Cars are a high-frequency hot word in the 2023 National Two Sessions. As the automotive industry enters the second half, intelligence and connectivity have become the focus of car companies. The intelligent connected automobile industry is a new industrial form deeply integrated with automobile, electronic information, transportation and other industries. With the comprehensive transformation and upgrading of the global manufacturing industry, as well as the accelerated evolution of vehicle electrification, networking, and intelligent technologies, intelligent connected vehicles have gradually become the strategic direction for the transformation and development of the automobile industry and an important engine for promoting sustained economic growth.

01

Intelligent connected automobile industry chain

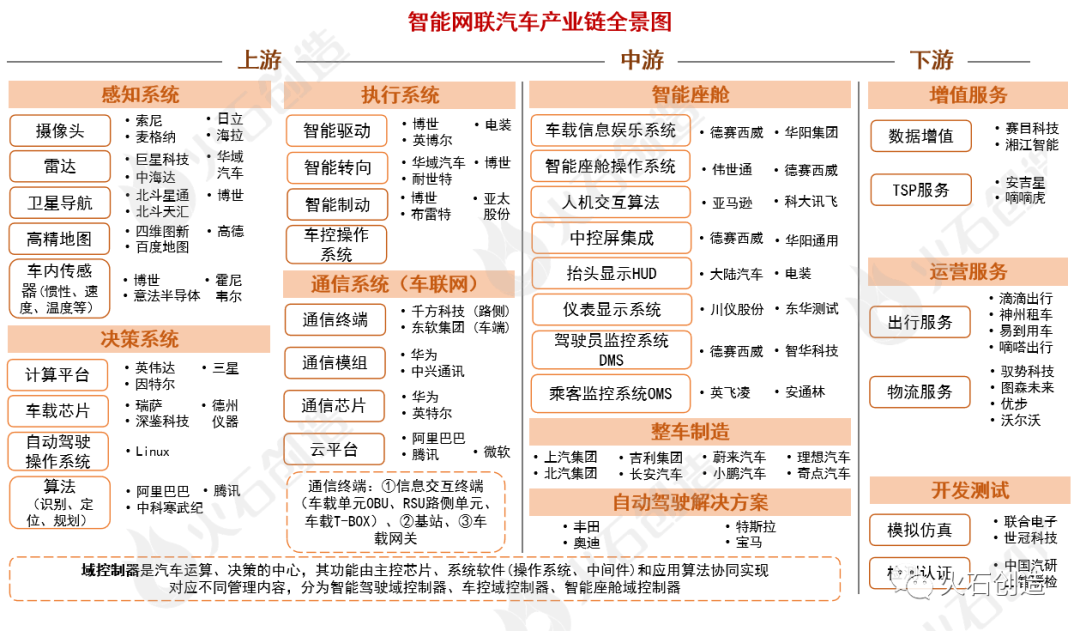

Intelligent Connected Vehicle (ICV) refers to the organic combination of the Internet of Vehicles and smart cars. It is equipped with advanced on-board sensors, controllers, actuators and other devices, and integrates modern communication and network technologies to realize the connection between cars, people and roads. , backend and other intelligent information exchange and sharing, with functions such as complex environment perception, intelligent decision-making, collaborative control, etc., which can achieve safe, comfortable, energy-saving, efficient driving, and ultimately a new generation of cars that can replace human operation. The intelligent connected automobile industry chain includes upstream key systems, midstream system integration, and downstream application services. The upstream of the industrial chain includes perception systems, decision-making systems, execution systems, and communication systems; the midstream includes intelligent cockpits, vehicle manufacturing, and autonomous driving solutions; and the downstream includes key services such as value-added services, travel services, and simulation.

Panoramic view of the intelligent connected automobile industry chain丨Source: Firestone Creation compiled based on public information

02

Autonomous driving level classification

According to the Society of Automotive Engineers (SAE) automatic driving level classification, automatic driving technology is divided into six levels: L0-L5. Among them, L0-L2 belongs to the ADAS (Advanced Assisted Driving System) category and still requires a driver to drive; L3 is a watershed. Starting from L3, the car truly enters the category of autonomous driving; L3 and L4 level intelligent connected cars should have artificial intelligence Driving mode and corresponding devices, and equipped with a driver; L5 level is fully autonomous driving, it does not need to have manual driving mode and corresponding devices, and does not need to be equipped with a driver.

