbeat comes from TI's breakthrough BAW resonator technology

- Keil newly built project, why can't I find ADuC7029

- [Fudan Micro FM33LG0 Series Development Board Evaluation] Development Board Hardware Evaluation, CMSIS-DAP Download Test

- What is carrier bandwidth in wireless communications?

- Participate to get gifts | Welcome to Tektronix High Speed Serial Knowledge Planet

- 【Fudan Micro FM33LC046N】A breathtaking clock

- What happened to ZTE? I saw an article and shared it with everyone

- [Gizwits Gokit 3 Review] + Late Unboxing Review

- SHT31 review + sharing an mdk5 engineering code file

Basic Training for Electrical Motors (Leeson Electric)

Basic Training for Electrical Motors (Leeson Electric) Sliding Mode Controller

Sliding Mode Controller

京公网安备 11010802033920号

京公网安备 11010802033920号