In the iterative upgrading process of the global semiconductor industry, there is something that may seem "little known" but is indispensable. It can even be said to be a key step in determining whether chip performance can be maximized - adhesive technology.

In fact, whether it is as small as transistors, as large as transformers, microelectronic devices, or various radars, navigation, communications, household appliances, handheld devices, instrumentation, large computers, etc., it covers the entire electronic and electrical industry including semiconductor subsets. Even other fields such as consumer goods are inseparable from the application of various bonding and sealing materials.

In the new energy vehicle market that continues to heat up, coupled with the artificial intelligence track that began to surge last year, adhesive technology is also heading towards a new round of rising trends. As one of the leaders in the industry, Henkel Adhesives is poised for positive development.

Henkel exhibits at SEMICON China 2023

The automotive grade market has been building momentum for a long time

“When it comes to the automotive semiconductor industry, including the entire semiconductor industry, we at Henkel believe that the future of this industry depends on the silicon wafer area, because this will determine how much packaging materials we will use. "At SEMICON China 2023, the annual event of the semiconductor and electronics industry that just passed, Ram Trichur, Global Marketing Director of Semiconductors of Henkel's Adhesive Electronics Division, said in an interview with a Gasgoo reporter.

He further pointed out, "If we look at the year-on-year growth rate of the global overall silicon wafer area from 2022 to 2025, all demand will be about 1.7 percentage points. However, if we dig deeper into automotive semiconductors, the year-on-year growth rate will be very high. Nice, 10%, double digits.”

Ram Trichur, Global Marketing Director Semiconductors, Henkel Adhesive Electronics Division

The nearly 6-fold annual growth rate gap in silicon wafer area, at a time when the global semiconductor industry has entered a cyclical downturn and is still at the bottom, is enough to illustrate the popularity of the automotive semiconductor market and the huge market space that can be imagined in the future.

In fact, at the current stage of global semiconductor growth slowdown, automobiles have been considered by the industry to be the largest terminal driving the growth of the entire industry. Industry insiders believe that an electrified car is comparable to an enlarged version of a mobile computer. The realization of intelligent driving functions in automobiles will have an exponential impact on the entire semiconductor industry, because the amount of semiconductors required for intelligent driving is very large.

According to statistics from the World Society for Semiconductor Trade Statistics (WSTS), the automotive application field has experienced the fastest growth period in the past year, accounting for 14.1% of global semiconductor sales, and the Asia-Pacific region is expected to become the fastest growing market for automotive chips.

Data from the China Association of Automobile Manufacturers also shows that the number of automotive chips required for a traditional fuel vehicle is 600-700, and the number of automotive chips required for electric vehicles will increase to 1,600 per vehicle, while more advanced smart cars require chips. The quantity is expected to increase to 3,000 pieces/vehicle.

As the core component of the automotive control system, the importance of automotive chips is indisputable. The evolution of automobile electrification and intelligence has made the control requirements of automobiles more and more complex, which not only drives the usage of chips to double, but also places higher requirements on the performance of automobile chips.

Chip packaging process and design optimization are key to improving chip performance and reliability. Ram Trichur pointed out that more than 90% of automotive semiconductor packaging uses traditional wire bonding packaging, and chip bonding glue must be used to complete wire bonding packaging.

