It is reported that more and more LiDAR RFQs are being sent to various manufacturers. Obviously, LiDAR is beginning to penetrate the ADAS market. However, relevant people warn not to expect only one LiDAR supplier to win this gamble.

Of all the automotive sensor modalities designed to enhance sensing and object detection, lidar offers by far the most complex and diverse options. The technology used in each lidar system often differs not only in the light source, but also in the "ranging" and "imaging" methods. Some mature lidars are entering mass production. But new lidar technologies are generally considered more promising - but they are currently only in the R&D or proof-of-concept stage. Inevitably, these lidars vary greatly in cost, size, and performance.

To complicate matters further, an increasing number of LiDAR vendors (estimated at 70-80) are crowding the market, and M&A is fierce. Some LiDAR companies have gained new life by choosing SPAC (Special Purpose Acquisition Company) status. Many startups see SPACs as another way to raise funds and enter the public equity market.

The market will become more complex. As lidar companies pursue different technologies, automakers and tier-one companies are split on how to use lidar for what applications.

“We have been told by several lidar companies that each OEM and Tier 1 has different requirements – requiring lidar to be integrated at a specific field of view, distance and position,” said Pierrick Boulay, solid-state lighting and lighting systems analyst at Yole Développement.

“This is not going to be a winner-take-all market,” said Stephen Lambright, chief marketing officer at AEye. Lambright noted that many lidar companies are still experimenting with many ideas, “just like the biotech industry.”

Of course, it’s hardly reassuring to equate lidar with biotechnology.

But the automotive industry’s need for lidar is real. Lambright found that in the ADAS space alone, his company has received 15 to 16 different lidar quote requests for vehicles that ADAS plans to produce in 2025-26. Lambright noted that despite the fragmentation of the lidar market, “automotive companies are starting to bet on deployments four or five years out in the next 18 months.”

Technology Matrix

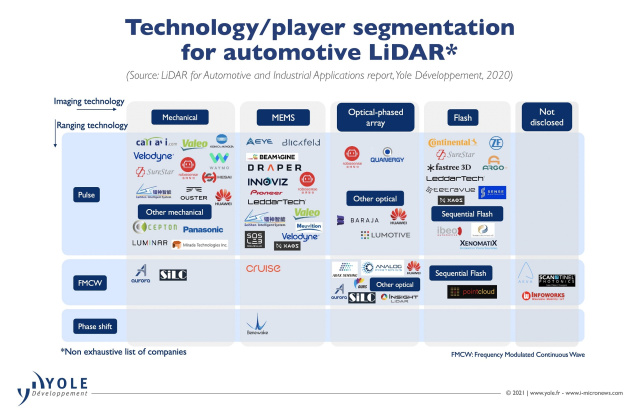

The best way to examine the diversity of LiDAR technologies is to draw a chart: one axis focuses on imaging, the other on ranging. Imaging technologies vary from mechanical, MEMS, optical phased array, to flash. Ranging technologies include pulse ranging, frequency modulated continuous wave ranging, and phase shift ranging.

Yole Développement does this by placing different players in different quadrants. This chart may not include everyone, as new players are constantly emerging, but this chart illustrates the diversity of technologies used in lidar.

Different lidars use different light sources. Most lidar manufacturers use 905nm edge emitters and avalanche photodiodes (APDs) because these components are easy to produce in large quantities. Some lidars, such as Luminar, have begun using 1550nm all-fiber laser sources. The challenge facing the latter will be cost. However, 1550nm lasers are more capable of longer ranges without affecting the eyes. One problem that plagues 905nm lasers is that they are not eye-safe except for low-resolution or short-range applications.

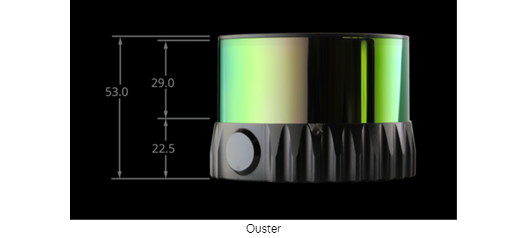

But edge emitters and fiber lasers aren’t the only options. LiDAR companies are rapidly adopting vertical-cavity surface-emitting lasers (VCSELs), an idea first sparked by Apple’s iPad Pro 11 lidar scanner. Germany’s Ibeo uses VCSEL technology from Austria’s ams, and they’ve scored a design win with China’s Great Wall Motors, which is expected to be released in 2022. Ouster started with mechanical lidar and last year announced a combination of VCSELs and single-photon avalanche diodes (SPADs) for lidar for ADAS, scheduled for production in 2024. Israel-based Opsys is also developing a solid-state scanning lidar that uses a fully addressable VCSEL transceiver and SPAD receiver, expected to launch later this year. Opsys’s detection range is 200 meters and the scanning frequency is 1000 Hz.

pros and cons

The development of LiDAR has evolved from mechanical to MEMS, Flash-based LiDAR and FMCW. However, this is not a simple straight line.