SAE autonomous driving level classification丨Source: Firestone Creation compiled based on public information

01

Development status of domestic intelligent connected automobile industry

① Market size: Continuous development and growth, the “14th Five-Year Plan” is expected to exceed the trillion mark:

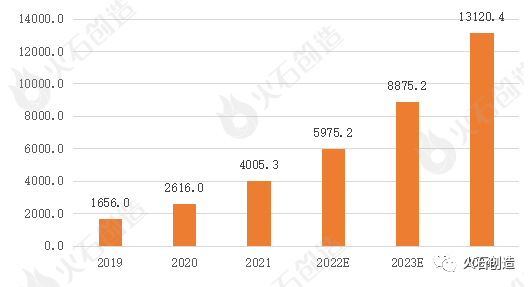

With the rapid development of intelligent network technology and the continuous influx of various Internet industry giants, the field of smart cars is becoming a strategic highland for a new round of technological revolution and industrial revolution, and my country's smart car industry has gradually entered a golden period of development. According to data from CCID Consulting, the scale of China's intelligent connected automobile industry has increased from 165.60 billion yuan in 2019 to 400.53 billion yuan in 2021, with an average annual growth rate of 55.52%, and industrial development is showing rapid growth. Driven by factors such as the accelerated commercialization of 5G and the comprehensive advancement of vehicle electrification transformation, the scale of China's intelligent connected vehicles is expected to exceed the trillion yuan mark in 2024.

Scale of China’s Intelligent Connected Automotive Industry丨Source: Firestone Creation compiled based on public information

②Regional distribution: It is blooming all over the country, and the Yangtze River Delta region has become an important project gathering place.

According to incomplete statistics, as of the end of 2022, there have been more than 50 city-level IoV pilot demonstrations across the country, including more than 40 demonstration sites promoted by national ministries such as the Ministry of Industry and Information Technology, the Ministry of Transport, the Ministry of Housing and Urban-Rural Development, and the National Development and Reform Commission. From the perspective of regional distribution, currently, nearly 30 provinces across the country have launched intelligent network connection test demonstration projects, basically covering all first-tier and most new first-tier cities, and the radiation network has been initially established. Among them, the Yangtze River Delta region is an area with a prominent total number of intelligent network demonstration projects and a concentration of major projects; Shanghai (4), Jiangsu (4), Guangdong (4), Beijing (3), and Chongqing (3) It is a key province to promote the demonstration construction of intelligent network connection at the national level; Wuxi (2), Changsha (2), Wuhan (3), Guangzhou (3), and Chengdu (2) are the provinces to promote the demonstration of intelligent network connection at the national level. key cities for construction.

Statistics of city-level intelligent network test demonstration zones promoted by various national ministries and commissions丨Source: Firestone Creation compiled based on public information

③Market competition: There are many participants, and Internet companies are making intensive cross-border layouts

The ecology of the intelligent connected automobile industry is relatively complex, with many market participants, including automobile OEMs, parts companies, ICT companies, Internet companies, etc. Among them, automobile OEMs focus on integrating software, hardware, functions and ecological service providers to complete the delivery of complete vehicle manufacturing to long-term travel services; Internet companies have advantageous resources such as software, data and maps, and continue to tap "people, "car, life" application scenarios to create an Internet service ecosystem.

Automobile OEMs formulate strategic plans for intelligent connected vehicles and strengthen the layout of the Internet of Vehicles. FAW released the "Zhitu" connected intelligent technology strategy in 2015, clearly stating that it will realize the operation of an intelligent business service platform by 2025, and the penetration rate of vehicle products with highly autonomous driving technology will reach more than 50%. Chery released the "Chery Lion" Group Intelligent Strategy in April 2018, covering five major sectors: autonomous driving, Internet of Vehicles, digital marketing, mobility, and intelligent manufacturing. Changan Automobile launched the Beidou Tianshu intelligent strategy in August 2018 to accelerate the transformation from a traditional automobile company to a smart travel technology company. In October 2018, BAIC Group released the BAIC Intelligent Connected Vehicles five-year action plan - the "Dolphin+" strategy, which clarified the phased goals, tasks and implementation plan for the deep integration of digital technology and automobiles, and made efforts to develop intelligent technologies, intelligent products, Four major areas: intelligent ecology and intelligent transportation.