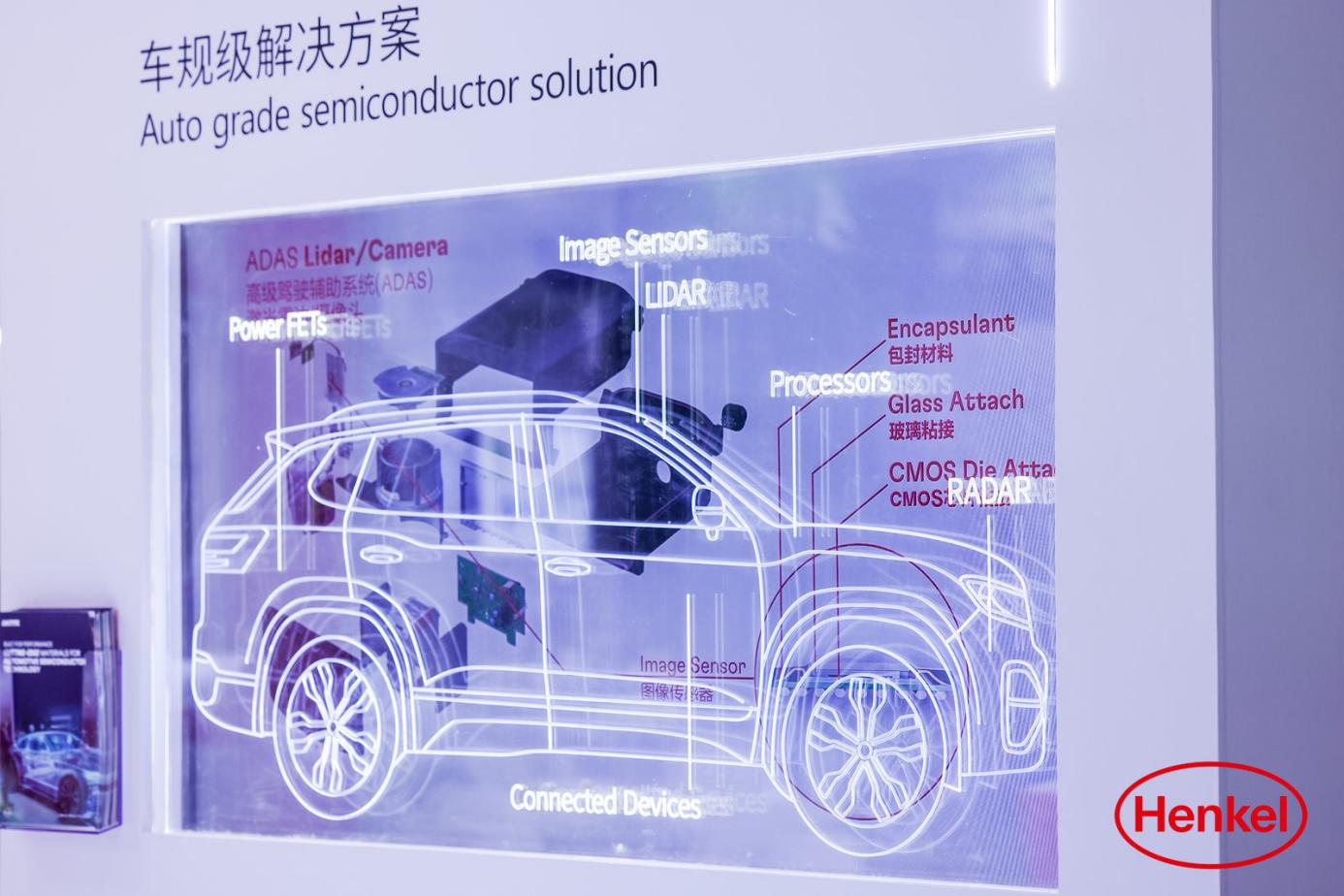

As one of the world's largest suppliers of semiconductor packaging materials, Henkel has been paying close attention to the needs and changes of the automotive market. At the scene, Henkel also summarized the current four major automotive overall application scenarios based on the company's business:

The first is the power semiconductors used in automobiles, such as FETs (field effect transistors), that is, semiconductor switches, which are widely used in new energy vehicles; the second is ADAS (advanced assisted driving systems), which involves cameras, radars, lidars, etc. Products all require supporting packaging materials; the third is the Internet of Vehicles, which involves wireless communications and interconnection-related semiconductor products; the fourth is the ultimate goal of automobiles, autonomous driving, which puts forward new requirements for the performance and reliability of central computing chips. High requirements and involving some advanced packaging solutions.

Moreover, with the rapid development of new energy vehicles, the application scenarios of this industry have also produced some other new demands.

Ram Trichur believes that there are three main aspects. First, there is a higher thermal conductivity demand for chip bonding glue and chip bonding film; second, for the huge product portfolio, customers need to carry out the most stringent vehicle-level certification for the products inside; Third, the automotive industry is also facing some new trends and challenges at the packaging level. In particular, more and more domestic customers are using copper frames, which are metal frames used in wire bonding packages. Copper frames provide higher reliability and are more cost-competitive than traditional silver-plated or nickel-palladium-plated frames.

Henkel showcases automotive grade solutions

Through interviews, we learned that Henkel has been very diligent in both the "offense" and "defense" of these application scenarios. Henkel has launched automotive grade solutions including high thermal conductivity chip bonding, chip bonding film, etc., and based on years of mass production experience, helps customers meet all levels of automotive grade reliability requirements.

Looking specifically at the products, in the field of die attach adhesives and die attach films, Henkel's latest Loctite Ablestik ATB 125GR is suitable for wire bonding substrates and frame packages, and is compatible with small to medium-sized chips. And the material itself has excellent workability.