For example, many mechanical lidars still dominate today, largely because they are cheaper. However, Boulay pointed out that the biggest disadvantage is that mechanical parts can be a source of failure. The main advantage of MEMS lidar is its small size. Its solid-state state makes it more reliable, and it still uses tiny moving parts.

Flash lidar, by contrast, has no moving parts. “This is considered more reliable, but the current generation still suffers from a limited detection range,” Boulay said.

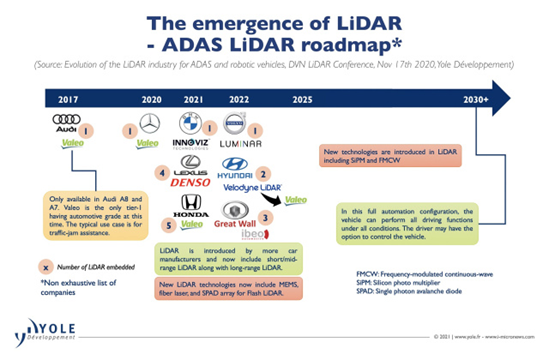

Yole positions FMCW lidar as a technology under development. Boulay: "We don't expect to see FMCW lidar before 2025. Last year, Waymo talked about FMCW's future domestic lidar. Most notably, Mobileye called it the lidar of choice for its fully autonomous vehicle lidar under development.

Coherent detection is much more sensitive than direct detection and offers better performance, such as single-pulse velocity measurement and immunity to interference from glare and other light sources (including lidars used by other cars). However, serious challenges facing FMCW lidar include "manufacturing capabilities of silicon photonics" and the cost of the technology. However, Mobileye believes it can overcome this by leveraging Intel's silicon photonics technology, including its own fabs, manufacturing, and IP.

Today's design results

The best way to predict where the LiDAR market is headed is to look at today’s designs. Announced models include: Valeo-Audi A8; Valeo-Mercedes-Benz; Innoviz -BMW; Luminar – Volvo. While many of the success stories mentioned here focus on installing one type of LiDAR on ADAS or fully autonomous vehicles, the latest moves by automakers are installing short, medium, and long-range LiDARs on the same vehicle.

VSI Lab, an applied research company focused on active safety and autonomous control technologies, recently oversaw AEye’s lidar performance testing in California. VSI Lab’s validation report confirmed that AEye’s iDAR sensor could read dozens of points on an unmodified Chevrolet Bolt at a range of 1,000 meters.

“It’s incredible that lidar can detect objects a kilometer away,” said Phil Magney, director of the VSI Lab. “We’ve never seen anything like it.”

Magney believes that the problem with lidar compared to other sensors when it comes to highway autonomy is that "cameras can't see that far down the road." Anything that comes from a camera is an estimate. "What about radar?" "Radar is OK, but it's really bad at lateral positioning. Lidar, however, is an instrument that gives you a precise value for "everything it sees."

But if an ADAS car used for highway driving has to change lanes, Boulay made it clear, “you need to have short- and medium-range lidars on the side.”

Flexibility requirements

Given the variety of use cases for lidar, flexibility in architecture, wavelength, and field of view becomes increasingly important.

While Opsys is not the first company to pursue a high-performance SPAD and VCSEL lidar approach, the company claims that its micro-flash lidar can provide more than four times the resolution and scan rate of flash lidar. Opsys executive chairman Eitan Gertel promised that the company will launch a pure solid-state micro-flash lidar with a range of 200 meters and the ability to scan the full field of view at 1,000 frames per second.

Boulay noted that “Opsys is younger than Ouster,” but Opsys has a deep background (Opsys’ leadership team came from Finisar, a maker of optical communications components and subsystems). “They are experts in optoelectronic systems. Gertel was CEO of Finisar from 2008 to 2015.”

The key to Opsys’ microLiDAR is bundling multiple base sensors into a single LiDAR system, providing an integrated single 4D point cloud with a flexible field of view. Gertel said this makes the microLiDAR “customizable” for automakers and Tier 1s who want different fields of view on different types of vehicles.

