Among these three lidar suppliers, one is Livox, which was incubated by DJI, the other is Huawei, and the last one is Tudatong. Other players, such as Tanwei Technology, Yijing Technology, etc., are also becoming increasingly active.

The back wave emerged, but the protagonists on the stage had to be Sagitar and Hesai.

In January 2021, Sagitar exhibited for the first time the SOP version of its MEMS semi-solid-state lidar M1, which it has developed for more than 5 years, at CES in the United States, and conducted a real-time demonstration, which later became M1.

In August of the same year, Hesai released its own semi-solid lidar AT128.

Of these two products, the former uses a two-dimensional MEMS chip scanning solution, and the latter uses a one-dimensional rotating mirror scanning solution. Sagitar, Hesai, and Innoviz all use 905nm semiconductor lasers, while Luminar and Tudatong use 1550nm fiber lasers.

There have been many discussions in the industry about which one is better, 905nm or 1550nm. Judging from the results, the 905nm route is currently slightly better.

Because its technology and supply chain are more mature and more reliable, it quickly surpassed its opponents in terms of designated models and mass production progress.

According to statistics from Yole, Valeo ranks first in the global automotive lidar market in 2021, with a share of 28%. The shares of Sagitar Jutron, DJI, Tudatong, Huawei and Hesai Technology are 10%, 7%, 3%, 3% and 3% respectively, and the total of domestic companies reaches 26%.

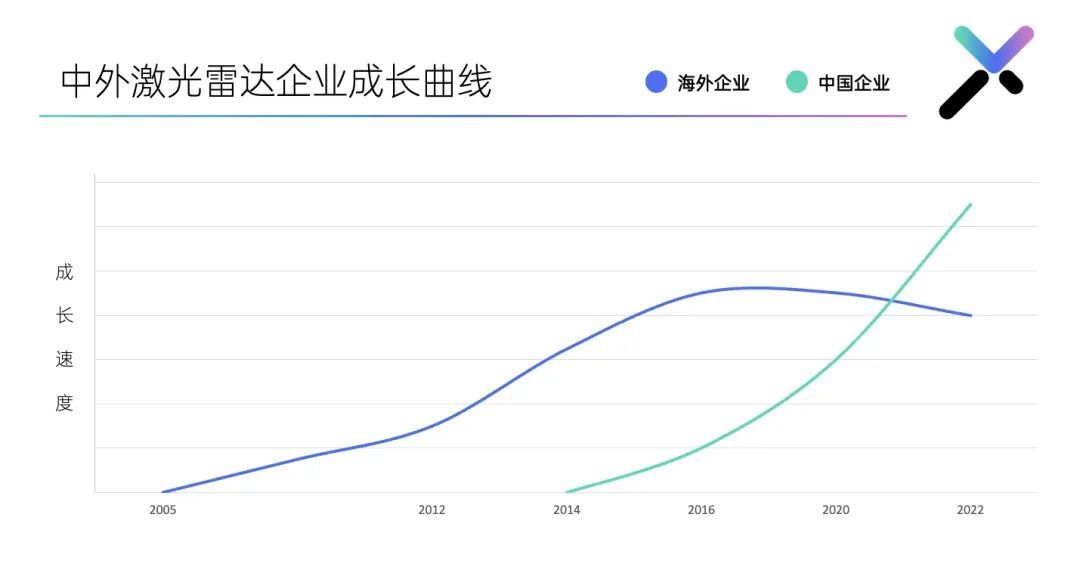

In 2022, the offensive of Chinese lidar companies will become increasingly fierce.