Internet companies rely on their technological and financial advantages to enter the Internet of Vehicles market and build independent vehicles or provide technical solutions. Starting from the second half of 2016, Tencent began to deploy in the field of autonomous driving and established an autonomous driving laboratory to conduct technology research and development in the fields of high-precision maps, environmental perception, fusion positioning, and decision-making control. In December 2020, Alibaba teamed up with SAIC and Zhangjiang Hi-Tech to establish Zhiji Automotive Technology, focusing on the mid-to-high-end electric vehicle market segment. In January 2021, Baidu announced that it would cooperate with Geely to form a smart car company and enter the automotive industry as a vehicle manufacturer. In March 2021, Xiaomi Group issued an announcement on the establishment of a smart electric vehicle business, planning to establish a wholly-owned subsidiary to be responsible for the smart electric vehicle business. In April 2021, Huawei and Cyrus officially reached a partnership to provide Cyrus with smart electric vehicle travel solutions.

④Autonomous driving: It has not crossed the watershed and is currently in the transition stage from L2 to L3.

Thanks to the gradual maturation of hardware platforms and software algorithms, autonomous driving is gradually transitioning from L2 to L2+ and L3, and the penetration rate of automobile intelligence continues to increase. According to statistics, the penetration rates of L2 and L3 new cars on sale in my country will be 35% and 9% respectively in 2022, and are expected to reach 51% and 20% in 2023. However, due to technical and regulatory constraints, the L3 level has not yet been implemented in large-scale mass production. It can only be installed on small-volume models, or some L3-level functions can be embodied in L2+ vehicles. The "14th Five-Year Plan" period will be a critical stage for the development of the domestic autonomous driving market. According to the "Smart Vehicle Innovation and Development Strategy" jointly issued by 11 ministries and commissions including the National Development and Reform Commission, the Cyberspace Administration of China, and the Ministry of Industry and Information Technology, large-scale production of L2 autonomous driving will be achieved in 2025. , L3 level is marketed and applied in specific environments. Therefore, the current autonomous driving has not yet crossed the L3 "watershed" and is in the initial stage of development. However, with the further liberalization of the policy environment and the rapid development of related "software and hardware" technologies, L3 and above autonomous vehicles are expected to accelerate their entry into the market.

Previous article:Analysis of ten common ADAS functional systems

Next article:What is the main function of the EthIf module? What are the common function interfaces of Ethif?

- Popular Resources

- Popular amplifiers

- Huawei's Strategic Department Director Gai Gang: The cumulative installed base of open source Euler operating system exceeds 10 million sets

- Analysis of the application of several common contact parts in high-voltage connectors of new energy vehicles

- Wiring harness durability test and contact voltage drop test method

- Sn-doped CuO nanostructure-based ethanol gas sensor for real-time drunk driving detection in vehicles

- Design considerations for automotive battery wiring harness

- Do you know all the various motors commonly used in automotive electronics?

- What are the functions of the Internet of Vehicles? What are the uses and benefits of the Internet of Vehicles?

- Power Inverter - A critical safety system for electric vehicles

- Analysis of the information security mechanism of AUTOSAR, the automotive embedded software framework

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

Professor at Beihang University, dedicated to promoting microcontrollers and embedded systems for over 20 years.

- Innolux's intelligent steer-by-wire solution makes cars smarter and safer

- 8051 MCU - Parity Check

- How to efficiently balance the sensitivity of tactile sensing interfaces

- What should I do if the servo motor shakes? What causes the servo motor to shake quickly?

- 【Brushless Motor】Analysis of three-phase BLDC motor and sharing of two popular development boards

- Midea Industrial Technology's subsidiaries Clou Electronics and Hekang New Energy jointly appeared at the Munich Battery Energy Storage Exhibition and Solar Energy Exhibition

- Guoxin Sichen | Application of ferroelectric memory PB85RS2MC in power battery management, with a capacity of 2M

- Analysis of common faults of frequency converter

- In a head-on competition with Qualcomm, what kind of cockpit products has Intel come up with?

- Dalian Rongke's all-vanadium liquid flow battery energy storage equipment industrialization project has entered the sprint stage before production

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- Installation of the digital multimeter + RL78G14 development environment based on the serial port

- 【Recruitment】Full-time and part-time RF engineers

- Explore Ultra-Wideband (UWB) Technology

- #It turns out I owe so many trees#Have you planted trees? Happy Arbor Day~

- AD09 cannot open AD files.

- AC servo motor based on STSPIN32F0

- Digital Circuit Design and VerilogHDL.pdf

- [GD32L233C-START Review] Review 2: Library function analysis, GPIO lighting

- Design of an ultra-low power micro-ECG stethoscope

- Modeling and simulation of power electronics and motor control systems

iCoupler Isolation in CAN Bus Applications

iCoupler Isolation in CAN Bus Applications

京公网安备 11010802033920号

京公网安备 11010802033920号