Molex Global Automotive Electrification Study Reveals Accelerating Pace of Innovation

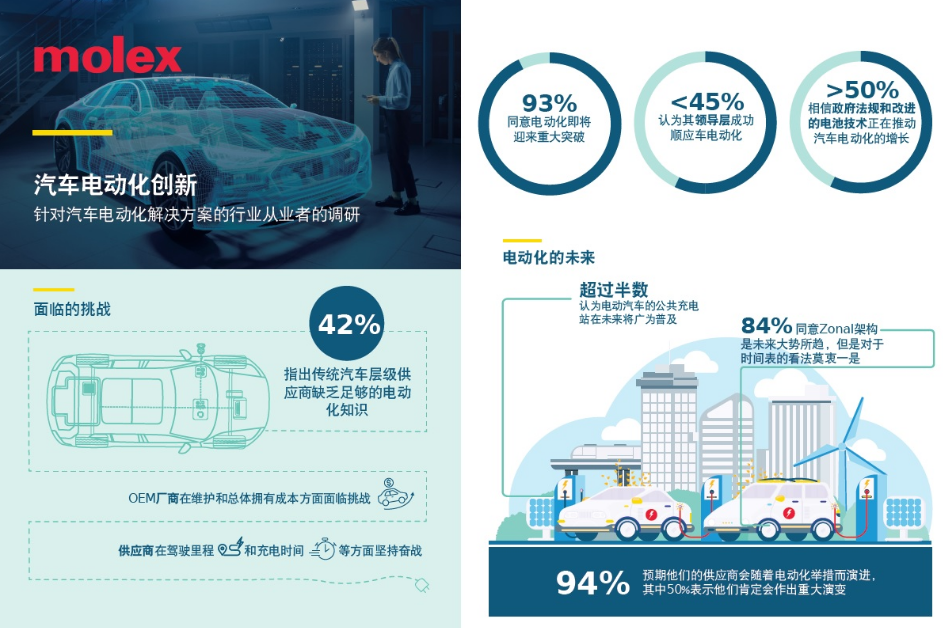

• 93% of respondents believe that electrification is about to have a major breakthrough

• 91% of respondents said they have difficulty gaining expertise in vehicle electrification innovation

• Increased collaboration between automotive original equipment manufacturers (OEMs) and Tier 1 or Tier 2 suppliers, as well as increased R&D and capital investment, will drive progress in electrification

• 84% of respondents believe that Zonal architecture will become the standard in the future

Lisle, Illinois - December 1, 2021 - Molex, a global electronics leader and connectivity innovator, today announced the results of a new survey of global automotive industry practitioners to identify the key trends and barriers affecting electric vehicle (EV) innovation. As a major driver of changes to the entire vehicle architecture (including charging stations), successful electrification requires increased collaboration between automotive OEMs and suppliers, increased R&D and capital investment, and the design, development and delivery of breakthrough technologies in power control and battery management.

“Vehicle electrification is a complex undertaking that goes far beyond the transition from an internal combustion engine to an electric motor,” said Kevin Alberts, senior vice president and general manager, Molex Power and Signal Business Unit (PSBU). “Highly sophisticated engineering and fully integrated manufacturing processes leveraging ultrasonic welding, sustainable production and automation are accelerating the delivery of next-generation electrification solutions, increasing the pace of innovation in all aspects of electrification.”

Molex commissioned Dimensional Research to conduct a survey on automotive electrification innovation in October 2021 with 204 participants, including automotive companies, Tier 1 or Tier 2 suppliers, and charging station suppliers from North America, Europe, the Middle East, Africa, and the Pacific, with positions ranging from R&D, engineering, products, innovation, strategy, manufacturing to supply chain. Survey participants answered questions related to electric vehicles and in-vehicle power systems (such as power electronics, wiring harnesses, sensors, battery management systems, etc.) and out-of-vehicle electrification solutions (such as charging stations).