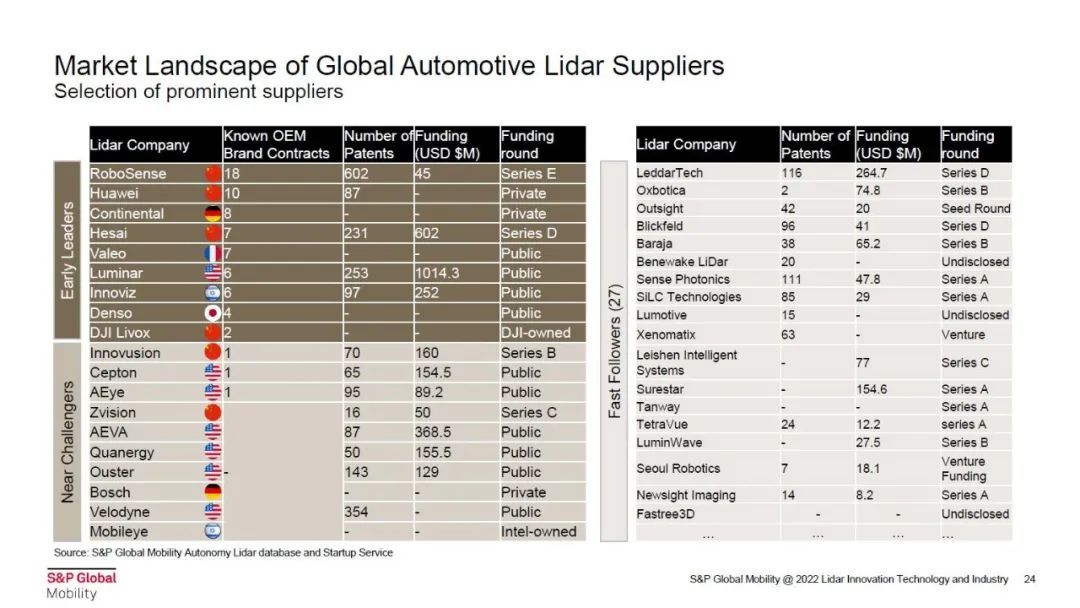

According to the 2022 survey and analysis data of S&P Global (Standard & Poor's), the top international financial analysis institution, the number of designated cooperative automobile companies that global lidar companies have obtained in the vehicle pre-installation market: Sagitar has 18 companies, ranking first in the world; Huawei has 10 companies, Ranked second in the world; Mainland China, with 8 companies, ranked third; Hesai, with 7 companies, ranked fourth; DJI Lanwo, with 2 companies, ranked 10th.

China is far ahead.

Not only that, overseas players who have shown signs of decline have also exposed problems one after another.

In Q1 of 2022, "prodigy" Luminar's losses intensified and its market value was cut in half; on November 7, "inventor" Velodyne and Ouster announced their merger; on November 8, dreamer Quanergy also lost money due to its market value being less than US$15 million for 30 consecutive trading days. were asked to initiate delisting procedures.

To this day, Innoviz’s lidar products have not been mass-produced and delivered, and Luminar’s products are still only available in the SAIC Feifan R7.

Where is the "originator" Ibeo?

The mass production of Ibeo's Audi A8 suffered a setback. It struggled to win the model spot of Great Wall Motors in 2020, but was ultimately unable to turn the tide. In October this year, difficulties in mass production and long-term lack of funds became the straw that broke the camel's back - what Ibeo was waiting for was not mass production, but bankruptcy.

At this point, overseas lidar companies are "Twilight of the Gods", while Chinese lidar companies are "new kings are emerging".

A new era has begun.

decisive battle! "Double stars" compete for glory

Turning to the Chinese LiDAR battlefield, the first thing that unfolds in front of us is an extremely involuted picture.

In November this year, Sagitar and Hesai released their own pure solid-state short-range blind-filling lidar products, Sagitar E1 and Hesai FT120, almost simultaneously.

Hesai said that the FT120 has obtained more than one million units, while Sagitar unceremoniously showed off core indicators such as field of view and detection distance, announcing that the E1 is better.

In fact, to compare who is better, there is a core dimension for reference, and that is the chip.

Because one of the core barriers of all-solid-state lidar is the receiving chip. It depends not only on whether it can be laid out early, but also on whether the core chip can be produced.

A senior lidar industry observer told us, "The receiving chips of some current products are actually SPAD (Single Photon Avalanche Diode), and the process is similar to that of early CCD cameras. The most critical technology in the transmitting and receiving links , are not something that some small factories can master.”

In addition to technology and products, Sagitar and Hesai are also flexing their muscles around testing and verification, car-level standards, fixed-point, mass production and investor lineup.

On the one hand, Sagitar's mid- to long-range M1 lidar has won fixed orders for more than 50 models with a total of more than 10 million units, including BYD, SAIC, Geely, FAW, BAIC, Great Wall, Chery, Xpeng and more than a dozen other companies. Leading car companies, covering different models such as sedans, SUVs, coupes, supercars and heavy trucks.