Even better, Opsys’ multi-wavelength laser spectroscopy technology allows multiple sensors to be installed on a vehicle without interference.

Where is the best place to place LiDAR?

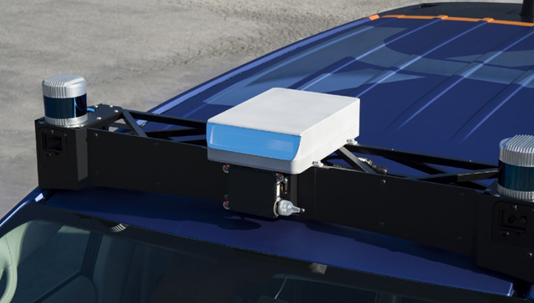

Finally, lidar positioning is a big issue, both in terms of appearance and operation. “We have traditional lidar on the top of the vehicle,” said Magney of VSI Lab. “When we drive through the rain and snow, lidar is the first sensor used.”

“A lot of it has to do with how much heat the sensor can generate to melt the frozen material. But when your lidar is on the roof of a car, it’s exposed to the elements. Then, cleaning the sensor becomes an issue.”

In evaluating AEye lidar performance, VSI Labs believes that AEye can place the lidar behind a windshield with minimal impact on lidar performance. AEye said the result was less than a 10% drop in performance. AEye's Lambright suspects that because glass, especially windshields, is so dispersive, it could cause "huge interference" to frequency-guided lidars such as FMCW.

Previous article:Tesla V11 software update revealed, new automatic driving control function

Next article:ACEINNA and Point One Navigation Collaborate to Launch High-Precision Positioning Platform

Recommended ReadingLatest update time:2024-11-16 12:58

- Popular Resources

- Popular amplifiers

-

LiDAR point cloud tracking method based on 3D sparse convolutional structure and spatial...

LiDAR point cloud tracking method based on 3D sparse convolutional structure and spatial... -

GenMM - Geometrically and temporally consistent multimodal data generation from video and LiDAR

GenMM - Geometrically and temporally consistent multimodal data generation from video and LiDAR -

Comparative Study on 3D Object Detection Frameworks Based on LiDAR Data and Sensor Fusion Technology

Comparative Study on 3D Object Detection Frameworks Based on LiDAR Data and Sensor Fusion Technology -

Dual Radar: A Dual 4D Radar Multimodal Dataset for Autonomous Driving

Dual Radar: A Dual 4D Radar Multimodal Dataset for Autonomous Driving

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- Innolux's intelligent steer-by-wire solution makes cars smarter and safer

- 8051 MCU - Parity Check

- How to efficiently balance the sensitivity of tactile sensing interfaces

- What should I do if the servo motor shakes? What causes the servo motor to shake quickly?

- 【Brushless Motor】Analysis of three-phase BLDC motor and sharing of two popular development boards

- Midea Industrial Technology's subsidiaries Clou Electronics and Hekang New Energy jointly appeared at the Munich Battery Energy Storage Exhibition and Solar Energy Exhibition

- Guoxin Sichen | Application of ferroelectric memory PB85RS2MC in power battery management, with a capacity of 2M

- Analysis of common faults of frequency converter

- In a head-on competition with Qualcomm, what kind of cockpit products has Intel come up with?

- Dalian Rongke's all-vanadium liquid flow battery energy storage equipment industrialization project has entered the sprint stage before production

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- 04. Anlu SparkRoad domestic FPGA evaluation [Learning] Digital tube display

- Download TE's latest trend report "Antenna Considerations When Designing Wireless Communication Systems" and answer questions to win prizes!

- L3 value range

- EEWORLD University Hall----Live playback: TI Zigbee 3.0 and multi-protocol solutions

- Xiaomi Mi 10 makes GaN popular! Learn about GaN simulation modeling in 10 minutes

- Has the United States loosened its grip? TSMC has obtained permission to supply Huawei, and the NBA can also be watched!

- Getting Started with CC256x

- Today at 10 am, there will be a prize live broadcast | Explore the high technology of network cameras with Infineon

- Today at 10:00 AM Live: Building Sensor-Based Test Systems with NI CompactDAQ and LabVIEW

- How can I buy the blood glucose sensor chip from Maxim? Is there any sample program available?

LiDAR point cloud tracking method based on 3D sparse convolutional structure and spatial...

LiDAR point cloud tracking method based on 3D sparse convolutional structure and spatial...

京公网安备 11010802033920号

京公网安备 11010802033920号