Loctite's Ablestik ABP 6395T material has a thermal conductivity of up to 30 W/mK and does not require sintering to achieve design flexibility and automotive grade reliability; Loctite's Ablestik ABP 6389 material not only has a thermal conductivity of 10W/mK , can also penetrate into a variety of applications to help customers achieve a single BOM; in addition, Henkel has also developed a version that takes into account cost and efficiency. It has recently received the first batch of customer orders and is about to be commercialized.

Specifically addressing the challenges of automotive electrification, Henkel has positioned sintering as the solution of choice for meeting the demanding bonding, thermal and electrical requirements of power semiconductors. In June, Henkel has added the new Loctite Ablestik ABP 8068TI to its high thermal conductivity chip attach adhesive product portfolio. With a thermal conductivity of 165 W/mK, the product has the highest thermal conductivity in Henkel's semiconductor packaging product portfolio and can meet the performance requirements of high-reliability automotive and industrial power semiconductor devices.

Advanced packaging solutions, industry leader

At this stage, if you want to find a track that is as popular as new energy vehicles and may even surpass it in the future, it is none other than the generative AI represented by ChatGPT that became popular around the world in the second half of last year. The resulting significant increase in computing power demand has also brought more challenges to the semiconductor field, especially how to package and iteratively upgrade computing power chipsets.

As Moore's Law continues to approach the physical limit, how to obtain higher performance, miniaturized and cost-effective chips has become a consideration - using wafer-level packaging (WLP), system-in-package (SiP), through silicon via (TSV) ), 2.5D/3D packaging, embedded multi-chip interconnect bridge (EMIB) and other advanced packaging technologies have gradually become the mainstream of the industry.

However, during the packaging process, the chip and the packaging substrate are bonded together, or the stacking of multiple chips can easily cause problems such as product overheating. This once caused such headaches to industry leaders that they even had to abandon some product packaging solutions. However, as time goes by and technology is upgraded, these problems are gradually being solved.

Currently, Henkel's advanced packaging solutions help customers solve challenges faced in flip-chip and stacked packaging designs, fan-in fan-out wafer-level packaging (WLP) and 2.5D/3D integrated architectures, ensuring long-term reliability reliability, excellent performance, high UPH and excellent workability.

As for advanced packaging materials further upstream, Henkel has also proposed three major categories of solutions: the first category is underfill (Underfrill), that is, underfill; the second category is wafer encapsulation materials; the third category is Cover plate bonding and reinforcing ring bonding. In these respects, Henkel is almost way ahead.

Ram Trichur further introduced that the underfill solution provided by Henkel can currently match the industry's most advanced chip manufacturing processes, such as 5 nanometers and 3 nanometers; the underfill glue is more than 30% faster than industry peers, which can help customers improve production efficiency, cut costs.

Previous article:Three major unified charging standards in North America: General Motors, Ford and Tesla

Next article:What do you think of the European Battery Law?

- Popular Resources

- Popular amplifiers

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- Innolux's intelligent steer-by-wire solution makes cars smarter and safer

- 8051 MCU - Parity Check

- How to efficiently balance the sensitivity of tactile sensing interfaces

- What should I do if the servo motor shakes? What causes the servo motor to shake quickly?

- 【Brushless Motor】Analysis of three-phase BLDC motor and sharing of two popular development boards

- Midea Industrial Technology's subsidiaries Clou Electronics and Hekang New Energy jointly appeared at the Munich Battery Energy Storage Exhibition and Solar Energy Exhibition

- Guoxin Sichen | Application of ferroelectric memory PB85RS2MC in power battery management, with a capacity of 2M

- Analysis of common faults of frequency converter

- In a head-on competition with Qualcomm, what kind of cockpit products has Intel come up with?

- Dalian Rongke's all-vanadium liquid flow battery energy storage equipment industrialization project has entered the sprint stage before production

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- How to expand the BIM code space of CC2640 SDK sample code

- Sound Level Meter MASTECH MS6700 Disassembly Pictures and Information

- Design of Multi-channel Data Acquisition System Based on CPLD

- EEWORLD University Hall----Underactuated Robotics MIT 2019 spring 6.382

- Let's talk about what technologies we can use to help in the face of this pneumonia virus? ? ?

- EEWORLD University Hall----C2000 series new products bring convenience to servo and motor drive systems

- Wireless positioning principle: TOA&AOA

- MSP430F149 IO port

- MKL26 accelerator debug error, which god can help me take a look

- Old Iron

ARA2004S23P1

ARA2004S23P1

京公网安备 11010802033920号

京公网安备 11010802033920号