Key findings include:

• 94% of respondents believe that electrification is more than just switching to electric motors; 93% of respondents believe that electrification is about to have a major breakthrough

• Respondents cited increased government policy support for electrification, improvements in battery technology, and a wider selection of electric/hybrid vehicles as the top three growth factors

• Over the past two years, automakers and their suppliers’ focus on electrification has increased significantly in terms of customer experience (55%), operating performance (51%), leadership focus (50%), and expected speed to market delivery (48%)

• Despite strong momentum towards electrification, 92% of respondents said their design teams were having difficulty with electrification, while 91% reported challenges acquiring much-needed expertise

Top functional innovations are ready to go

Respondents agree that innovations in electrification will lead to broad improvements in vehicle functionality, including autonomous driving and driver assistance (53%), safety (43%), total cost of ownership (41%), vehicle charging time (39%), and vehicle range (37%). Nevertheless, challenges remain in improving vehicle charging time (31%), increasing vehicle range (29%), and improving autonomous driving and driver assistance (29%). Respondents also reported progress in batteries, modules or packs (51%), motors (47%), and powertrain electronics (45%). However, they have difficulty innovating controllers (37%), wiring harnesses, connectors and busbars (34%), cameras and sensors (33%), and powertrain electronics (26%).

Zonal architecture will become the standard

84% of respondents said that with the strong support of automakers and suppliers for the electronic and electrical architecture (E/E), the Zonal architecture will become the standard in the next five years or more. Zonal will not only reduce the network harness of traditional vehicle architecture, but this innovation will also significantly reduce the number of electronic controllers (ECUs) in the vehicle, while significantly reducing the length, weight and cost of the harness.

Collaboration is the key to success in electrification

Survey participants face a range of issues in acquiring much-needed expertise to drive their innovation practices. Traditional automotive Tier 1 or Tier 2 suppliers often lack electrification expertise, while automotive OEMs face increasing competition from technology giants, making their internal hiring targets more challenging. Automotive OEMs see increased collaboration with suppliers as the biggest driver of innovation; suppliers believe that increased investment in R&D and capital (e.g., tools, machinery, factories) is most likely to drive progress in electrification.

Molex Power and Signal Expertise

Molex's proven portfolio of innovative interconnect products and solutions is driving the development of next-generation powertrain motor controllers, electronic controllers and battery management systems. With more than 30 years of experience serving leading automakers and suppliers in the automotive industry, Molex is committed to designing and providing key electronics, power, signal and connectivity solutions that form the central nervous system of future electric vehicles.

Previous article:Lithium-ion battery technology breakthrough! Altech Chemicals "breaks the silicon barrier"

Next article:More efficient and safe, Toyota updates 1990s battery cell technology for its latest hybrid

Recommended ReadingLatest update time:2024-11-16 07:53

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- Innolux's intelligent steer-by-wire solution makes cars smarter and safer

- 8051 MCU - Parity Check

- How to efficiently balance the sensitivity of tactile sensing interfaces

- What should I do if the servo motor shakes? What causes the servo motor to shake quickly?

- 【Brushless Motor】Analysis of three-phase BLDC motor and sharing of two popular development boards

- Midea Industrial Technology's subsidiaries Clou Electronics and Hekang New Energy jointly appeared at the Munich Battery Energy Storage Exhibition and Solar Energy Exhibition

- Guoxin Sichen | Application of ferroelectric memory PB85RS2MC in power battery management, with a capacity of 2M

- Analysis of common faults of frequency converter

- In a head-on competition with Qualcomm, what kind of cockpit products has Intel come up with?

- Dalian Rongke's all-vanadium liquid flow battery energy storage equipment industrialization project has entered the sprint stage before production

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- [NUCLEO-WL55JC2 Review 4] STM32WL sub-GHZ RF (LoRa\FSK..)

- AVRDUDE released version 6.4 and moved to github

- Several issues on hysteresis compensation

- I wish you all good health and a safe family and a happy new year!!!

- MSP430FR2311 microcontroller infrared reflective sensing

- Does anyone have the BAP protocol in Volkswagen's CAN protocol?

- [RVB2601 Creative Application Development] 8 If more than a certain number of letters are not shot down, the game will be displayed as over.

- NRF51822 production capacity is urgent, what should be used as a replacement?

- [Construction Monitoring and Security System] 9. Kaluga loads project configuration from SD card

- pspice study notes - circuit simulation process

New Energy Vehicle Control System Inspection and Maintenance (Edited by Bao Pili)

New Energy Vehicle Control System Inspection and Maintenance (Edited by Bao Pili) 2024 DigiKey Innovation Contest

2024 DigiKey Innovation Contest

京公网安备 11010802033920号

京公网安备 11010802033920号