Hesai also announced that its medium- and long-range lidar AT128 has received millions of fixed points. Its cooperative car companies include Jidu, Gaohe, Lotus, Ideal, AIWAYS and Changan, and has achieved monthly delivery of more than 10,000 units.

The massive number of fixed orders almost all come from Chinese car companies, which shows the high acceptance of lidar in the Chinese market. This market, with annual car sales of up to 26 million units, is the most fertile land for LiDAR companies.

Up to now, Sagitar’s industrial investors include Alibaba Cainiao, BYD, BAIC, Desay SV, GAC, Geely, SAIC, Xiaomi, Luxshare and Yutong.

Hesai’s industrial investors also include Baidu, Xiaomi, Bosch and Meituan.

On the other hand, Sagitar has established the only automotive lidar laboratory in the industry that has received CNAS certification. Different systems and multiple rounds of rigorous testing can be conducted on different products and different car companies.

At the same time, the two companies are still vying to be the leading organization in setting standards, influencing the direction of multiple vehicle-level standards for lidar. Hesai took the lead in the "Vehicle LiDAR Performance Requirements and Test Methods" standard, while Sagitar took the lead in the "MEMS Vehicle LiDAR" standard.

In terms of factories, Sagitar chose three mass production models at the same time. It built its own production line + established a joint venture with Luxshare Liteng + cooperated with Jabil, a global third-party manufacturing company, to create a "Trinity" intelligent manufacturing cluster. The investment in the first phase exceeded 1 billion yuan, with a factory area of over 55,000 square meters, it has built nearly 20 automated production lines, invested more than 1,000 robots, and has an annual output of one million levels. It has now entered large-scale mass production.

Hesai has firmly adopted the self-built factory model and spent US$200 million to establish a 60,000-square-meter "Maxwell" intelligent manufacturing center in Jiading, Shanghai, with an annual production capacity of one million levels and is expected to be completed in 2023.

The "new king" looms

This involution of Chinese companies has created a huge sense of oppression for overseas companies.

The strong are always strong, you can feel it from the table below.

It can be seen that the "80/20 rule" has begun to take effect, and the "snowball" has already started to roll. In the world's largest automobile market, in the market with the strongest policy support in the world, China is building its own new star in the East. A wide and deep "moat".

The global lidar industry will enter an industry structure similar to that of power batteries. Companies that win in the Chinese market will compete for the top spot in the global market.

Who will be the new king of the lidar industry, Sagitar or Hesai? Or is it a dark horse that has yet to show its strength? In short, it will definitely be on the land of China.

Previous article:Are domestic MCUs ready to lose money as they gather together to make car specifications?

Next article:Lidar and self-driving cars "break up"

- Popular Resources

- Popular amplifiers

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

- Innolux's intelligent steer-by-wire solution makes cars smarter and safer

- 8051 MCU - Parity Check

- How to efficiently balance the sensitivity of tactile sensing interfaces

- What should I do if the servo motor shakes? What causes the servo motor to shake quickly?

- 【Brushless Motor】Analysis of three-phase BLDC motor and sharing of two popular development boards

- Midea Industrial Technology's subsidiaries Clou Electronics and Hekang New Energy jointly appeared at the Munich Battery Energy Storage Exhibition and Solar Energy Exhibition

- Guoxin Sichen | Application of ferroelectric memory PB85RS2MC in power battery management, with a capacity of 2M

- Analysis of common faults of frequency converter

- In a head-on competition with Qualcomm, what kind of cockpit products has Intel come up with?

- Dalian Rongke's all-vanadium liquid flow battery energy storage equipment industrialization project has entered the sprint stage before production

- Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

- Car key in the left hand, liveness detection radar in the right hand, UWB is imperative for cars!

- After a decade of rapid development, domestic CIS has entered the market

- Aegis Dagger Battery + Thor EM-i Super Hybrid, Geely New Energy has thrown out two "king bombs"

- A brief discussion on functional safety - fault, error, and failure

- In the smart car 2.0 cycle, these core industry chains are facing major opportunities!

- The United States and Japan are developing new batteries. CATL faces challenges? How should China's new energy battery industry respond?

- Murata launches high-precision 6-axis inertial sensor for automobiles

- Ford patents pre-charge alarm to help save costs and respond to emergencies

- New real-time microcontroller system from Texas Instruments enables smarter processing in automotive and industrial applications

AD75062AD

AD75062AD

京公网安备 11010802033920号

京公网安备 11010802033920号